Product

April 19, 2022

SMU Steel Buyers Sentiment Index Remains Strong

Written by Brett Linton

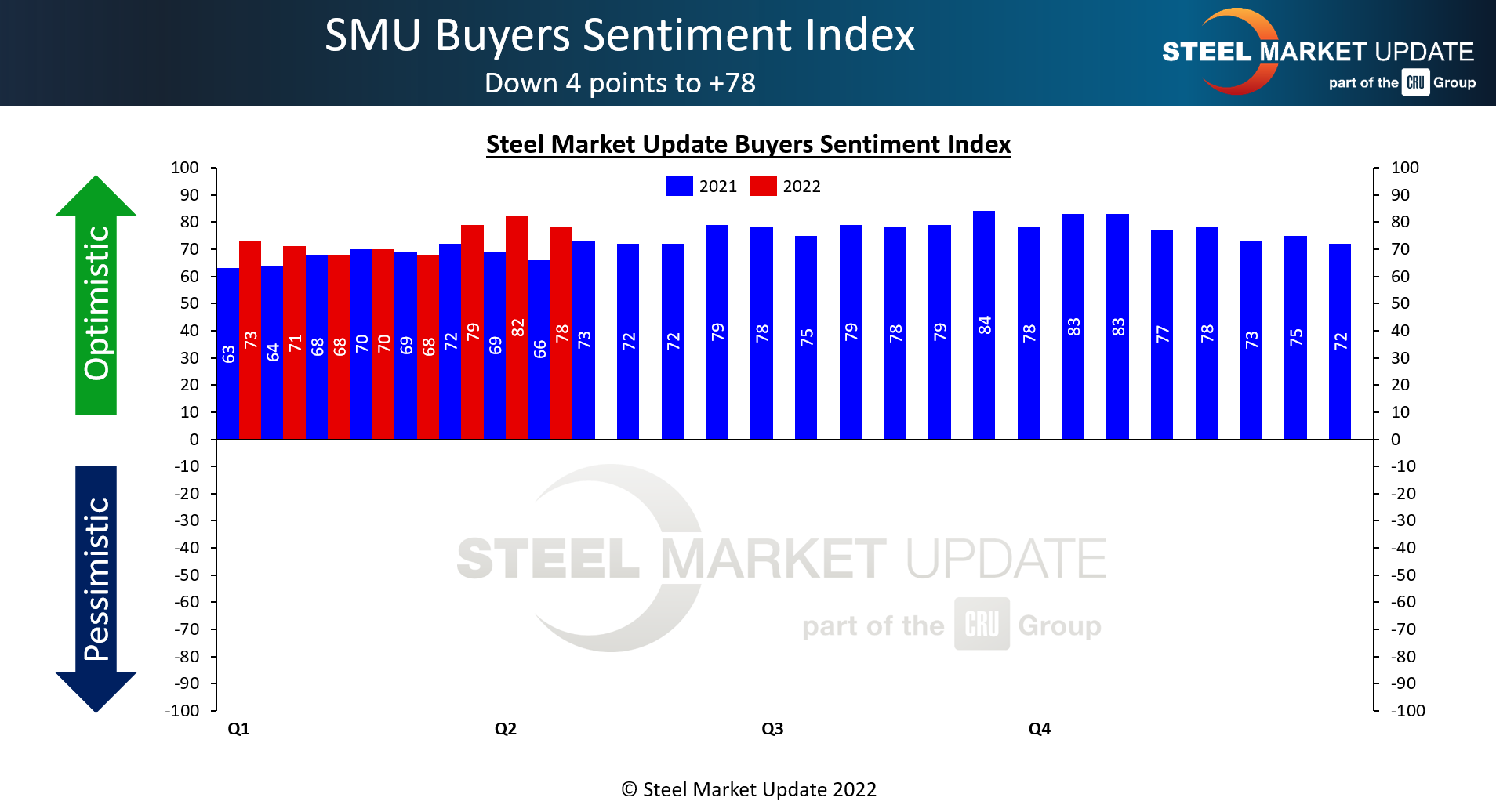

Steel Market Update’s Steel Buyers Sentiment Index moved 4 points lower this week, following a 3-point bump up two weeks prior and an 11 point surge in mid-March. Theses sentiment measures correlate with the sharp rebound in steel prices caused by the Ukraine-Russia war, as well as the recent slowdown seen in prices.

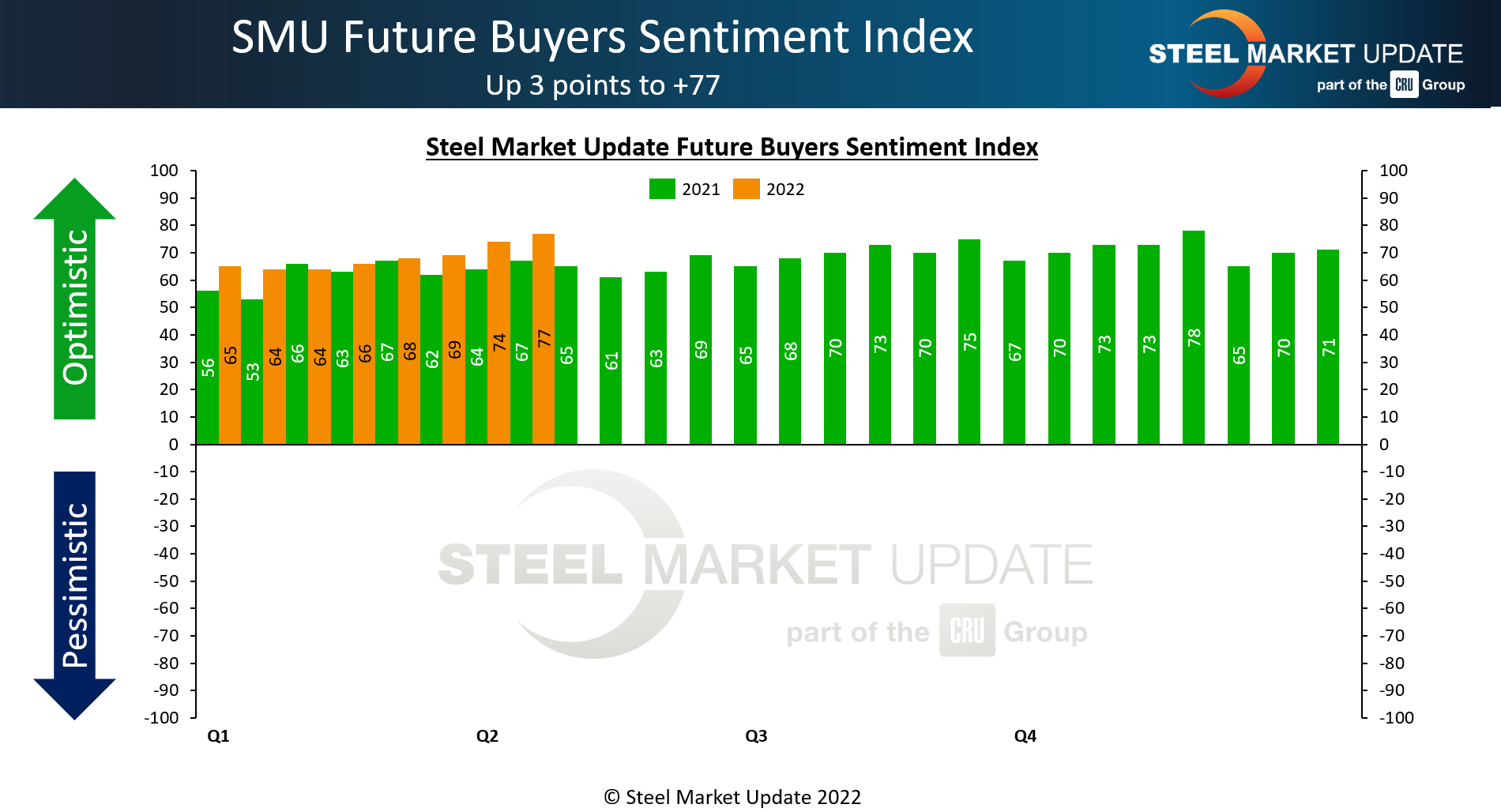

Steel Market Update’s latest benchmark price for hot rolled coil was $1,450 per ton ($72.50 per cwt) as of last Tuesday, up $15 over two weeks prior, and up from $1,000 per ton in early March. The spread between current and future sentiment now suggests that buyers feel positive about the current market as well as 3-6 months ahead, despite lingering effects of war, inflation and supply-chain issues.

SMU surveys buyers every two weeks and asks how they view their chances of success in the near and longer term. SMU’s Current Sentiment Index registered +78 this week, down from a 5-month high of +82 in mid-March. Although lower than the previous index, Current Sentiment is still at the third highest level in 2022.

{loadposition reserved_message}

SMU’s Future Sentiment Index, which measures buyers’ feelings about their prospects three to six months in the future, increased 3 points to +77. This is the highest reading recorded since Nov. 2021.

Recall that last September, when steel prices had peaked, Current Sentiment reached an all-time high of +84 and Future Sentiment was at a near-record +75.

Measured as a three-month moving average, the Current Sentiment 3MMA has risen to +74.17, and the Future Sentiment 3MMA is up to +69.67. Both measures are the highest levels seen since the first week of 2022, indicating that steel buyers’ attitudes remain positive despite volatile market conditions.

What SMU Survey Respondents Had to Say

“We have weathered many challenging times and continue to push through.”

“The market is fairly stable and increasing cost wise. A decent market to move forward.”

“The record profits are continuing – admittedly for far longer than I initially anticipated. It’ll be a very, very strong 1H.”

“I still feel very good about Q3, but the calls for a recession next year and problems due to inflation will at some point become too big to ignore…even for the most bullish of bulls.”

“Demand is strong, and (restricting) Russian import steel coupled with supply challenges in Europe is a recipe for higher prices for now.”

Tracking steel buyers’ sentiment is helpful in predicting their future behavior.

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat-rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings run from +10 to +100. A positive reading means the meter on the right-hand side of our home page will fall in the green area indicating optimistic sentiment. Negative readings run from -10 to -100. They result in the meter on our homepage trending into the red, indicating pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace. Sentiment is measured via Steel Market Update surveys that are conducted twice per month. We display the meter on our home page.

We send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies. Approximately 40 percent are manufacturers, 40 percent are service centers/distributors, and the remainder are steel mills, trading companies or toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.

By Brett Linton, Brett@SteelMarketUpdate.com