Market Data

May 16, 2022

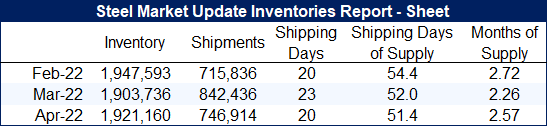

Service Center Shipments and Inventories Report for April

Written by Estelle Tran

Flat Rolled = 51.4 Shipping Days of Supply

Plate = 48.3 Shipping Days of Supply

Flat Rolled

US service center flat rolled inventories declined slightly in April in terms of shipping days of supply, while the amount of material on order rose again. At the end of April, service centers carried 51.4 shipping days of supply on an adjusted basis, according to SMU data. This is down from 52 shipping days in March. Sheet inventories represented 2.57 months of supply in April, which is up from 2.26 months in March. April had 20 shipping days, not counting Good Friday as a shipping day. This is lower than March’s 23 shipping days.

The daily shipping rate in April rose for the second consecutive month and was the highest level since May 2021. This increase represents increased trade among service centers as well as higher throughput at service centers as mill shipments remain stronger than in 2021. The higher shipping levels in April were somewhat at odds with the comments about merely steady demand or even declines to certain segments, such as automotive. Others have reported more activity in the oil and gas industry.

The big factor to watch is the amount of material on order. This was elevated in April, even considering the higher daily shipping rate.

Despite claims that service centers were being careful not to buy too much as prices surged in April, there was a strong uptick in both contract and spot orders in March and early April. The high levels of material on order coupled with potentially slowing demand may translate to rising inventories, though this had not materialized yet in April.

We expect that with prices receding, service centers will be more conservative about booking new orders with domestic mills. Some contacts have said that imports may become workable if mills remain unwilling to negotiate. Most service center contacts have said that import offers are not attractive though. With the elevated levels of material on order, we expect future orders to slow, unless there is an unforeseen increase in demand.

Plate

US service center inventories rebounded in April, after falling sharply in March. At the end of April, service centers carried 48.3 shipping days of plate supply. This is up from 44.4 shipping days in March. Plate inventories at service centers represented 2.41 months of supply in April, up from 1.93 months in March.

Service center shipments in March were bolstered by more shipments to other service centers than usual. Some of this was driven by discomfort with high mill prices and surcharges, and so service centers found it easier to trade with each other. Plate prices reached a peak in mid-April and have been sliding since. As steel pricing settled, plate shipments apparently followed the trend of lower shipments seen in sheet.

The amount of plate on order increased for the second consecutive month and in April was at the highest level since October 2021. Inventories at the end of April finished on the lower side. The increase in material on order in April should help to bring inventories back into balance with intake expected to increase over the next two months. If outbound shipments do not follow the upward trend in inbound material, then inventories may rise to higher levels than desirable.

With slowing demand and sliding prices, service centers may be cutting back on new orders. We have seen this already in the latest SMU lead time survey. Plate mill lead times fell back to 5.25 weeks in the latest survey, down from 6.43 weeks in the April 28th survey.

By Estelle Tran, Estelle.Tran@CRUGroup.com