Prices

May 10, 2022

March Steel Exports Rise to 843,000 Tons, Near 4-Year High

Written by Brett Linton

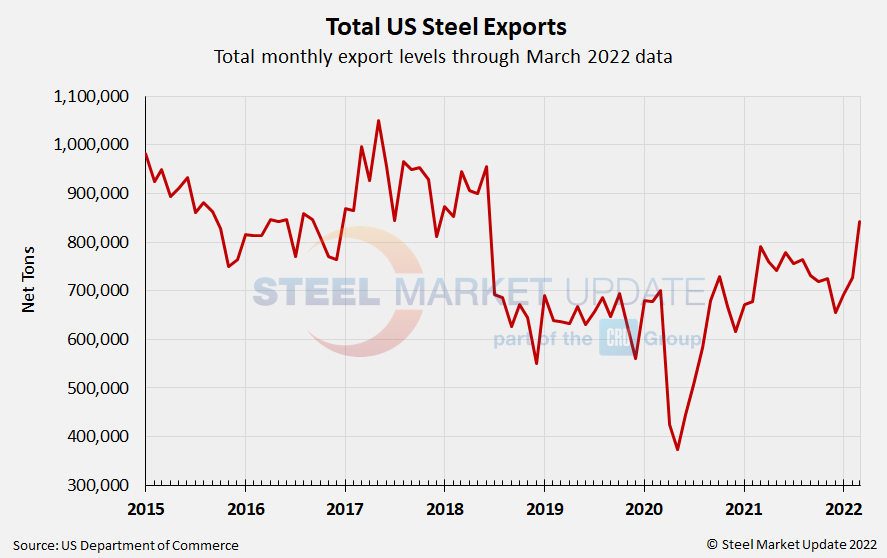

US steel exports jumped 16% in March to 843,000 net tons, now the highest monthly level seen since June 2018, according to the latest US Department of Commerce data. On a 12-month moving average, March exports continue to hold onto a 3-year record high at 741,000 tons per month. Total March exports are 7% higher than levels seen one year ago.

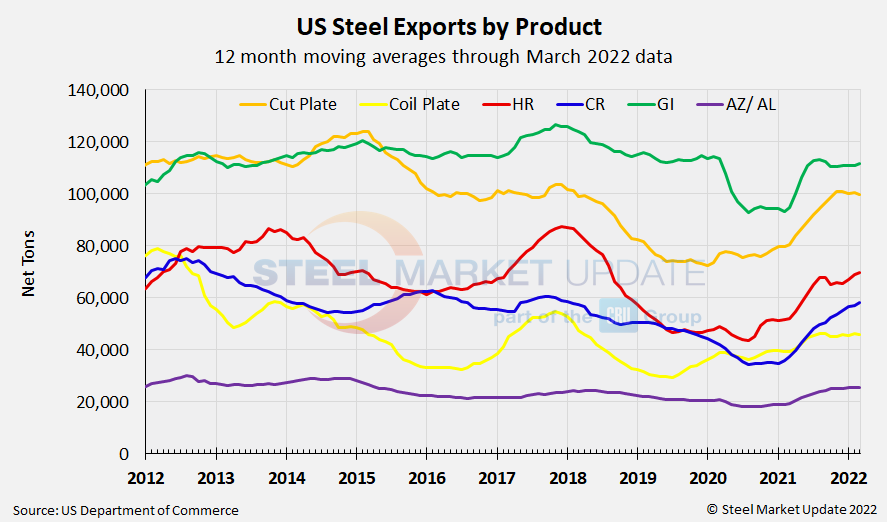

As shown in the graph below, March exports are now at the highest level seen in nearly four years. Prior to this month, the previous multi-year record high was seen exactly one year ago, when we saw a 3-year high of 790,000 tons in March 2021. Recall that in May 2020 total steel exports had fallen to a 24-year low of 374,000 tons.

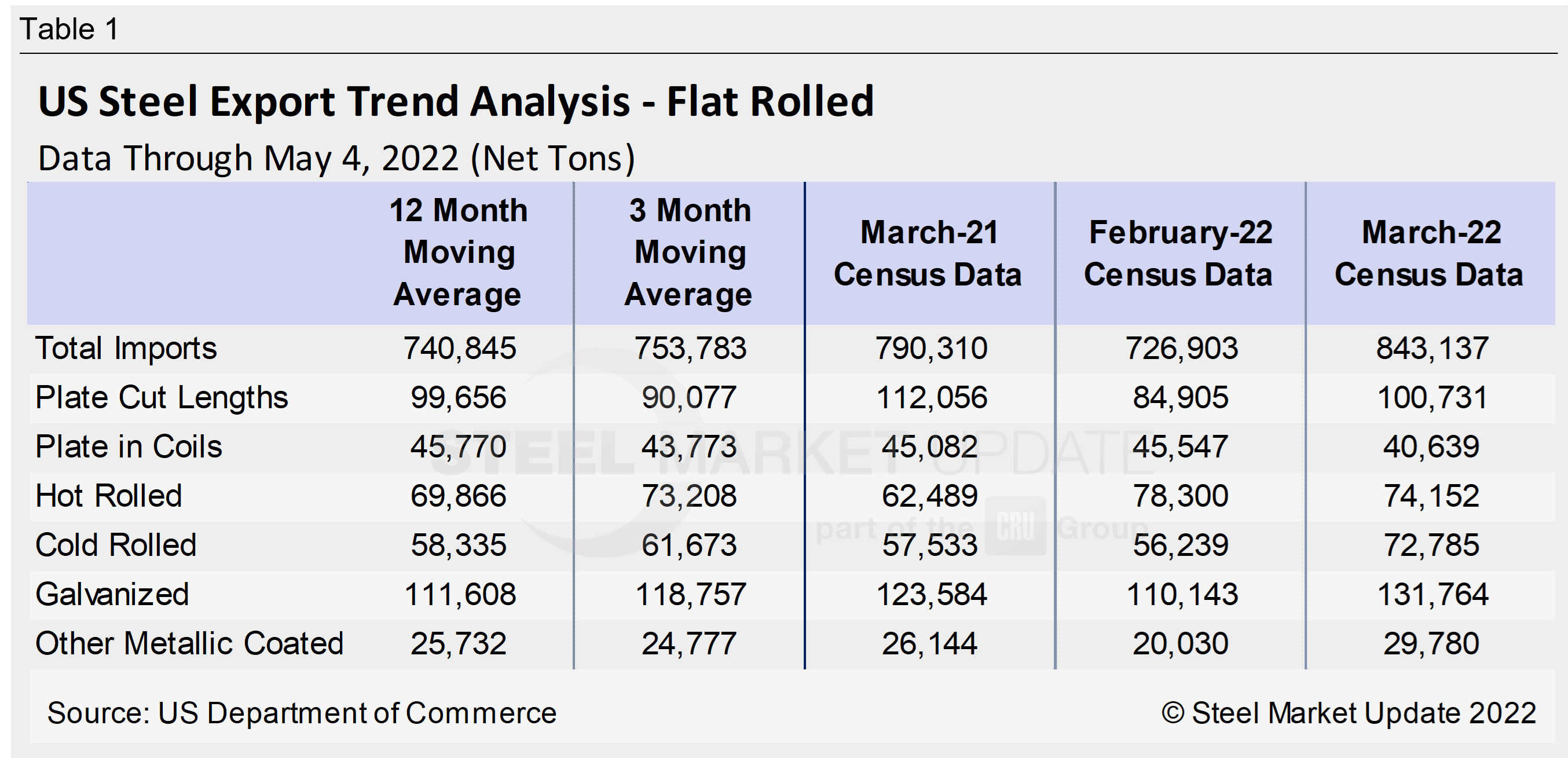

Of our six monitored product groups, four increased month-over-month in March.

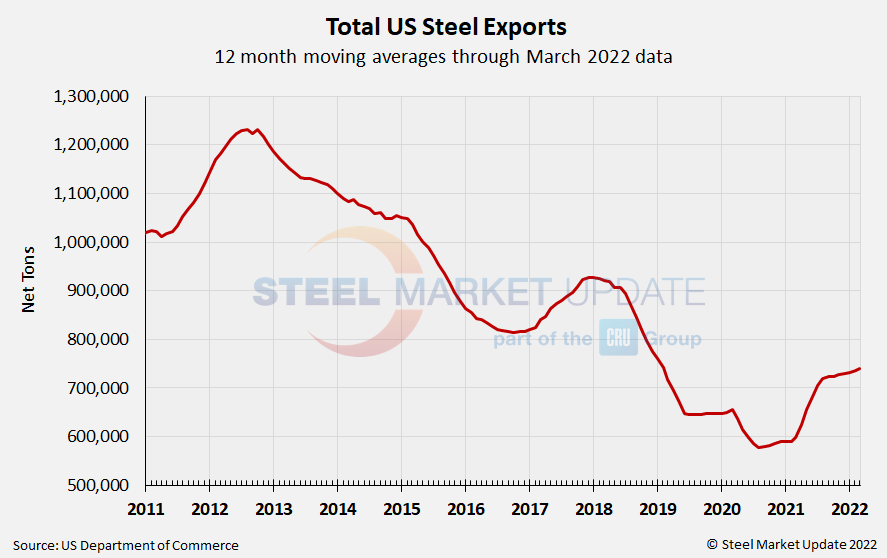

On a rolling 12-month average, March exports are now at a 37-month high of 741,000 tons (recall August 2020’s record low 12MMA of 577,000 tons). Total exports averaged 731,000 tons per month in 2021, compared to 591,000 tons in 2020, 648,000 tons in 2019, and 775,000 tons in 2018.

Total March exports are 12% above the three-month moving average (average of January through March 2021), and 14% above the 12-month moving average (average of April 2020 through March 2021). Here is a detailed breakdown by product:

Cut-to-length plate exports rose 19% over February to 100,731 tons, down 10% compared to one year ago.

Exports of coiled plate were 40,639 tons in March, down 11% from the prior month and down 10% from levels this time last year.

March hot rolled steel exports declined 5% from February to 74,152 tons, up 19% from one year prior.

Exports of cold rolled products were 72,785 tons in March, 29% higher than February and up 27% from the same time last year.

Galvanized exports increased 20% month-over-month to 131,764 tons. Compared to levels one year ago, March is up 7%.

Exports of all other metallic-coated products were 29,780 tons, up 49% from February and up 14% year-over-year.

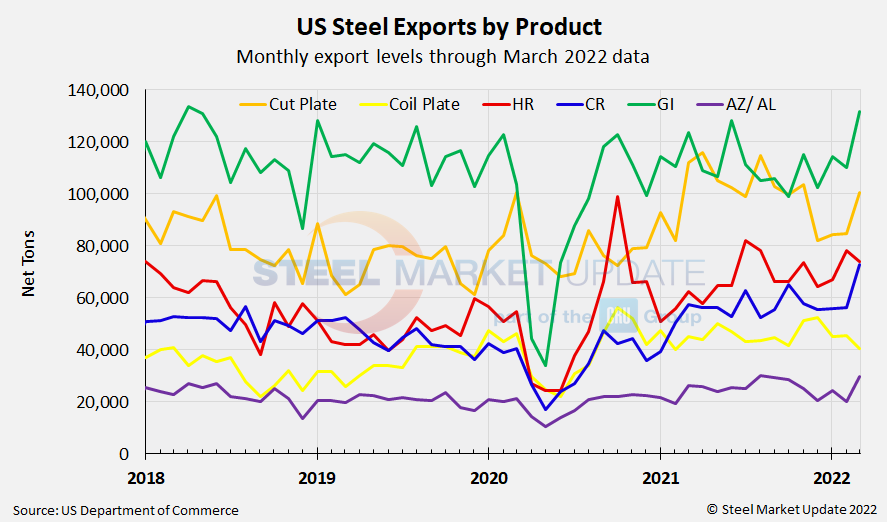

The graphics below show US exports by product, both monthly levels and as a 12MMA.

We have an interactive graphing tool available on our website here where readers can further investigate historical export data in total and by product. If you need assistance logging into or navigating the website, contact us at Info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com