Overseas

May 12, 2022

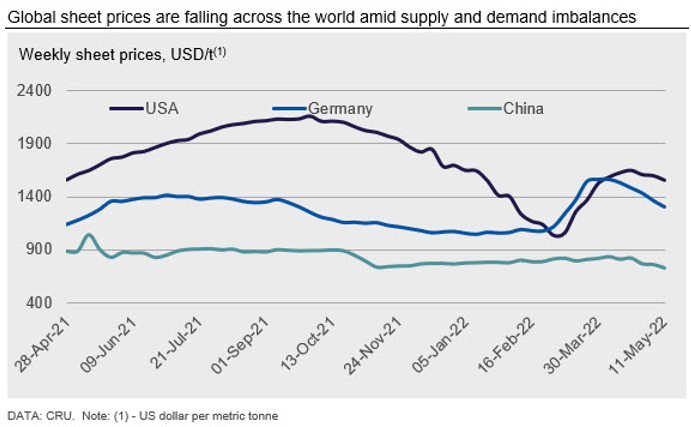

CRU: Supply Begins to Outstrip Demand, Global Sheet Prices Fall

Written by Ryan McKinley

By CRU Senior Analyst Ryan McKinley, from CRU’s Steel Sheet Products Monitor, May 11

The CRUspi plunged month-on-month (MoM) in May by over 8.6%, which is the largest percentage point decline since late 2008 and the second-largest ever in terms of total fallen points. Supply chain readjustments for both sheet and steelmaking raw materials in the wake of the war in Ukraine have happened quickly enough to cause notable price drops in the US and in Europe while weakening demand elsewhere has forced mills to lower offer prices.

A slowdown in the upward trajectory of global steel sheet prices in late April has now reversed course around the world. In markets like the US and Europe, prices have come under pressure from supply-side market dynamics such as falling raw material prices and higher sheet import availability. In contrast, lower demand was the driver of falling prices in Asia and Africa as Ramadan production slowdowns curtailed buying activity outside of China. Within China, increasingly strict Covid lockdowns across the country have also depressed manufacturing activity and, by extension, steel demand. It appears that this price downtrend will continue for the near term as global supply continues to outstrip demand even if CIS material remains absent.

European prices have faced the steepest declines compared to other markets, with HR coil falling by 12% MoM. The enormous price increases that took place shortly after the Russian invasion of Ukraine have now attracted more than enough material from abroad to force domestic mills to lower offers. US HR coil also underwent a decline, falling by (a relatively smaller) 4% MoM. Supply increases were another driver of this decline, but more from a raw material standpoint as scrap supply flooded into the market and concerns over pig iron availability subsided. In our most recent US and European markets assessments, we also note an increasingly bearish tone in terms of demand outlooks.

Falling demand has already impacted markets outside of the US and EU. In China, Covid lockdowns have driven domestic sheet demand notably lower over the last month, causing producers and traders to focus on exporting material. At the same time, domestic production rates have fallen by relatively little. This reroute of material from the domestic market to other countries in Asia coincided with a decline in demand from Europe and slower buying activity in countries where the observation of Ramadan slowed manufacturing output. In all, this has resulted in domestic mills lowering their offer levels to compete for shrinking market share as supply rises.

In the CIS region, some Ukrainian production has come back online as much of the focus of the war shifts toward the southern and eastern parts of the country. While demand in the country is extremely low, both the EU and the US have dropped tariffs on the country, providing an outlet for this production in the future. Meanwhile, HR coil prices in Russia continue to decline as other regions eschew buying from the country, which has led to a domestic oversupply.

Outlook: Global market downtrend to continue

While regions were split in terms of factors driving prices lower during in May, with prices in the West falling on rising supply and in the East on weakening demand, we are increasingly seeing these factors blur together. Demand now seems to be weakening in the West as inflation begins undermining consumer spending on durable goods and as manufacturing output slows. In markets like China, logistical constraints caused by lockdowns are causing mills to build inventory levels as domestic shipping becomes increasingly difficult, leading to yet more supply in the market. At the same time, lower demand from Europe and increasing supply from China will keep weighing on other markets in Asia. Add to this that at least some Ukrainian production may enter the international market in the coming months, and the global picture appears quite bearish for the near term.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com