Market Data

May 12, 2022

Steel Mill Lead Times Slip Again, Nearing 'Normal' Levels?

Written by Brett Linton

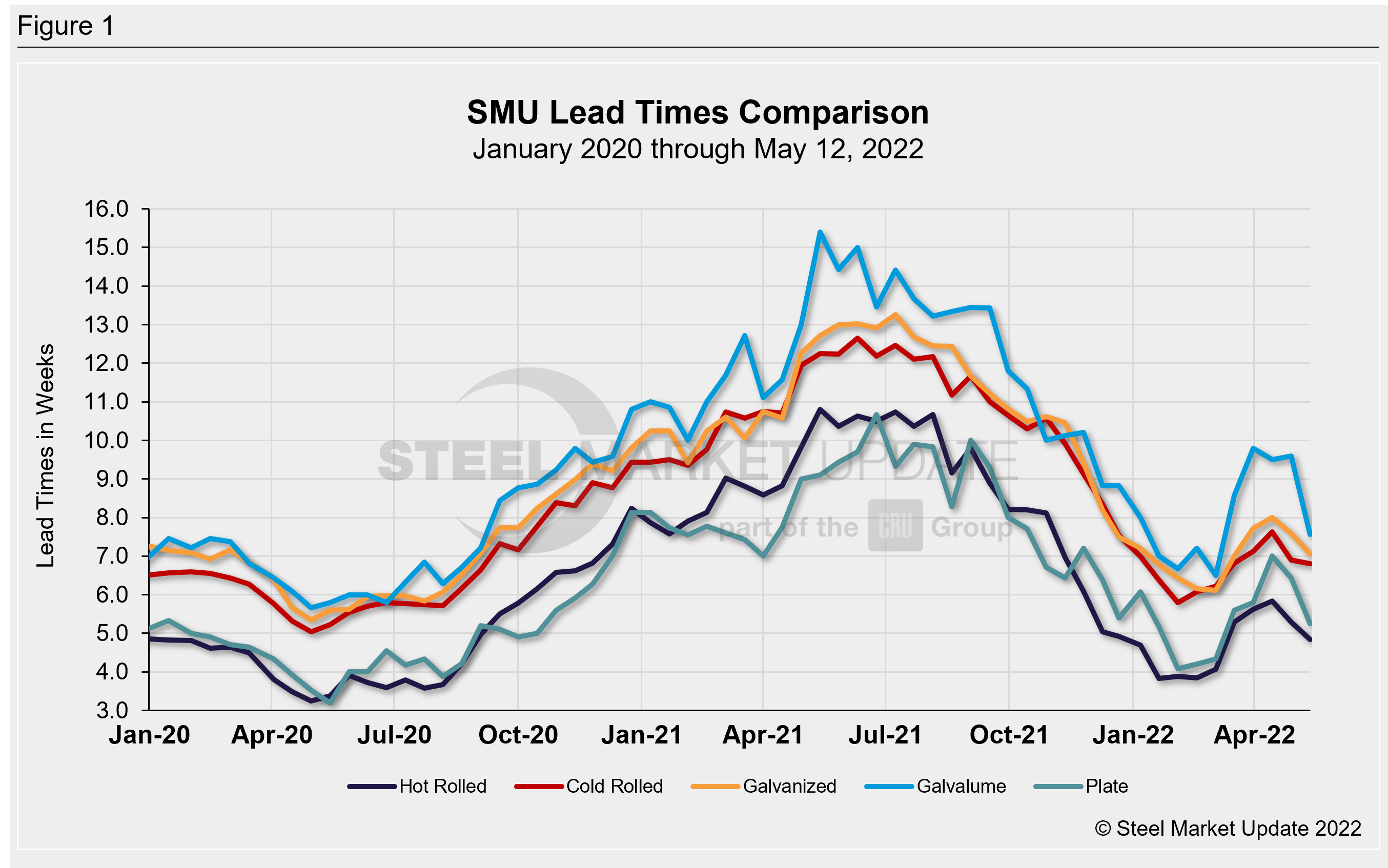

Steel Market Update’s market check this week indicates steel mill lead times are shortening for both sheet and plate products, easing an average of 0.9 weeks compared to two weeks prior. This also marks the first time lead times have fallen consecutively since January. Lead times for all tracked products are now roughly in line with levels seen in early March, before they extended sharply on the war in Ukraine.

Buyers surveyed this week reported mill lead times ranging from 3-8 weeks for hot rolled, 5-10 weeks for cold rolled, 5-9 weeks for galvanized, 6-9 weeks for Galvalume, and 4-7 weeks for plate.

Hot rolled lead times declined by half a week from late April, now averaging 4.8 weeks. Cold rolled lead times eased slightly to 6.8 weeks, while galvanized lead times fell 0.5 weeks to 7.1 weeks. The average Galvalume lead time declined by 2 whole weeks to 7.6 weeks. Mill lead times for plate are now at 5.3 weeks, shortening by 1.2 weeks from SMU’s previous analysis.

Only 56% of the executives responding to this week’s questionnaire told SMU they were seeing stable lead times, down from 70% when they were polled two weeks ago. And 43% said lead times were slipping, up from 16% in late April. Just 1% said lead times were extending, down from 14% two weeks prior. Here’s what a few of them had to say:

“More customers are on the sidelines, so I see some slippage in lead times.”

“Mills are taking in less orders.”

“Capacity isn’t an issue. And as we all know, more is coming on line.”

“Demand is balanced.”

“Demand is declining, lots of inventory in the market, mill lead times and prices are shrinking.”

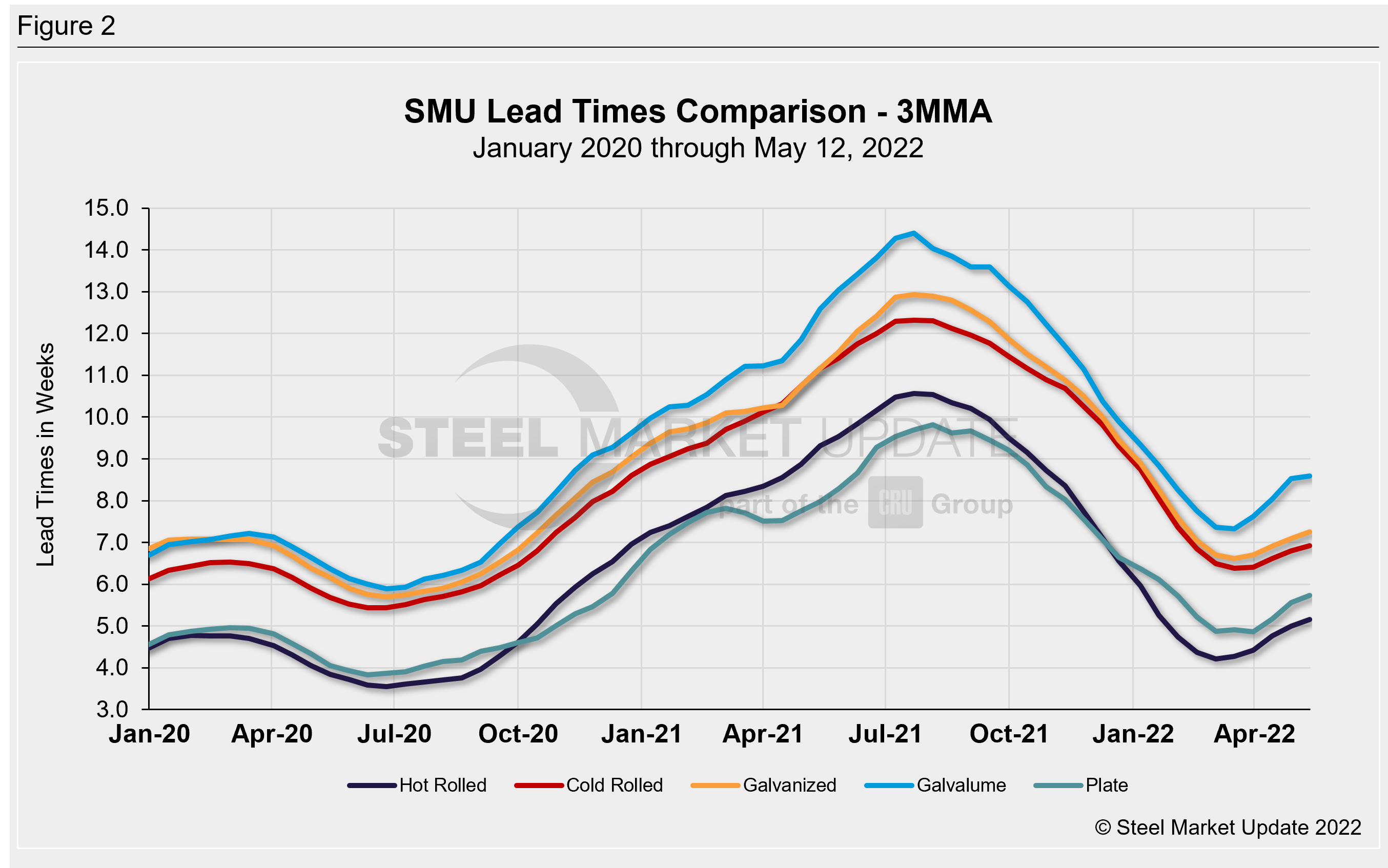

Looking at lead times on a three-month moving average can smooth out the variability in the biweekly readings. As a 3MMA, all products showed slight increases this week, rising by 0.1-0.2 weeks over late April. The current 3MMA for hot rolled is 5.2 weeks, cold rolled is 6.9 weeks, galvanized is 7.2 weeks, Galvalume is 8.6 weeks, and plate is 5.7 weeks.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. SMU measures lead times as the time it takes from when an order is placed with the mill to when the order is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our Steel Mill Lead Times data, visit our website here.

By Brett Linton, Brett@SteelMarketUpdate.com