Market Segment

March 15, 2022

SSAB Increases Plate Prices by $63/ton on Higher Heavy Melt Costs

Written by Michael Cowden

SSAB Americas has increased plate prices by $63 per ton ($3.15 per cwt) based on a raw materials surcharge mechanism unveiled last week.

The Mobile, Ala.-based steelmaker said the higher prices would apply to all new spot orders as well as both new and existing contractual agreements effective April 3.

![]()

The company reiterated that the increase was necessary because of “extraordinary market pressures brought on by recent global events,” in a letter to customers on Tuesday, March 15.

The global events in question are a reference to Russian forces invading Ukraine in late February and a war that has resulted in sharply higher raw material costs, including for ferrous scrap, and higher steel prices as well.

SSAB based its price increase on higher prices for heavy melting scrap, with the RMS kicking in dollar for dollar when heavy melt prices exceed $465 per gross ton.

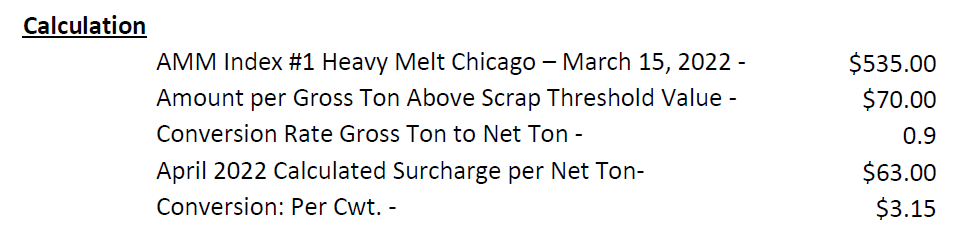

The formula the company used for the increase – snipped from its customer letter – is below:

SSAB’s price increase of $63 per ton comes after Charlotte, N.C.-based Nucor – one of three major plate players in the U.S. – announced a price hike of $40 per ton last week.

SSAB operates one plate mill in Mobile and another in Montpelier, Iowa.

Plate prices stand at $1,850 per ton, up $35 per ton (1.9%) from $1,815 per ton a week ago, according to SMU’s interactive pricing tool.

By Michael Cowden, Michael@SteelMarketUpdate.com