Market Data

March 31, 2022

Steel Mill Negotiations Tighten, Lock in Seller's Market

Written by Brett Linton

Mills are increasingly holding firm on higher prices. The result: the buyer’s market we saw at the beginning of the year is offically over.

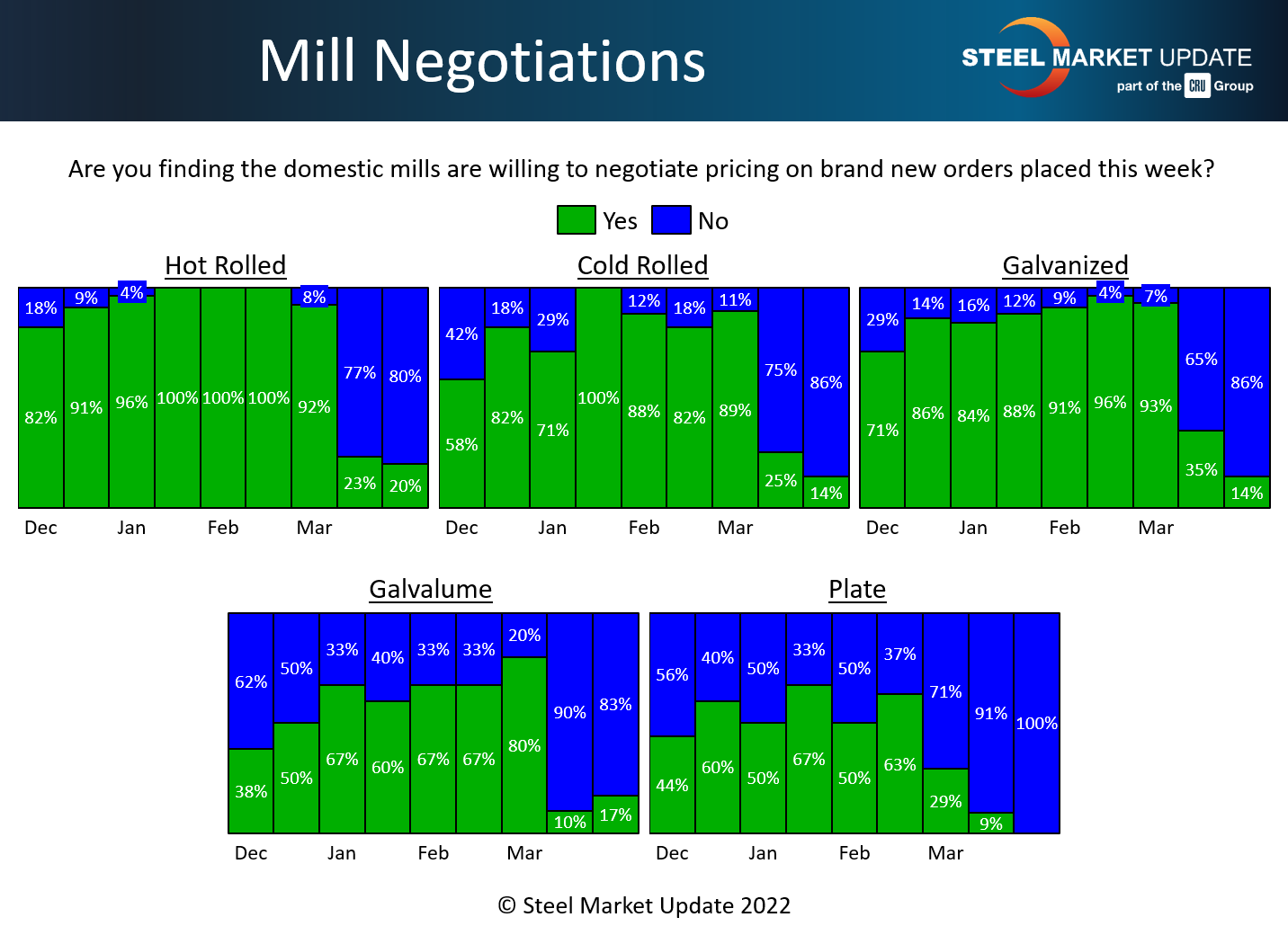

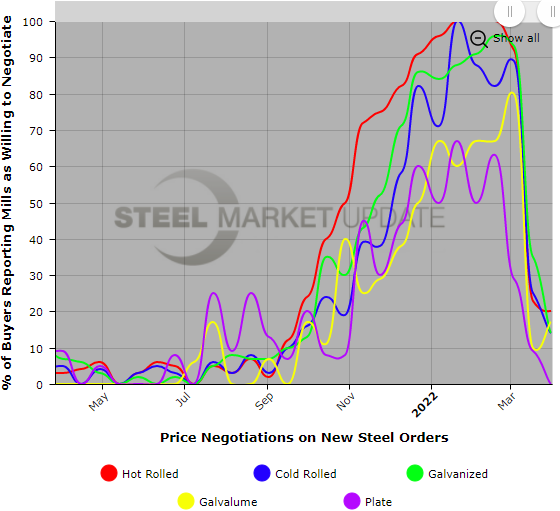

Every two weeks, Steel Market Update asks buyers: Are you finding domestic mills willing to negotiate spot pricing on new orders placed this week? The overwhelming majority of steel buyers polled this week reported that mills are no longer willing to negotiate lower on new orders, as indicated by the blue bars below.

Just 20% of hot rolled buyers said that mills were open to negotiation, while 80% said the mills are standing firm on prices – roughly similar to what we saw two weeks prior. The script late last year and the first two months of this year, when more than 90% of respondents reported mills were willing to negotiate lower prices. And that number climbed to 100% from late-January through mid-February as prices fell fast before the war in Ukraine sent them soaring upward again.

In the cold rolled and coated segments, most buyers report mills will not budge on prices to secure orders, with only 14-17% saying mills are willing to talk price. As with hot rolled, it’s an abrupt change from just a few weeks ago.

Negotiations were never quite as loose in the plate market and have been tightening since early-March. Our latest survey shows that every single plate buyer responding to our survey reported mills are not willing to bargain, versus a 91% rate two weeks ago and 71% in early-March.

SMU’s Price Momentum Indicator continues to point to Higher, indicating rising prices over the next 30-60 days. With the continued squeeze on raw material supplies driving global steel prices upward, the bargaining position of the mills is likely to hold for some time.

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.

By Brett Linton, Brett@SteelMarketUpdate.com