Plate

April 10, 2022

Hot Rolled vs Plate Prices: Ballooning Spread Eases from March Peak

Written by Brett Linton

Plate prices have remained relatively steady while sheet prices declined and then surged over the past six months. Plate prices typically carry a premium over hot rolled prices because plate is a value-added product and requires more time on the mill.

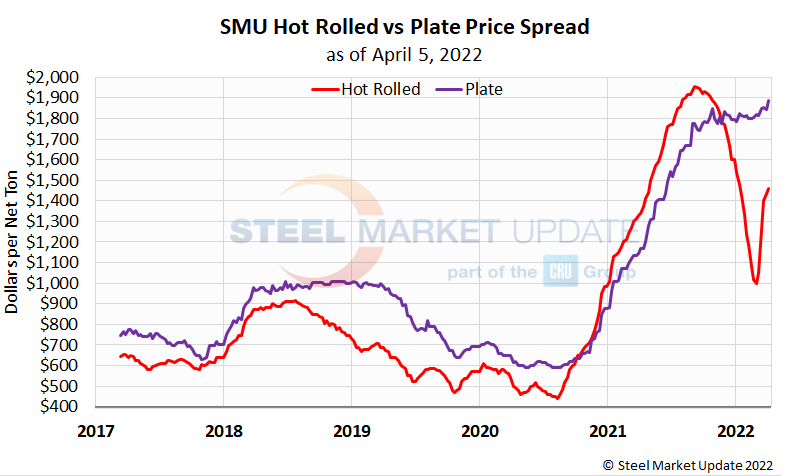

SMU’s hot rolled coil price averaged $1,460 per ton ($73 per cwt) last week and has risen each of the past five weeks. Recall our index had reached a 14-month low of $1,000 per ton in the first week of March, following a record-high $1,955 per ton in September 2021. Our latest plate index averaged $1,885 per ton last week, up $40 per ton from the week prior and up $70 per ton from a month ago. Plate prices have been stable compared to sheet prices, with our plate index remaining between $1,775 and $1,885 over the past six months.

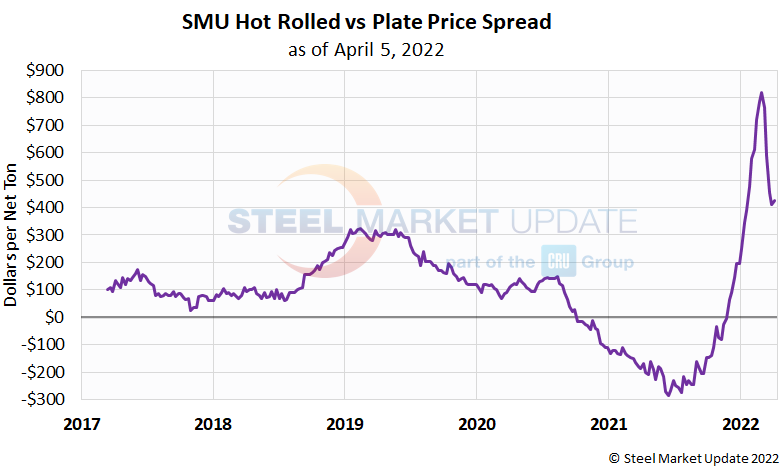

As shown in the graph below, in 2017 plate prices held an average premium of $99 per ton over hot rolled. That premium rose to a high of $325 per ton in February 2019, declining thereafter until it diminished and hot rolled begain to sell at a higher price in October 2020. HRC held onto that premium until November 2021, losing it after flat rolled prices began declining in October and plate prices stood their ground.

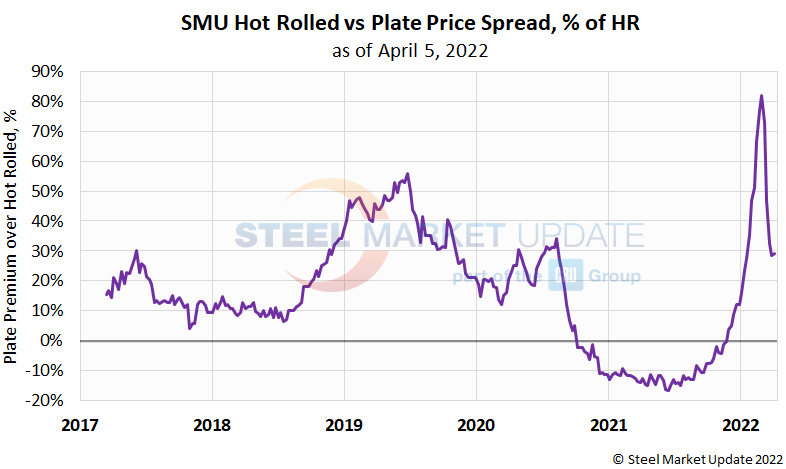

To better compare this price spread, we graphed the plate price premium over hot rolled as a percentage of the hot rolled price. This is an attempt to paint a clearer comparison against historical pricing data. (You remember, those distant times when sheet prices were three digits per ton!). Plate prices held a 16% premium over hot rolled in 2017 on average, climbing to a 56% premium in June 2019. The premium turned negative in October 2020 (when HR began to sell at a higher price than plate), falling to a low of -17% in June 2021. Plate regained its premium price in November 2021, rising to a record high spread of 82% in the first week of March. The latest spread has softened to 29% and has been roughly in that ballpark for the last three weeks.

By Brett Linton, Brett@SteelMarketUpdate.com