Prices

February 22, 2022

CRU: Russian Sanctions a Threat to Already Tight Markets

Written by CRU Americas

By CRU Multi Commodity Analyst Alex Christopher and Research Analyst James Mills, from CRU’s Steel Monitor, Feb. 17

The only certainty about the heightened state of East-West relations playing out over Ukraine is that the stakes are high. The gulf between Russian security concerns and guiding principles of NATO, the EU, and western liberalism are seeming intractable. The implementation of sanctions is never costless and commodity markets will certainly pay a high price. The most significant effects are sometimes less obvious, making their impact on trade flows uncertain.

Russian Sanctions Risk Remains

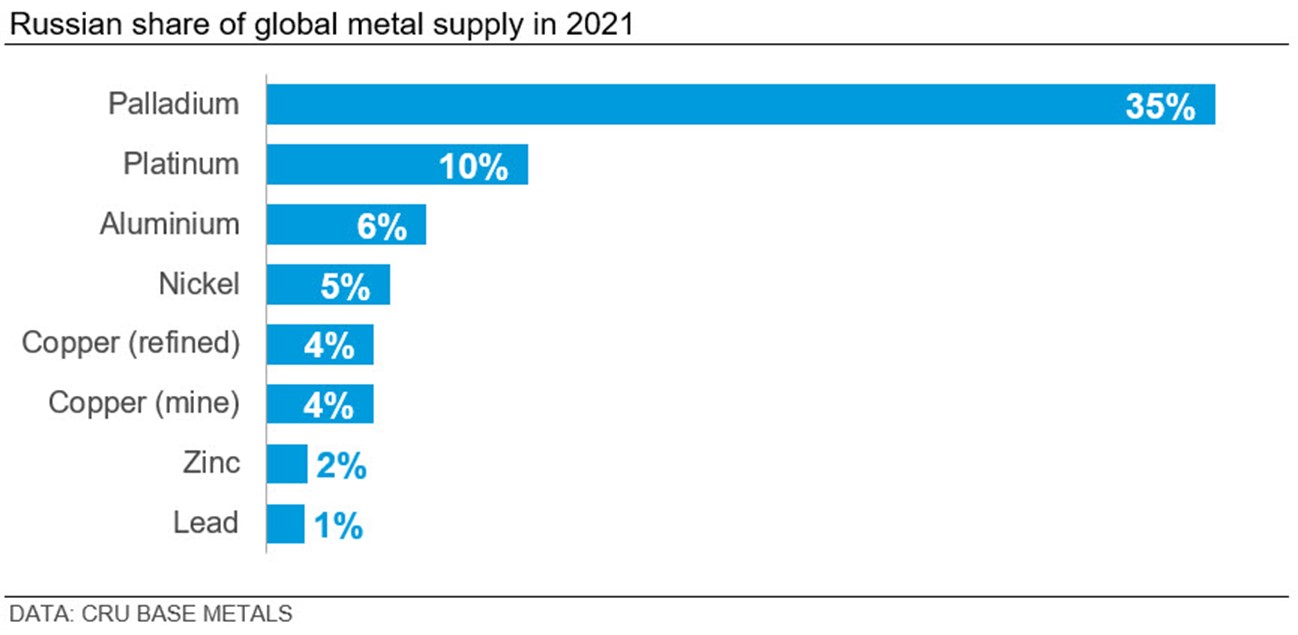

Little has been divulged about the form sanctions may take. They are likely to include direct sanctions against individuals who are seen to be supportive of Vladimir Putin’s regime or his government’s policy over Ukraine. Likely also are some form of sanctions to restrict Russian business access to capital markets, such as the exclusion from the SWIFT system. Both these scenarios or a combination of both would significantly increase commodity prices in the short term and disrupt trade flows. The Russian share of some commodity markets – palladium and fertilizers – may be considered too great to sanction. Russia is also a key EU supplier of oil, natural gas and solid fuels. Any disruption to supply could add additional inflationary pressure on energy intensive products.

Lessons from the UC Rusal Aluminum Sanctions in 2018

Imposing sanctions against a raw materials supplier can be very disruptive. You cannot easily disentangle supply chains or have a clear picture in advance of which industries may be impacted by sanctions around the world. For instance, UC Rusal has a large alumina refinery in Ireland. The halting of shipments from that refinery to aluminum smelters in Europe was nearly as disruptive as the halting of metal exports from Russia.

Existing Contracts Could Sit Outside of Sanctions

To limit disruptions to manufacturing, it is highly likely that any existing contracts would sit outside initial sanctions. There will still be risk with this as the Russian company may not want to supply if accessing the cash payment is burdensome or risky. Last time around, lawmakers initially underestimated the impact of sanctions on UC Rusal; it was only after substantial lobbying that rules were tweaked. Today, metal inventories are so low that the impact on commodity metals prices could be explosive.

Fertilizers – Are Some Markets Too Big to Sanction?

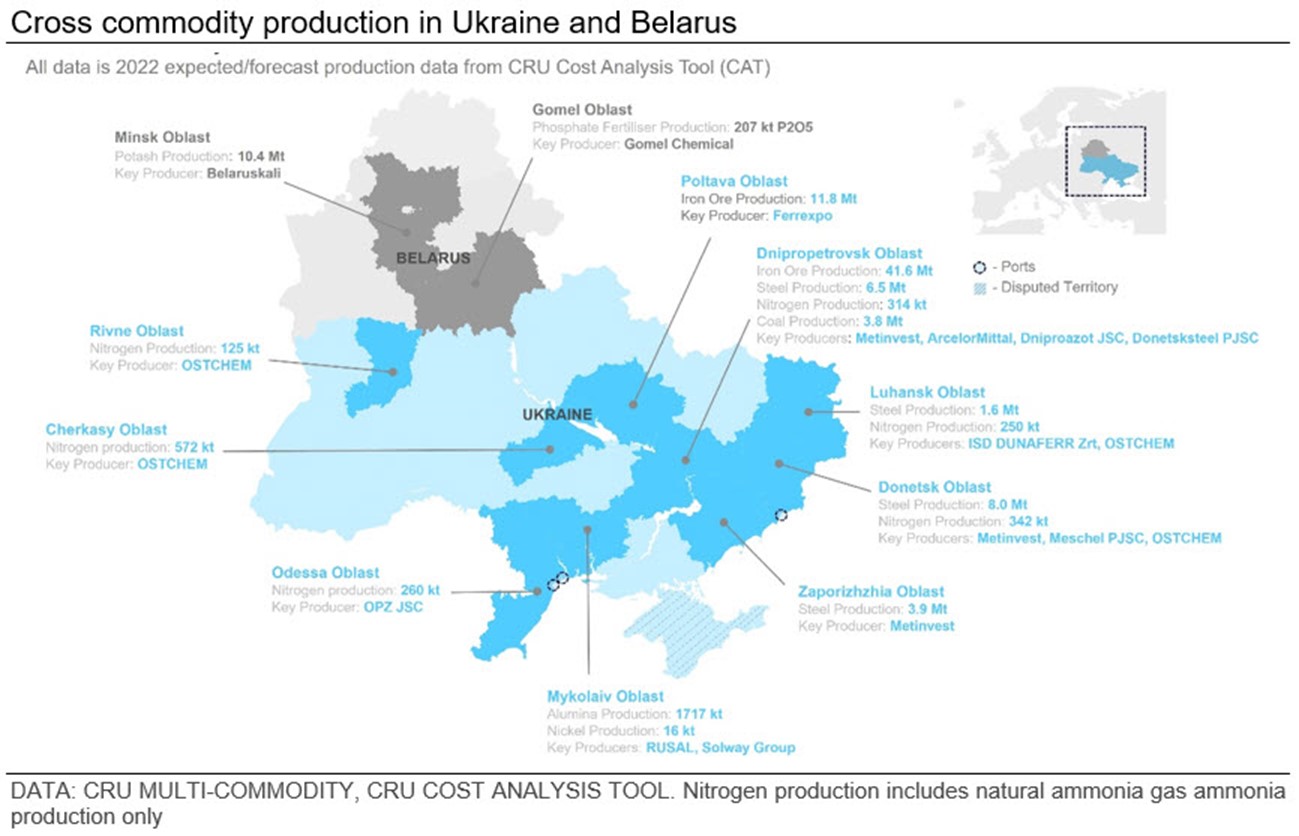

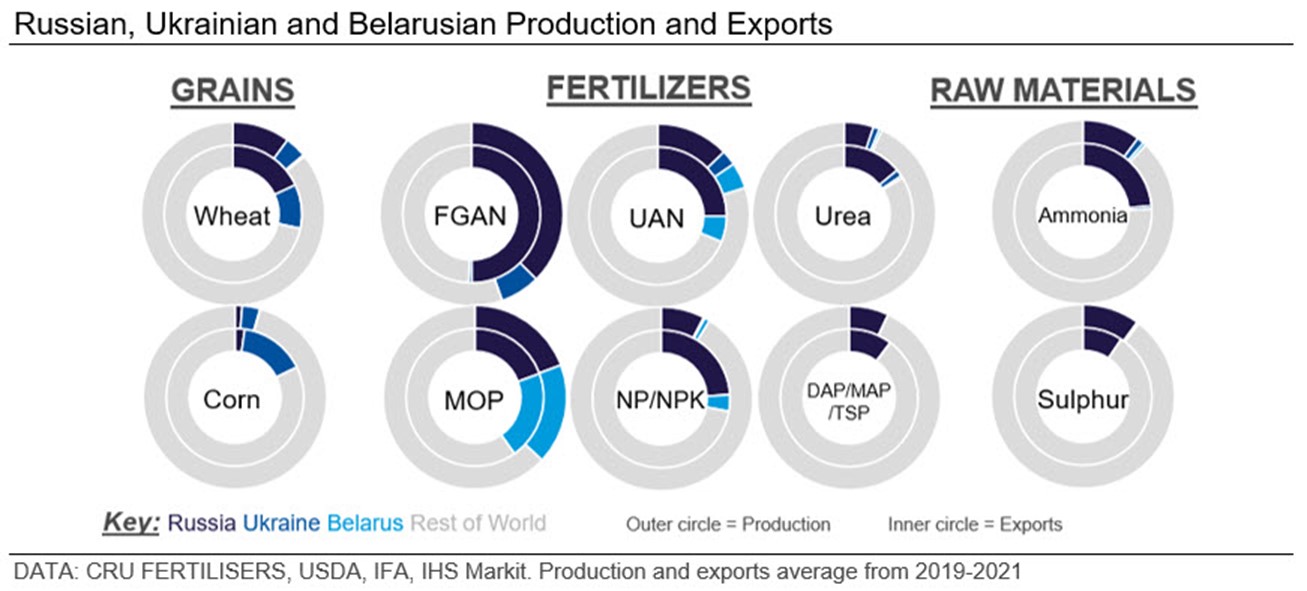

Russia, Ukraine, and Belarus are key producers and exporters in the global grains, fertilizers, and fertilizer raw materials markets.

Yuzhnny Port in Southern Ukraine is a significant export point for ammonia, with shipping at this port estimated to account for over half of Russian volumes. Around 25-30% of Russian urea exports also move through Black Sea ports. Conflict in Ukraine would severely disrupt the export of both Russian and Ukrainian nitrogen products, reducing global supply. The infrastructure capacity required to divert this supply to other export routes in the Baltic Sea is not currently available.

Russian and Belarusian MOP exports supply a significant portion of global demand. MOP prices have been steadily rising following the imposition of sanctions against Belarusian suppliers in 2021. Western sanctions against Russian MOP exports would further tighten an already tight market where prices more than trebled in 2021. Belarusian sanctions in 2021 did not impact existing contracts and it is unlikely Russian exports would be cut off overnight. The potential of reduced MOP supply due to further Western sanctions against Belarus and Russia would, in CRU’s view, create a sustained period of price rise.

EU Trade – What Are the Risks?

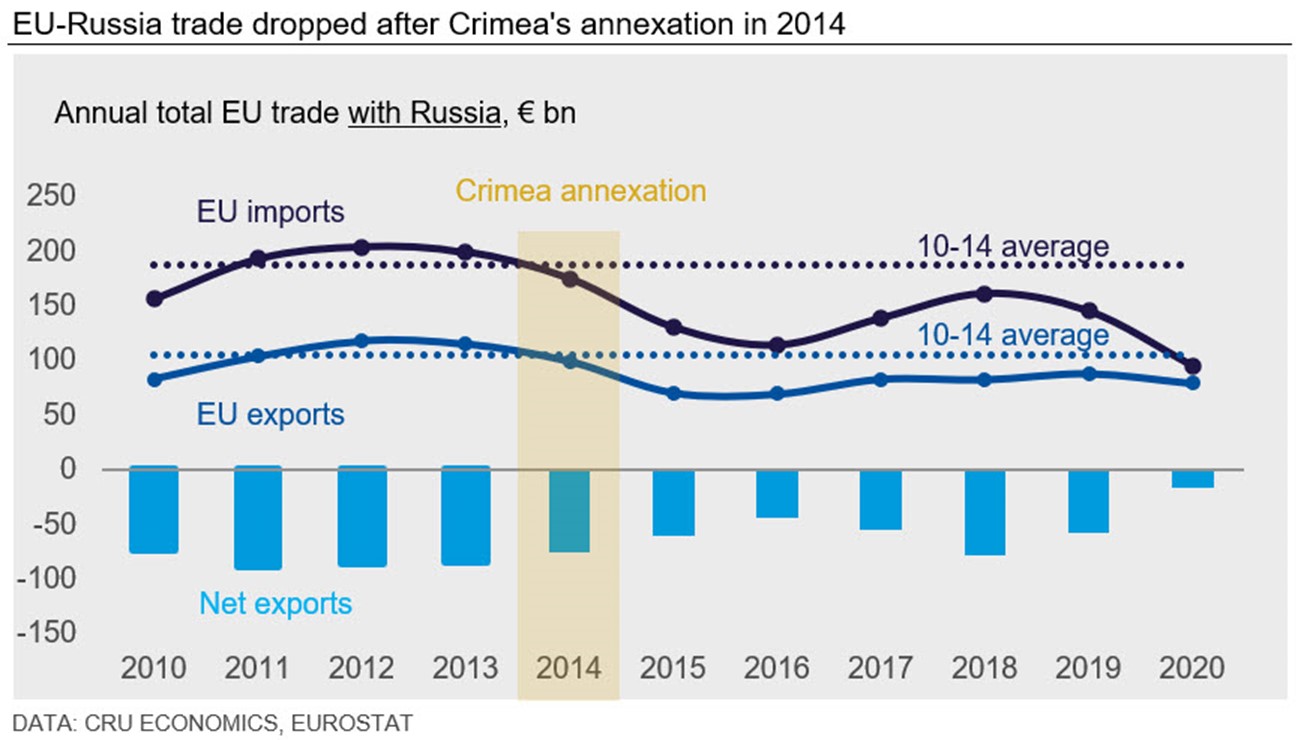

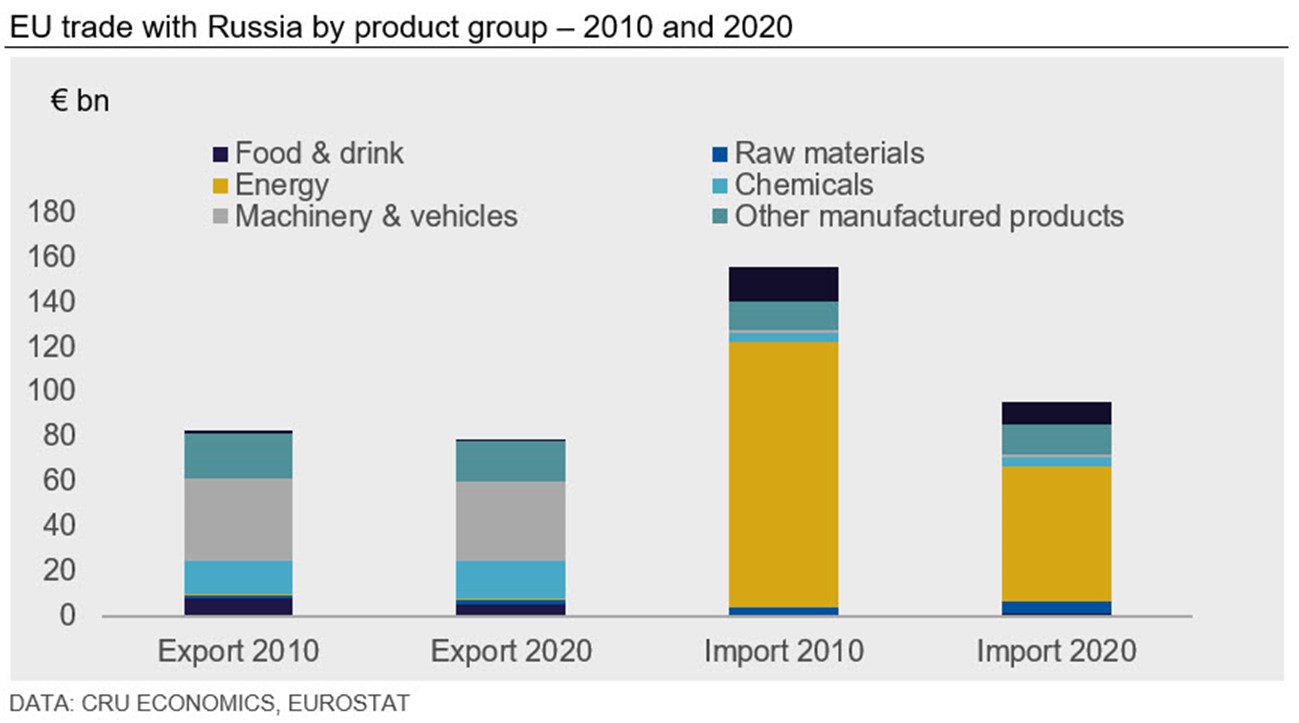

Russia and the EU share an important trading relationship centered on energy, chemicals and raw materials. The imposition of sanctions would further dampen this trade flow, pressuring already tight supply in regional energy, technology and raw materials markets. After the Russian annexation of Crimea in 2014, there was a significant decline in Russian trade with the EU as countries switched providers to avert inherent geopolitical risk. This type of action remains a possibility for the current conflict.

A key issue for the EU will be gas supply, which accounts for more than 40% of EU natural gas imports (excluding EU sources) and a significant amount of total EU imports from Russia. European gas prices have remained high in early 2022, as supply continues to be tight. The completion of the Russian Nordstream 2 pipeline is viewed as an inflection point for the European gas market, which will affect energy-intensive commodities, the competitiveness of European smelters and global nitrogen prices. A delay to commissioning the pipeline will result in higher gas prices for longer.

Small Critical Material Markets Can Have Large Effects

Often overlooked is the small but critical market for carbon products. Ukraine is the sixth largest producer of coal tar and 10th largest producer of coal tar pitch (CTP), which is a crucial component in anodes required for aluminum production. Ukraine currently exports coal tar to several EU nations and coal tar pitch to Russia and Egypt. Reduced anode production in these regions due to disrupted Ukrainian exports could greatly impact aluminum production, and prices considering the current tight aluminum market balance.

Russia and Ukraine are also significant exporters of steel products both globally and to the EU, jointly accounting for approximately 4.8% of the world’s total crude steel production. Sanctions and conflict would significantly disrupt this supply both globally and to Western European nations. Supply tightness from restricted Russian and Ukrainian supply would almost certainly cause increases in steel price, felt most acutely in the CIS and Europe. Restricting Russian supply would also cause significant disruption to global trade flows as material is diverted from traditional markets to replace lost supply. The disruption to trade flows is perhaps the most uncertain element of imposing sanctions while also being highly disruptive to markets, and thereby commodity prices.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com