Market Data

March 30, 2022

Final Review: US GDP Grew at a Robust 6.9% Rate in Q4

Written by David Schollaert

The US economy closed out 2021 by expanding at an annual pace of 6.9% from October through December, a slight downgrade from previous estimates, according to the US Commerce Department’s Bureau of Economic Analysis (BEA).

This agency’s third and final review showed the nation’s gross domestic product (GDP) up 5.7% in the fourth quarter, the fastest calendar-year growth since a 7.2% surge in 1984 in the aftermath of a recession.

The final tally, a downgrade from the government’s earlier estimated 7%, reflected a smaller increase in consumer spending and fewer exports. They were partly offset by an upward revision to private inventory investment, the Commerce Department said.

Looking ahead, growth is likely to slow sharply this year, particularly during the first quarter. Higher inflation is expected to weigh on consumer spending as Americans express concern over the economy’s direction. Home sales have fallen because the Federal Reserve has started pushing up borrowing costs, leading to a sharp increase in mortgage rates. Exports may weaken as overseas economies are disrupted by the war in Ukraine.

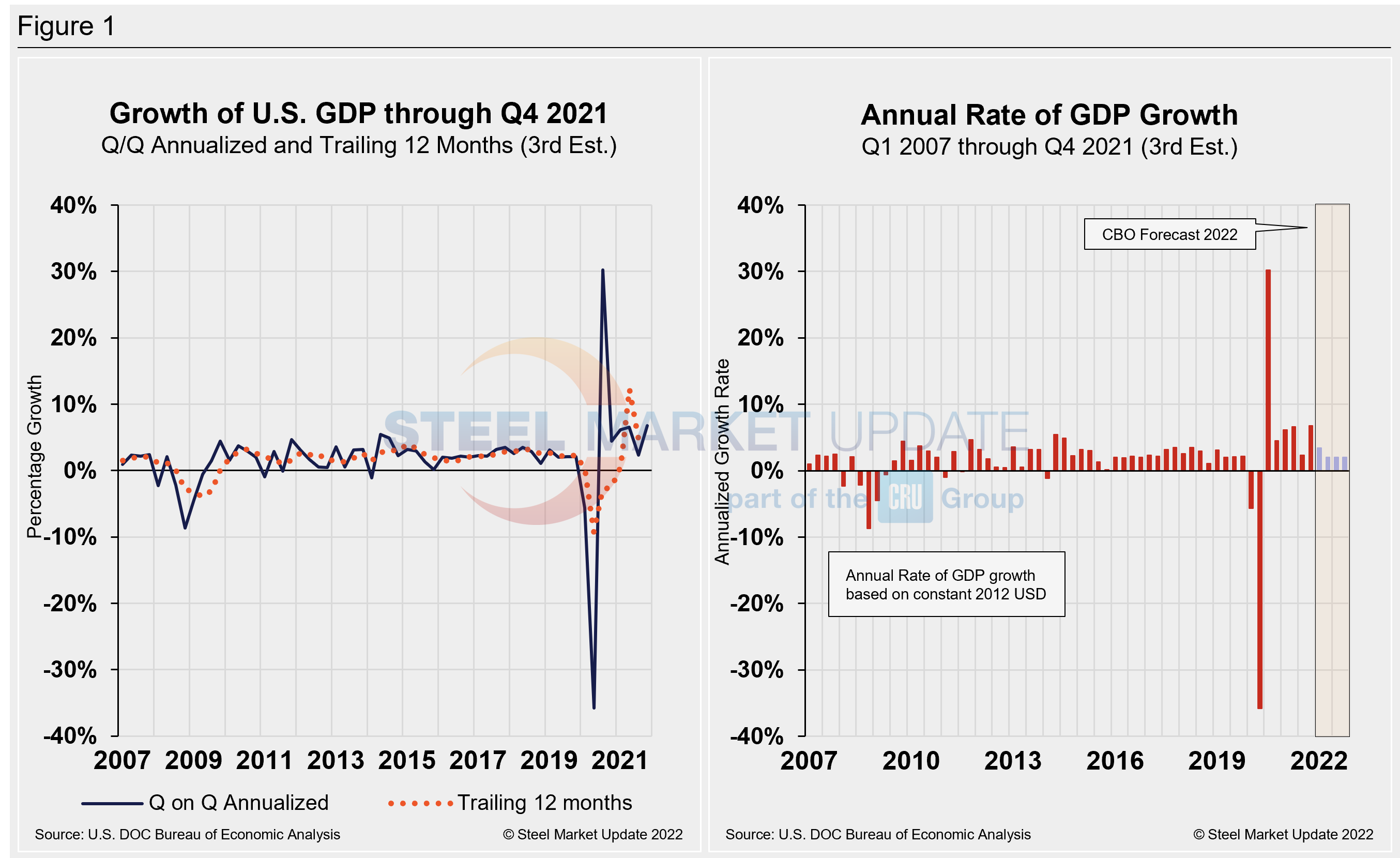

Commerce’s final look put total US GDP in Q4 at $24.00 trillion, a 14.5% jump or $800.5 billion, over the previous quarter. Below in Figure 1 is a side-by-side comparison of the growth of US GDP and the annual rate of GDP, both through Q4 2021. In the first chart, you’ll see the contrast between the trailing 12-month growth and the headline quarterly result. The chart on the right details the headline quarterly results since Q1 2007, including the Congressional Budget Office’s GDP projection through 2022.

On a trailing 12-month basis, GDP accelerated to 5.53% in the fourth quarter, up from 4.95% in the prior quarter but still well behind 12.23% growth in Q2. Nevertheless, it’s a vast improvement from -9.27% in Q2 2020 at the height of the pandemic. For comparison, the average in 48 quarters since Q1 2010 has been a growth rate of 2.09%.

The economy’s growth in the final quarter of 2021 was driven by a 33.5% jump in business investment as companies worked to replenish their inventories. In fact, inventory restocking accounted for 70% of fourth-quarter growth.

Restocking is likely to be the biggest drag on GDP in Q1 due to a huge inventory build-up in last year’s fourth quarter, as companies sought to get ahead of supply chain problems for the winter holidays. That inventory restocking added nearly six percentage points to fourth-quarter growth, a boost that wasn’t repeated in the first three months of this year.

Current forecasts indicate solid consumer spending pulled in more imports in the first quarter, while a stronger dollar and slower growth overseas reduced US exports. The combination is likely to weaken the economy in the first quarter.

Shown below in Figure 2 is a side-by-side comparison of two charts. On the left is the mix of the six major components in the GDP growth calculation, while the chart on the right puts a spotlight on personal consumption, a measure of consumer confidence and spending engagement. The most notable change and a major source of GDP fluctuation is personal consumption, which has experienced extreme swings at the onset of COVID and the subsequent rebound as the economy reopened.

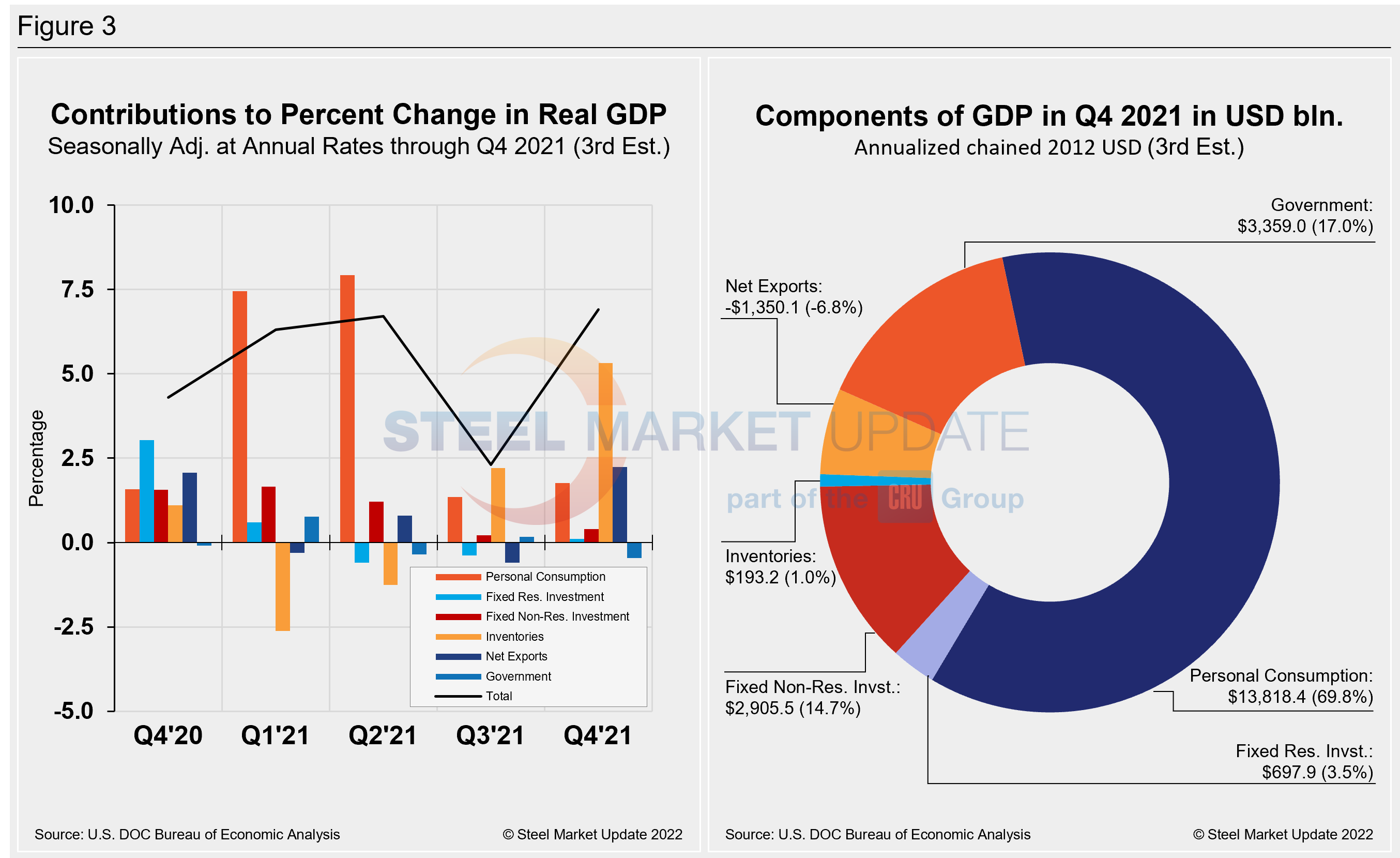

Quarterly contributions of the six major subcomponents of GDP since Q4 2020 and the breakdown of the $24.00 trillion economy in BEA’s second review of Q4 GDP are both shown in Figure 3. The chart on the left is for cross-comparison with Figure 1 above. The chart on the right shows the size of the other components relative to personal consumption.

SMU Comment: This report is a reminder that growth was sizzling coming into the year. But economists forecast that growth could fall to as low as 0.5% in the first three months of the year and may even slip into negative territory. That’s because while higher incomes should support continued consumer spending, they might not be enough to fully offset inflation.

The Federal Reserve forecasts the U.S. economy will expand 2.8% this year, much lower than in 2021 – but still a solid pace.

By David Schollaert, David@SteelMarketUpdate.com