Market Data

April 6, 2022

CRU: War in Ukraine Will Put The Brakes On World Growth

Written by Alex Tuckett

By CRU Principal Economist Alex Tuckett, from CRU’s Global Economic Outlook

The invasion of Ukraine by Russian forces has continued to rock commodity and financial markets. We expect the fallout from the invasion to reduce world growth this year and next, through three main channels:

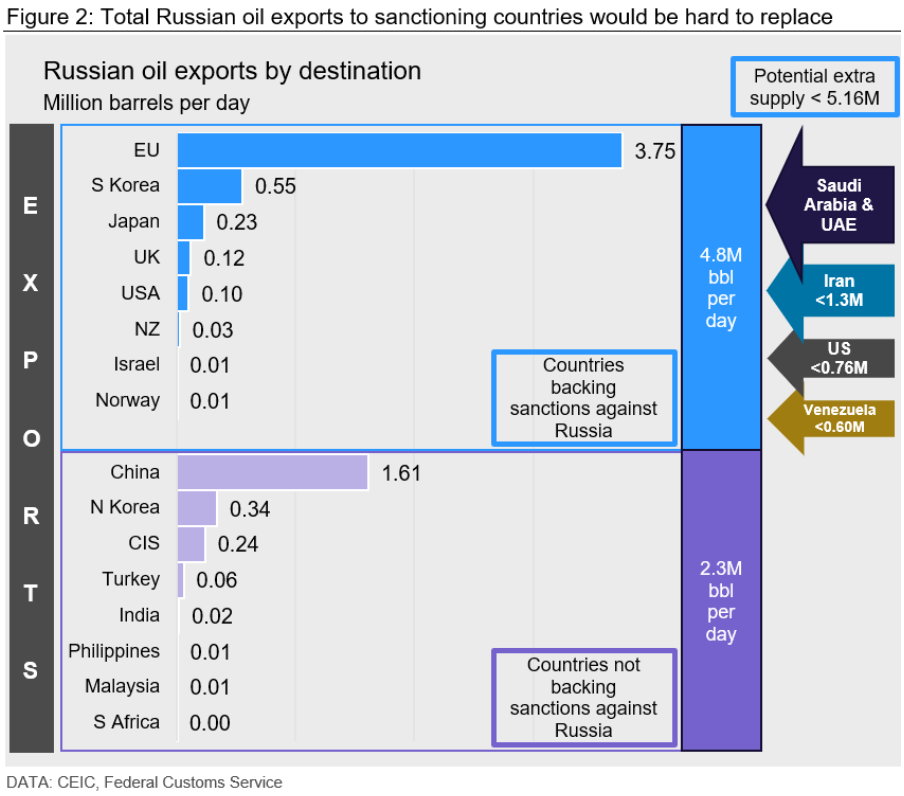

Energy prices. Russia is a major producer and exporter of oil, gas and coal, particularly to Europe. So far, the EU has not sanctioned Russian energy exports. But, as the oil section sets out, an embargo could result from further escalation of the war, and there has already been significant ‘self-sanctioning’ by private companies. If all countries sanctioning Russia were to embargo energy, the lost exports from Russia would be very difficult to replace with alternative supply (Figure 2). Russian exports of natural gas to Europe have so far continued to flow, prices now include a large premium for the risk there will be a reduction. Russia’s recent demand to be paid in rubles has increased anxiety. Higher energy prices will push inflation – already high – even higher, reducing consumer spending power. Higher inflation will also mean tighter monetary policy in some economies, which will hurt growth.

Supply chain impacts. Both Russia and Ukraine were major exporters of a number of non-energy commodities which play a crucial role in global supply chains, particularly for the automotive sector. These include Palladium, nickel, neon gas (important for chip production) and fertilizers. The war is likely to prolong the supply chain problems which dragged on the global manufacturing sector.

Financial and confidence effects. Many financial institutions, particularly in Europe, are exposed to the Russian economy and to commodity trading. Many western firms, from oil majors to auto OEMs, have investments in Russia. More importantly, the uncertainty created by the possibility of further escalations of the war or of sanctions will lead some firms to put off investment decisions. US-China trade tensions under during the Trump administration were associated with a slowdown in world trade and investment growth.

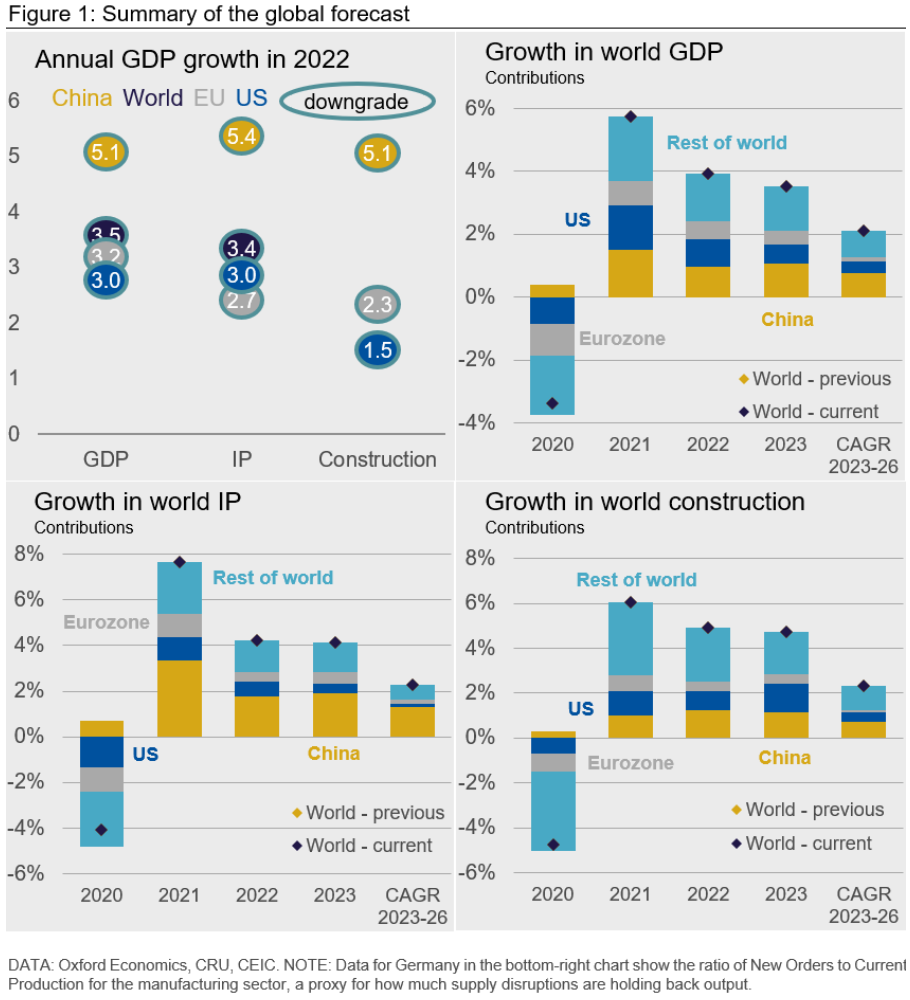

As a result of these impacts, we have downgraded our forecasts for world growth to 3.5% in 2022 (from 3.9% in our February forecast) and 3.3% in 2023 (from 3.5%). The world avoids an outright recession, but growth slows sharply. The slowdown is less severe than Scenario C which we presented in early March. This reflects the fact that energy prices have fallen from their peaks. It is also because we have revised up our forecast for 2022 growth in China, to 5.1% from 5.0%. We believe that the Two Sessions sent a positive signal on pro-growth policy that offsets the effects of the war in Ukraine. However, downside risks from Covid-19 have clearly risen in China.

The Eurozone is most exposed to the cocktail of risks posed by the war. Measures of household and business confidence have already dropped sharply. We expect growth to be 3.1% in 2022 (from 3.8% in our February forecast), and 2.8% in 2023 (from 2.9%). However, we do expect a fiscal response that will help cushion the blow to growth. The German Federal government has already announced 32bn Euros in relief, including cuts to fuel taxes and cash directly to households. France has taken similar measures. We also expect the ECB to be more tolerant of higher inflation than the Federal Reserve.

Industrial production (IP) will be affected more severely than GDP as a whole. We have downgraded our forecast for IP growth to 3.5% in 2022 (from 4.2% in our February forecast). The industrial sector will face prices for energy and other material inputs, as well as the risk of another bout of supply chain disruptions. On the demand side, the squeeze on household real incomes from higher inflation is likely to be felt more by cyclical areas of spending such as consumer durables. The automotive sector is particularly exposed to supply chain issues from this war, and we have revised down our forecast for global light vehicle production in 2022 by 2.4 million units. We have also revised down our expectations for growth in construction to 3.4% in 2022 (from 4.9%).

We have marginally revised up our forecast for world growth in 2024 and 2025. However, the levels of both world GDP and IP in 2026 are still 0.4% below our February forecast. We believe economic relations between Russia and the West have changed irrevocably, with long-lasting implications for global value chains.

This aritcle was originally published on March 31 by CRU, SMU’s parent company.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com