Market Data

May 12, 2022

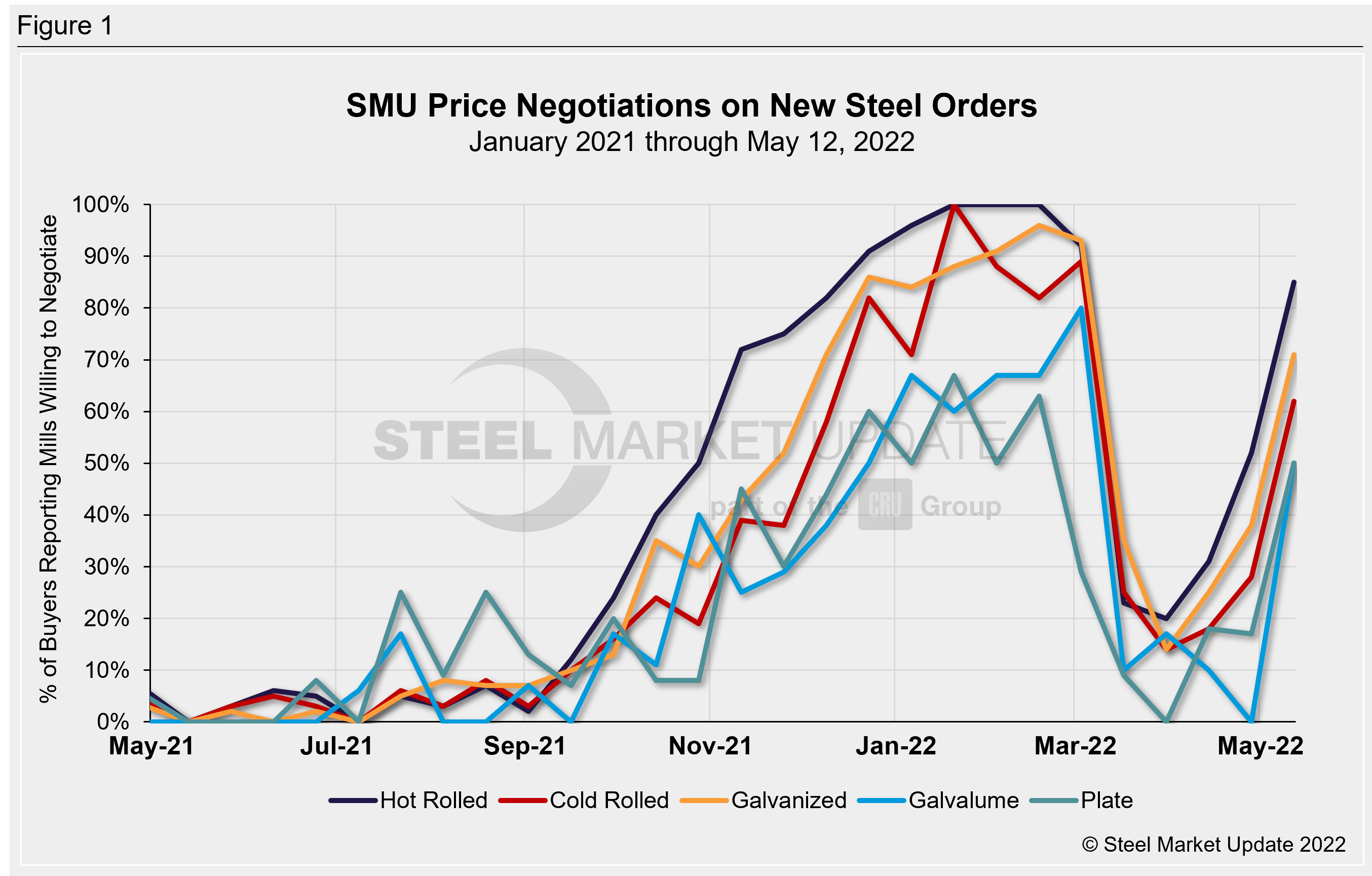

Mill Negotiations: It's a Buyer's Market Now

Written by Brett Linton

The firm grip mills have held on price negotiations in March and April has loosened, according to buyers polled in our latest steel market survey. A large portion of steel buyers now report that mills are willing to talk price to secure an order.

Every two weeks, SMU asks survey respondents: Are you finding domestic mills willing to negotiate spot pricing on new orders placed this week? On average this week, 70% of steel buyers report that mills were willing to negotiate lower prices on new orders, up from 35% two weeks prior. Mills’ willingness to negotiate has grown in each of our market checks over the past eight weeks. The shift to a buyer’s market this week was not a shock to some respondents: Several last month said that they expected mills to begin to budge more on price to secure new orders in May.

All told, 85% of hot rolled buyers surveyed responded that mills were willing to negotiate lower prices, up from 52% two weeks prior and 31% one month ago. In the cold rolled and galvanized segments, roughly two thirds of buyers report that mills are now negotiable, up from one third in late April. Negotiations on Galvalume products appear to be mixed, with half reporting yes and half no. Due to the limited size of that market and our small sample size, this figure can be more volatile.

Negotiations were never quite as loose in the plate market. But now even plate is close to being a buyer’s market. Our latest survey shows that 50% of plate buyers reported mills willing to bargain, up from just 17% two weeks ago.

SMU’s Price Momentum Indicator was adjusted to Lower on Tuesday of this week, indicating we expect prices to decline over the next 30-60 days.

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.

By Brett Linton, Brett@SteelMarketUpdate.com