Market Data

March 17, 2022

Steel Mill Lead Times Extend Again, Negotiations Shift

Written by Brett Linton

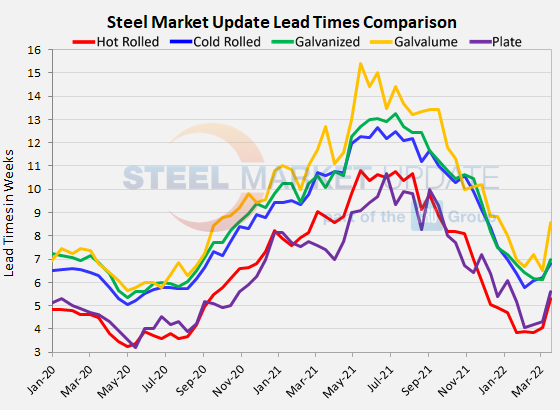

Steel mill lead times appear to be extending again. Steel Market Update’s check of the market this week shows lead times for orders of flat rolled and plate products increasing by an average of 1.2 weeks.

Buyers polled this week by SMU reported mill lead times ranging from 4-8 weeks for hot rolled, 5-8 weeks for cold rolled, 6-8 weeks for galvanized, 7-10 weeks for Galvalume, and 4-8 weeks for plate.

Survey results show that hot rolled lead times increased by 1.22 weeks from the beginning of March to an average of 5.29 weeks, the highest level since November. Cold rolled lead times now average 6.82 weeks, a 0.60 week increase from early-March. Galvanized lead times, now at 7.00 weeks, are up 0.88 of a week from what was a 19-month low. The average Galvalume lead time jumped from 6.50 to 8.57 weeks, but due to the small sample size this rise should be taken lightly. Mill lead times for plate are now at 5.60 weeks, up 1.27 weeks from 4.33 in SMU’s previous check of the market.

Steel prices had been on a downward correction since September, before the war in Ukraine sent them skyrocketing earlier this month. Mill lead times on hot rolled orders had shortened back to historic norms of around four weeks from a peak of more than 10 weeks last year when steel was in short supply. But with prices now on the upswing, and buyers placing orders ahead of the next increase, it’s no surprise that lead times are lengthening again.

Two out of three of the executives responding to this week’s questionnaire told SMU they believe lead times will soon or already are extending. The other one-third consider lead times stable at this point. Here’s what a few of them had to say:

“The market is in a wait-and-see mode. It will move out in the next three weeks.”

“Our lead times from Europe are increasing.”

“Mills will be taking more orders and lead times will extend as customers get off the sidelines.”

“Import is dead for now. This will enable the domestics to again cry “the sky is falling,” making everyone believe again there is no steel, lead times are way out and the order book is full. Can you say controlled order entry?”

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. SMU measures lead times as the time it takes from when an order is placed with the mill to when the order is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our Steel Mill Lead Times data, visit our website here.

Negotiations Shift

It has been a buyers’ market for several months, but that appears to be changing. Every two weeks, Steel Market Update asks buyers: Are you finding the domestic mills willing to negotiate spot pricing on new orders placed this week? As shown by the blue bars on the right in each graph below, three out four buyers reported that mills are no longer willing to negotiate on hot and cold rolled orders. About 65% of galvanized buyers reported the same, as did 90% of Galvalume buyers. Plate negotiations reached a five-month low, with only 9% of buyers reporting mills willing to discount prices to secure orders.

With the war in Ukraine squeezing raw material supplies and driving global steel prices upward, the bargaining position of the mills is likely to continue strengthening.

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.

By Brett Linton, Brett@SteelMarketUpdate.com