Market Data

May 6, 2022

CRU: War, Inflation and Covid; A Dangerous Recipe for Recession

Written by Alex Tuckett

By CRU Principal Economist Alex Tuckett, from CRU’s Global Economic Outlook

Each of the three largest economies now face a serious risk that could push them into recession:

For Europe, the greatest risk is the fall-out from the Ukraine war, particularly the potential impact on energy markets.

In China, a resurgence in Covid-19 which has led to highly disruptive lockdowns across many major cities poses the biggest threat to growth.

In the US, the key question is whether the Fed can bring inflation under control without triggering a recession.

If any one of these risks were to materialize, it would seriously be a serious headwind to world growth. The combination of all three would be a perfect storm. In the immediate term, the risks from China are most serious for commodity markets. But in the longer term, the re-orientation of the world economy in response to the geopolitical shock may be the most disruptive.

An outright recession is still not our central case. But the probability is now higher than at any time since the pandemic.

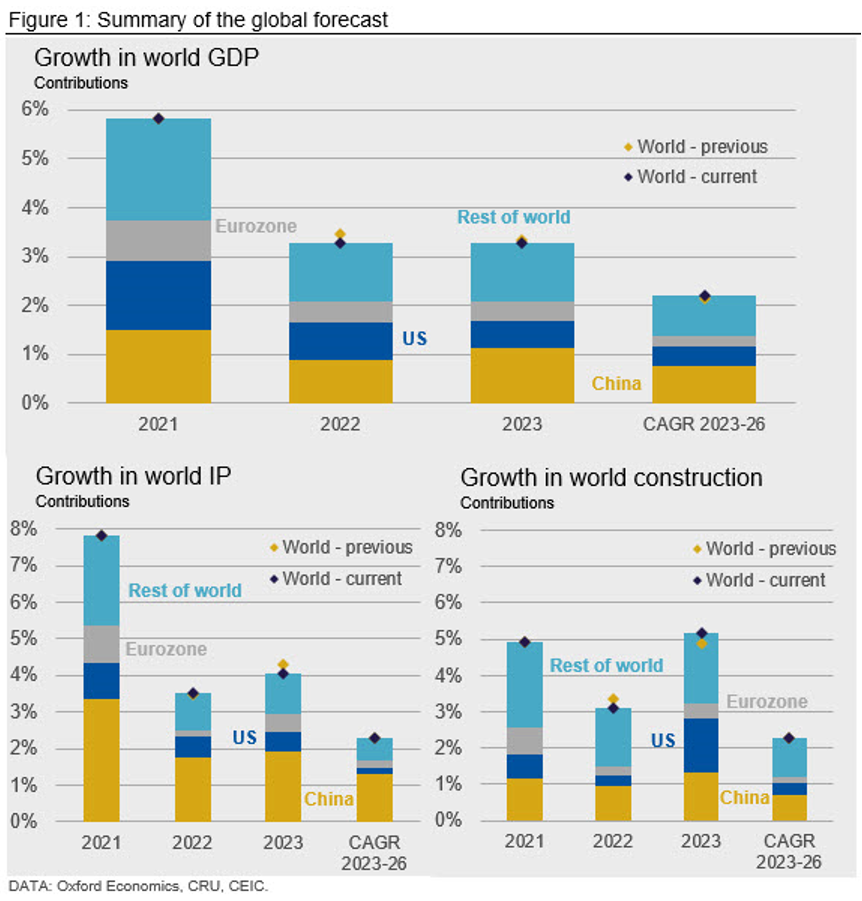

We have revised down our forecast for 2022 world growth to 3.3% (from 3.5% previously) driven by lower growth in Europe and China.

We have maintained our forecast for 2022 growth in world industrial production (IP) at 3.5%. We have downgraded our forecast for IP in Europe, but only marginally for China as the industrial sector is showing resilience in the face of lockdowns. We have revised up our US forecast reflecting strong data in Q1.

We have revised growth in automotive vehicle production down to 9.1% (from 11.4%), mainly as a result of weaker production in China. See our Automotive Sector Monthly Report for more detail.

Recent material published by the Economics team can be found in Table 1 below.

This aritcle was originally published on April 29 by CRU, SMU’s parent company.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com