Market Data

March 31, 2022

Steel Mill Lead Times Extend Again, But Pace Moderates

Written by Brett Linton

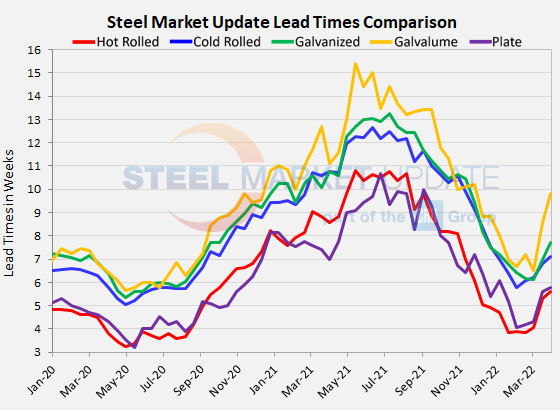

Steel mill lead times continue to extend, but they are rising at a more moderate pace compared to early March. Steel Market Update’s latest check of the market indicates that lead times for sheet and plate increased by an average of 0.6 weeks, compared to an average jump of 1.2 weeks two weeks prior.

Buyers surveyed Monday through Wednesday of this week reported mill lead times ranging from 4-8 weeks for hot rolled, 6-8 weeks for cold rolled, 5-10 weeks for galvanized, 7-12 weeks for Galvalume, and 5-8 weeks for plate.

Survey results show that hot rolled lead times increased by 0.3 weeks from mid-March to an average of 5.6 weeks, the highest level since last November. Hot rolled lead times are up 1.6 weeks compared to early-March. Cold rolled lead times now average 7.1 weeks, up 0.3 weeks. Galvanized lead times jumped 0.7 weeks to 7.7 weeks and are up 1.6 weeks compared to early-March. The average Galvalume lead time jumped from 8.6 weeks to 9.8 weeks. But that big gain should be taken with a grain of salt due to the small sample size. Mill lead times for plate are now at 5.8 weeks, up 0.2 weeks from SMU’s previous check of the market, and up 1.5 weeks from early-March.

Two out of three of the executives responding to this week’s questionnaire told SMU they think lead times are extending – but at a slower rate than prices. Approximately 20% consider lead times stable at this point, and 12% responded that lead times are extending just as rapidly as prices. Here’s what a few of them had to say:

“Both buyers and mills are cautiously negotiating next transactions; no panic buying underway, which is healthy.”

“Mills are not in a hurry to push lead times out until they get a handle on raw material costs.”

“Extending at a slower rate than normal because inventories are slightly high, and there is no reason to buy more than exactly what is needed. But inventories will get tight during the second quarter. If the war issue is still ongoing at that point, lead times could pop.”

“Raw material costs are driving the price increases, not demand.”

“I believe the mills have finally figured out order book discipline.”

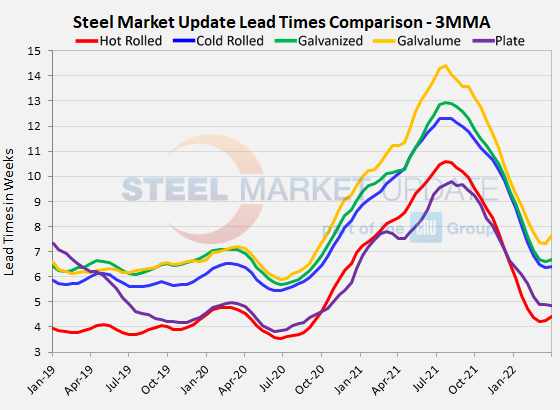

Looking at lead times on a three-month moving average can smooth out the variability in the biweekly readings. As a 3MMA, each of the flat rolled products showed a small uptick this week, the first upwards movement seen in 8 months, while plate lead times remained flat. The current 3MMA for hot rolled is 4.4 weeks, cold rolled is 6.4 weeks, galvanized is 6.7 weeks, Galvalume is 7.6 weeks, and plate is 4.9 weeks.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. SMU measures lead times as the time it takes from when an order is placed with the mill to when the order is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our Steel Mill Lead Times data, visit our website here.

By Brett Linton, Brett@SteelMarketUpdate.com