Market Data

April 18, 2022

Service Center Shipments and Inventories Report for March

Written by Estelle Tran

Flat Rolled = 52 Shipping Days of Supply

Plate = 44.4 Shipping Days of Supply

Flat Rolled

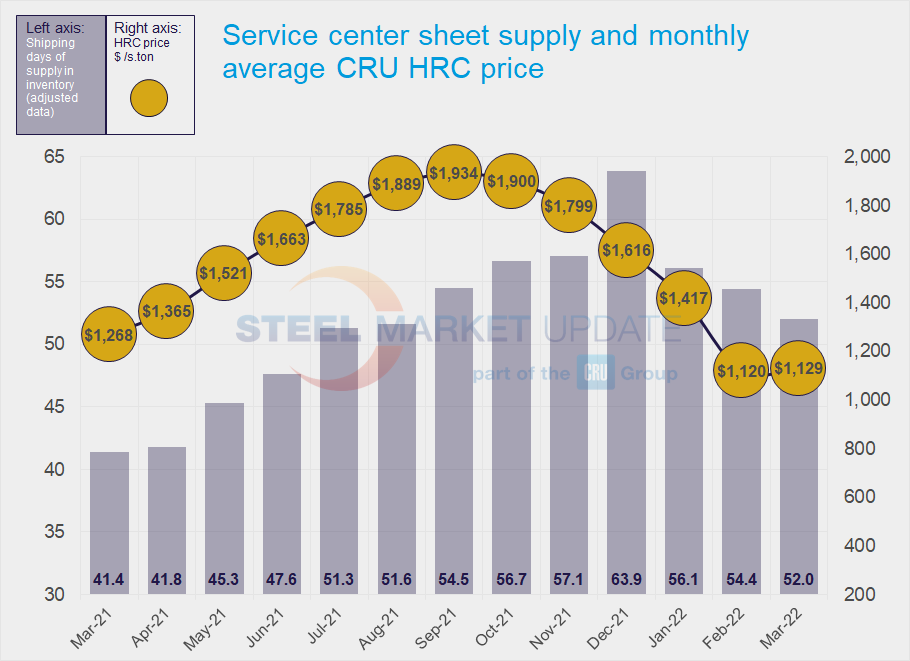

US service center flat rolled inventories edged down further in March. Inventories did not fall as much as expected, as attitudes about inventory changed with the reversal of pricing trends. At the end of March, service centers carried 52 shipping days of sheet supply, according to SMU data, down from 54.4 shipping days in February on an adjusted basis. The data for March did not need to be adjusted because all data providers responded to the survey. March inventories represented 2.26 months of supply, down from 2.72 months in February.

March had 23 shipping days, compared to February’s 20. After service centers scaled back inventories in February, strong shipments in March took the daily shipping rate to the highest level since June 2021. In early March, as prices bottomed out and surged upward on the back of higher raw material costs, service centers switched back into buying mode. Inventories at the end of March were higher than expected partly because of additional purchases made before price increases. At the same time, license data for March points to an increase in import arrivals over February. This might be because February imports were limited by logistics issues and congestion at ports.

With a pickup in new orders and rising prices, service centers placed more orders on both contract and spot terms. Some of these were opportunistic purchases near the bottom of the market. We have seen elevated levels of spot transactions since late February that supports this. The percentage of inventory on order rose in March. We saw this increased buying activity reflected in SMU mill lead times data as well. HRC lead times rose to 5.62 weeks in the March 31st survey from 4.07 weeks on March 3rd.

Despite the record week-on-week price gains, service centers were not clamoring for material as they did when prices shot higher in the first quarter of 2021. Market contacts said they were being careful not to overstock, not only because of pricing uncertainty, but also because of worries about slowing demand, driven partly by ongoing components shortages. The data suggests that the sheet market is well supplied between inventories and material on order. With a slower shipment rate in April, a shorter month and high levels of mill shipments, we could see current balanced inventories shift to surplus.

Plate

US service center inventories drastically reduced plate inventories in March as shipments picked up. Service centers carried 44.4 shipping days of plate supply at the end of March, down from 51.1 shipping days of supply in February. Plate inventories represented 1.93 months of supply in March, down from 2.55 months in February.

Service centers reported an increase in business to other service centers as mills were raising prices. Earlier in the year, service centers said that they were seeing resale business below replacement costs, despite stable mill pricing. Fears of plate prices following HRC prices down drove service centers to destock and limit new orders to only what they had sold. In March, however, as mills imposed new raw material and freight surcharges, service centers looked to other distributors to fill gaps in their inventories, partly to avoid the uncertainty surrounding new prices but also because of shorter lead times.

Lead times for plate extended to 5.80 weeks, according to the March 31st SMU survey, up from 4.33 weeks on March 3rd. Despite longer lead times, service centers are not concerned about supply and are avoiding buying more than they need. Service centers said that lead times remain relatively short for common items.

As business and prices increased in March, service centers added more orders. The amount of plate on order at the end of March jumped month on month.

There are mixed signals regarding plate demand. Some market contacts were surprised by the latest price increases because they were seeing weaker demand. But others are seeing robust demand not only from service centers but also from OEMs. While inventories at the end of March appear to be low relative to demand, the boost in the material on order indicates that inventories will be back in balance with demand in the coming weeks. There is a risk that higher shipment levels among service centers are skewing the view of end-user demand. The daily shipping rate in March was the highest level since April 2021. A faster drop off in shipments in April could cause inventories to climb sooner.

By Estelle Tran, Estelle.Tran@CRUGroup.com