Analysis

March 27, 2022

Final Thoughts

Written by Michael Cowden

The market has worked itself into a frenzy about rising costs: for fuel, for labor, and for raw materials. All that translates into sharply higher prices for steel.

There is a good case to be made that these factors – especially when it comes to fuel and raw materials – won’t go away anytime soon because of the war in Ukraine and sanctions on Russia.

But let’s play the devil’s advocate.

I don’t know how long it will take for us to find “normal”. But current market conditions won’t extend indefinitely. And new supply chains will eventually be established (e.g., pig iron won’t be scarce forever).

Here are some things to keep an eye on if you’re looking for an inflection point. I realize it’s early in the game to be doing that. But it’s better to be prepared than to have another big market move catch you by surprise.

Lead Times

Let’s start with the nuts and bolts of the US market. For starters, it concerns me a little that we haven’t seen lead times jump out in a more significant way.

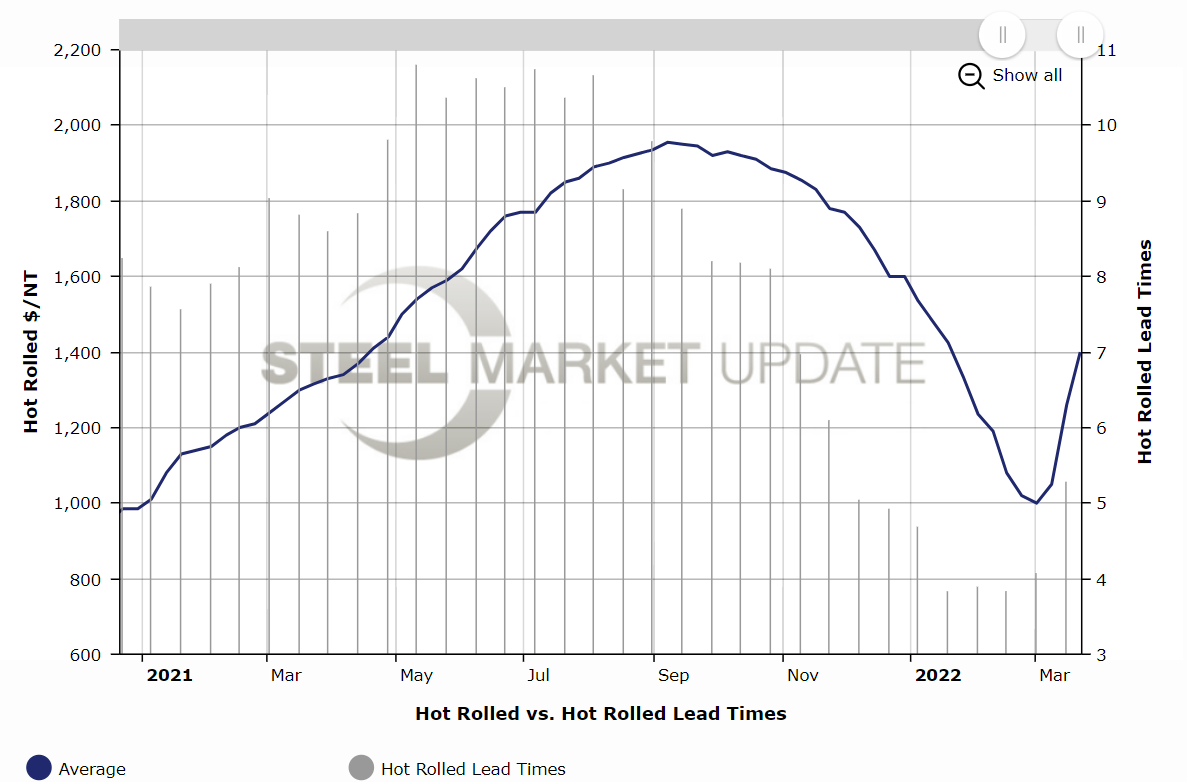

Hot-rolled coil prices at the end of February were $1,020 per ton ($51 per cwt), and lead times were 3.84 weeks. Now, HRC prices are $1,400 per ton, a 37% increase. Lead times are 5.29 weeks, a 38% increase. In other words, prices and lead times are stretching out in tandem – which is reassuring.

But let’s rewind to last year. When prices were last around $1,400 per ton – in late April 2021 – lead times were 9.81 weeks, or nearly double what they are now.

You can chart all this out on your own with SMU’s interactive pricing tool:

What gives? Also, why didn’t lead times provide as much of an advance warning as they have in past cycles? My best guess is because the invasion of Ukraine by Russian forces changed the market overnight – and I say that without any exaggeration.

February 24 changed everything, and we’ll be feeling the impact of it for a long, long time. The spread of Covid-19 from Asia to Europe, and then from Europe to North America – shockingly fast at the time – happened at a glacial pace compared to how quickly war has changed the market. The war doesn’t show signs of ending soon, and so I would expect lead times to continue to stretch out as people race to get ahead of additional anticipated price increases.

Still, I’d keep a close eye for our updated lead times, which we’ll publish on Thursday. Again, I’d expect them to continue increase. But if they don’t, it’s time to ask whether costs – not just for steel but also for fuel, for labor, for just about everything – are increasing at an unsustainable pace.

Inventories

Also, when it comes to the domestic market, I’d keep a close eye out for March inventory figures.

Inventories in February were still a little high (2.72 months of supply). If you’re a Premium member, take a look at the data here.

We don’t have March data yet. Which means that we’re currently looking mostly at a pre-war world. We’re of course running higher than we were this time last year (2.14 months). Because that’s when demand snapped back more quickly than expected from the pandemic and everyone was caught short on supply.

What’s notable is that we’re running a little ahead of February 2020 (2.58 months). And recall that 2020 started out as a good, mostly normal year for steel – before the pandemic upended the market in April (3.64 months).

I would expect to see a significant drop in inventory levels in March if supply-demand fundamentals support the sharp price gains we’ve seen over the last month. But, unlike last year, there is supply in the system – or at least there was in February. So is panic buying really justified now?

If inventories are still high in March – and, to be clear, I don’t expect them to be – would it mean that people are carrying more “just in case tons” because the war and broken supply chains mean “just in time” is no longer a workable model?

So March inventories are another set of SMU data that I’d keep a close eye out for. (They’re also a very good reason to upgrade to Premium.)

Global Prices

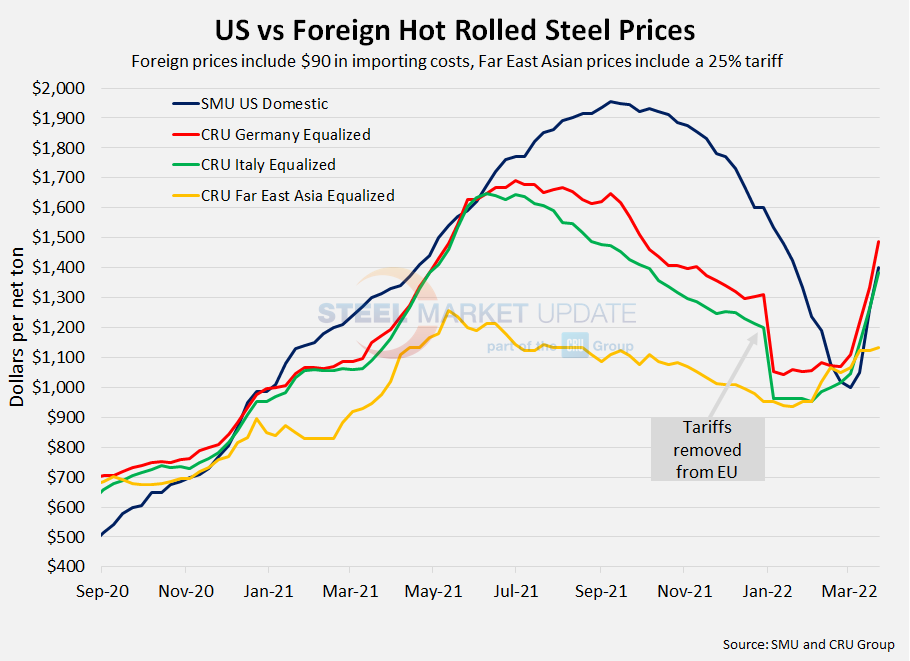

I always enjoy reading the global HRC price comparison that Brett Linton puts together on Thursdays. The trends this last week were even more interesting than usual.

Take a look at this chart again:

US and EU prices are up sharply and about at parity because of the war in Ukraine. But prices in Asia are a lot lower. Do prices in the US and EU come down, or do prices in Asia rise? (Why should Asia leave so much money on the table?)

I know a lot has been made about how trade flows between the “West” (a weird term, because it also includes Japan), Russia and even China might be forever changed. That said, stuff has a way of finding its way around even iron curtains – if that’s indeed what we’re dealing with. And it’s unusual for steel prices in one area of the world to be out of whack for long with those in another.

Any bets on whether the “West” will fall, whether Asia will rise – or whether we’ll meet somewhere in the middle? For the time being, I think this photo pretty much up sums up the current market.

Thanks to the service center exec who sent it over. Feel free to contact me with any others you think are a sign of these unprecedented – sorry, the ‘u’ word again – times.

And, as always, all of us at SMU thank you for your business.

By Michael Cowden, Michael@SteelMarketUpdate.com