Market Data

February 14, 2022

Positive Outlook for Energy Tubulars in 2022

Written by Tim Triplett

2022 is shaping up to be a good year for energy tubulars. With the U.S. economy near pre-pandemic levels, demand is up for oil and gas – and the oil country tubular goods (OCTG) and line pipe needed to deliver them. Rising energy prices are spurring increased drilling, while declining steel prices are lowering the costs to manufacture pipe and tube, promising better margins for tubular goods suppliers.

![]() The U.S. Energy Information Administration (EIA), in its February Short-Term Energy Outlook, forecast the Brent crude oil price will average $90 per barrel in February and nearly $88 per barrel for the first half of this year. Oil prices above $70 per barrel generally trigger more drilling activity.

The U.S. Energy Information Administration (EIA), in its February Short-Term Energy Outlook, forecast the Brent crude oil price will average $90 per barrel in February and nearly $88 per barrel for the first half of this year. Oil prices above $70 per barrel generally trigger more drilling activity.

“Petroleum production has been slow to catch up with consumption, which has prevented oil prices from moderating,” said EIA Acting Administrator Steve Nalley. “Market concerns about oil production disruptions, supply chain vulnerabilities, and uncertainties around how central banks may react to combat inflation all contribute to a highly unpredictable environment for oil and petroleum product prices.”

Market concerns over potential supply disruptions related to the conflict between Russia and Ukraine also are adding to the upward pressure on oil prices, EIA said.

EIA expects downward price pressures to emerge in the middle of the year, however, as growth in global oil production outpaces growth in consumption. Rising global oil inventories from 2Q22 through the end of 2023 will lower the Brent spot price to an average of $87 per barrel in 3Q22 and $75 per barrel in 4Q22. EIA forecasts the Brent price will average $68 per barrel for all of 2023.

Natural gas spot prices averaged $4.38 per million British thermal units (MMBtu) at the U.S. benchmark Henry Hub in January, a 16% increase from December prices. Cold weather in the Northeast and Midwest U.S. increased demand for natural gas for home heating. Global demand for natural gas also remains strong, and EIA expects 2022 U.S. liquefied natural gas (LNG) exports to increase 16% over 2021 levels. EIA forecasts that natural gas prices will rise to $4.70/MMBtu on average in February, then average around $3.80/MMBtu for the last three quarters of the year.

Higher oil and gas prices reflect supply constraints from a disciplined OPEC+ cartel plus ESG (environmental, social and governance) pressures in the U.S. along with cautious capital investment, said energy expert Kurt Minnich, president of Tulsa, Okla.-based Pipe Logix (www.pipe-logix.com).

On the economic front, ESG concerns have taken a backseat to recovering from the pandemic. “The White House started their new term by attacking the oil and gas industry (canceling the Keystone XL pipeline), but soon were releasing oil from U.S. strategic reserves and asking oil companies to produce more oil so as not to slow the economy,” he said.

U.S. production gains came from depleting the DUC (drilled but uncompleted) well count in 2021, which means further gains must come from more drilling rigs returning to the market, he noted.

Energy tubular prices were driven higher by a four-fold increase in the cost of hot rolled coil in 2021. Margins for electric resistance welded pipe, which is made from steel sheet, felt the squeeze, but production of seamless pipe, made from steel bars, thrived. The Pipe Logix Index for the line pipe price recently hit a record high, up 130%. And OCTG prices are at levels not seen since 2008 when tariffs suddenly removed Chinese supply from the U.S. market, Minnich said.

“The outlook for ERW in 2022 has improved, and pipe mills are positioning for it,” he said. “Pipe distributors are bullish as domestic supply of pipe approaches pre-pandemic levels.”

OCTG import volumes are on the rise, pushing against the Section 232 quota limits for some countries. “Some of the biggest volume increases have come from Argentina, Mexico and Russia, which, coincidently are now engulfed in a new AD/CVD trade case. Other countries are finding some relief from the Section 232 tariffs as the Biden administration looks for friends in international steel trade,” Minnich said.

He added: “All the variables point to elevated OCTG and line pipe pricing continuing through 2022 amid a declining cost basis and increasing demand.”

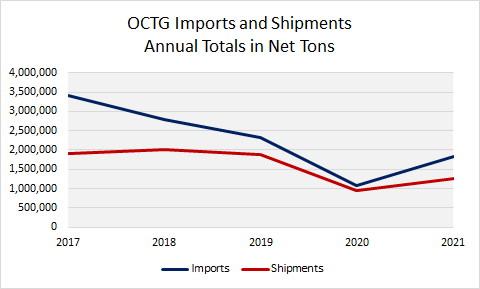

Commerce Department data for OCTG and line pipe imports and shipments, in the charts above, show the hit the market took in 2020 as the economy struggled with the pandemic, and the recovery the energy market has seen over the past year. Energy tubulars consumption still has a long way to go before regaining pre-COVID levels, however.

By Tim Triplett, Tim@SteelMarketUpdate.com