Prices

April 24, 2022

CRU: The Risks of Demand Destruction to Aluminum

Written by Matthew Abrams

Matthew Abrams, Analyst, CRU Group

As costs, premiums, and prices all remain high, market participants across all sectors are all looking for the edge of the cliff. The war, Covid 19, and inflation are all part of the daily conversation.

Supply disruptions and demand destruction are very real worries for all those involved. In what could be a preview of things to come, the IMF downgraded its forecast for GDP growth worldwide.

Despite rising inflation and interest rate hikes in an attempt to slow inflation, the US saw one of the smallest downgrades of the major economies. Growth is expected to stay close to 4% throughout 2022 and to drop off to 2.3% in 2023.

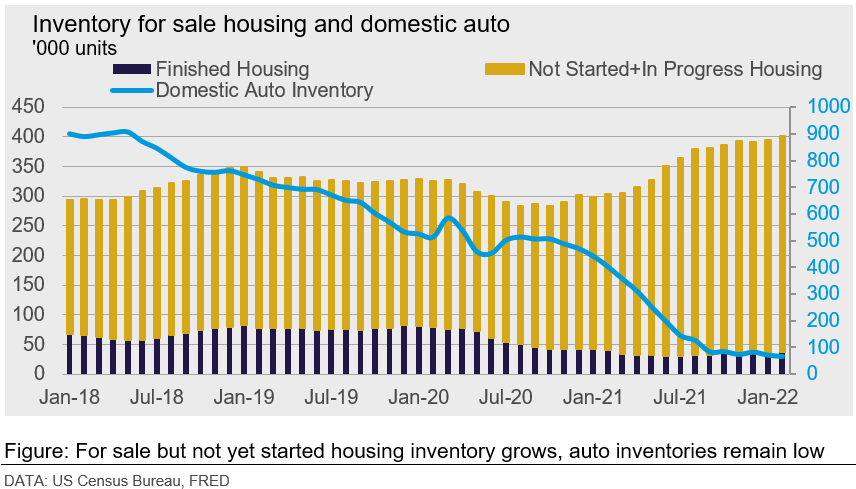

Demand Remains Strong Through Another Month

These trends can be seen directly in the aluminum industry. March has been a historically strong shipment month, and this year continued that trend. Extrusions, sheet and plate, foil, and can stock were up 3.2%, 17%, 5.3%, and 12.8% respectively. The growth number seen is particularly impressive considering last year was also a period of strong demand with the economy in a recovery period. Pent-up demand remains in sectors hit by slowdowns, such as aerospace and automotive, and the March new orders index remained strong. Housing is also facing its own challenges in catching up to demand. The percentage of units for sale but not yet started is the highest since the ‘70s.

Aerospace in particular has seen its first signs of an increase in demand since the pandemic hit. Airlines have echoed this sentiment as airline ticket sales have been strong. Hotel and other accommodations also mentioned an uptick in bookings. Looking at TSA passenger throughput, the amount of passengers is up 75% YTD when compared with 2021 and only 15% back from the 2019 number. The travel sector, while having lower volume when compared to automotive or packaging, will be an important component in improving operating margins for rolling mills. They were lower throughout 2020-2021 due to higher costs and higher output dedicated to the low margin, high growth packaging sector.

Lockdowns in China Slowing Things Down

The lockdowns in China pose new challenges to supply. Big disruptions to primary supply have been avoided for the most part. But in the supply chain everything is noticeably slower. According to freight company G7, the number of trucks currently in use each week in China is down 20% from 2019 averages. The buildup at the Port of Shanghai has spiked to new, higher levels as well, with VesselsValue showing more than 300 ships now waiting to load or discharge compared with the typical monthly average of slightly over 100. These slowdowns are stacked on top of pre-existing supply chain issues seen worldwide: namely, higher costs for freight, oil, and warehousing.

These challenges directly affect the aluminum market, particularly when taken together with news about new sanctions on Russia. Direct sanctions have not been placed on aluminum, yet. But the supply of alumina and bauxite going into Russia has been targeted. Australia banning the export of these intermediate goods to Russia has created a problem for Rusal, Russia’s largest aluminum producer. To combat this, Russia and Rusal turned to importing more from China in attempt to bridge the gap as much as possible. With these slowdowns, and additional transit costs, the process is very slow. Right now, overall supply from China continues to flow. But the impacts of these Covid-related slowdowns on top of the growing effects from sanctions on Russia are expected to change future metal trade flows.

Matthew Abrams joined CRU in January 2022 as a Research Analyst, focusing on aluminium rolled products. Prior to joining, he was finishing his degree from Konkuk University in Seoul, Korea, where he studied Economics and Statistics as well as the Korean language. Matthew is based in CRU’s Pittsburgh office. He can be reached at matthew.abrams@crugroup.com.

CRU also covers the alumina market comprehensively. Please contact Lais Santos (lais. santos @crugroup.com) or Anthony Everiss (anthony. Everiss @crugroup.com) to explore CRU’s alumina coverage.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com