Overseas

March 13, 2022

CRU: Steel Markets Thrown into Turmoil by War in Ukraine

Written by Chris Bandmann

By CRU Analyst Chris Bandman, from CRU’s Steel Monitor, March 16

The war in Ukraine is having widespread and deleterious effects on the global steel markets, but no one region has been more heavily affected than Europe. Steel prices in the region have soared to unseen heights and continue to rise on a daily basis. Elsewhere in the world, steelmakers are adapting to the seismic shift of the loss of Russian finished and semifinished steel on the international markets. Only the Chinese market has remained mostly unaffected at present, though the war presents a significant risk factor as global supply chains realign.

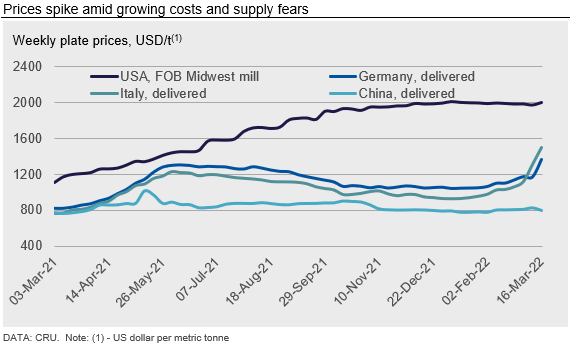

The CRUspi Global Steel Prices Index rose sharply in March, rebounding following months of decline. Both sheet and longs prices have risen in key markets around the world as growing costs and supply tightness push up prices.

European Supply Disrupted by War in Ukraine…

The outbreak of war in Ukraine has had a swift and tumultuous impact on the global steel markets. German HR coil prices have now exceeded the highest points of 2021, and these continue to rise on a daily basis.

The primary issue for sheet products is the loss of both the import supply of finished sheet as well as the loss of Russian and Ukrainian slab imports. The EU imports substantial volumes of Russian and Ukrainian finished steel, and buyers are now scrambling to re-source from other exporters. This has generated plenty of interest in Turkish and Indian offers, among others, but the European safeguard measures present a barrier to the wholesale diversification toward these other countries. Slab supply is even more critical, as more than 90% of EU slab imports are sourced from Russia and Ukraine and there does not appear to be an easy replacement for this material. Compounding this, rising raw material costs are providing further support for prices – and producers are attempting to price in these increases on a daily basis.

The situation is different for European long products, where the volumes traditionally imported from Russia and Ukraine are comparatively smaller. However, here prices are also rising – driven by increasing electricity costs. These have spiked significantly over the last few weeks, rising up to five-fold in some countries. Producers are attempting to pass these increases on to prices, but where this is impossible we are seeing the first signs of producers opting to idle EAF production. There is a significant risk of supply shortages in the near future if producers fail to achieve the price increases required to cover their electricity costs.

…and Exporters are Adapting Globally

The effects of both rising raw material costs and the adjustment of trade flows are also impacting producers outside Europe. U.S. finished steel prices have seen a sharp rebound following weeks of falls off the rise in scrap and pig iron prices. Indian prices have risen off raw material costs and export prospects toward Europe, and prices in Southeast Asia are on the rise as Indian offers fall away.

China is the exception here, where prices have seen some volatility but are mostly rangebound. However, even here we see some risks in the near future around both further Covid-19 outbreaks and the war in Ukraine.

Within the CIS region itself, Russian prices have risen over the past weeks – but there is a risk that prices could plummet if sellers redirect their volumes to the domestic markets. In Ukraine, most steelmaking facilities are currently being hot idled as operations are suspended.

Outlook: Adjustments on a Global Scale

The outlook for the steel markets is closely linked to the outlook for the war in Ukraine. In the short term, buyers and sellers are realigning their supply chains to account for the loss of Russian and Ukrainian material on the international markets. This will lead to some short-term disruption as the markets adjust, with some larger open questions around topics such as options for slab supply into Europe, as well as options for sourcing pig iron for European and U.S. producers.

In addition to this, the Chinese markets have not yet been significantly impacted by the effects of the war in Ukraine. There may be an opportunity for increased exports given the changes in trade flows, but this risks the possibility of governmental intervention should these grow too strongly.

Over the longer term, this realignment of trade flows will leave some regions undersupplied. Southeast Asia, for example, will need to rely more on Chinese material if Indian exporters fully refocus their trade toward Europe.

The European Commission has signaled a willingness to adapt the safeguard quotas to the new reality in the markets, but the simple allocation of Russian volumes to the “other countries” residual quota will not be enough to alleviate the tightness in import supply. We would need to see further liberalization of these quotas should exporters such as Turkey or India be expected to replace Russian steel in the European markets.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com