Prices

February 10, 2022

Hot Rolled Futures: Declines Pick Up Steam

Written by Jack Marshall

The following article on the hot rolled coil (HRC), scrap and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Hot Rolled

Will the velocity of the down move in hot rolled prices be maintained as HR price spreads to global prices narrow and adjustments to HR supply get implemented?

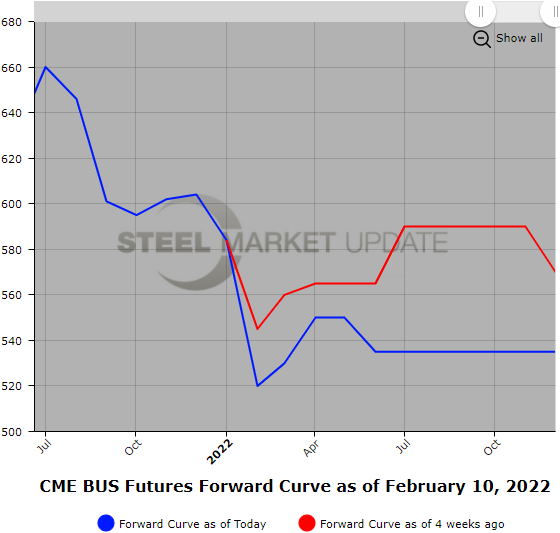

HR spot price declines picked up steam this week as all the HR indexes were down significantly. The front month CME HR contract has settled below $1,150/ST today and is over $100/ST lower than a month ago. However, a look further out the forward curve paints a different picture. The latter half average price of Calendar 2022 has HR futures $10/ST higher than a month ago ($938/ST) and the Q1’23 quarter average price will settle up $50/ST ($910/ST). Latest price moves suggest market participants are focusing on the narrowing of the U.S. price versus global HR prices as witnessed by some profit-taking in this price range, which coincides with an earlier price peak. The Q2’22 HR average price today rose $45/ST just since yesterday following the large spot decline. Despite the price movement, the curve remains pretty flat as reflected by the small discount between Mar’22 HR and Mar’23 HR ($1,020/ST settle versus $908/ST settle), which is just $112/ST over 13 months forward.

There has been some discussion of when the next round of purchasing/hedging by OEMs will occur. The latest news on the auto front suggests that the impact of COVID will continue to hamper the days of supply of semiconductors for at least the next two to three quarters, leaving some HR demand softness in the picture. In addition, expected Fed interest rate increases will make forecasting future steel demand even trickier, even as new planned HR production comes online while some old production lines are furloughed.

HRO options transactions have steadily increased since the beginning of the year as the pool of participants grows. In the last month, almost 66,000 ST of HRO options have traded. Open interest in HRO options is 3,335 contracts, which is almost 9% of the HR open interest. Lower implied volatility and thus falling premiums supported the pickup in trading.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

Editor’s note: Want to learn more about steel futures? Registration is still open for SMU’s Introduction to Steel Hedging: Managing Price Risk Workshop to be held Feb. 14-15. You can get more information by clicking here.

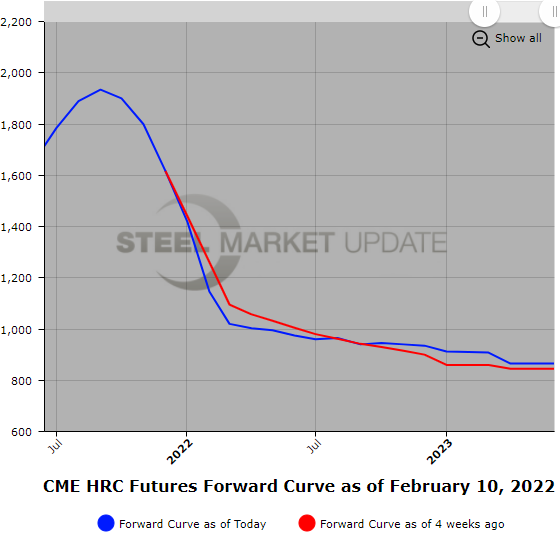

Scrap

The BUS futures forecasts for Feb’22 settlement were very difficult to pin down during the month. Early expectations had BUS prices dropping about $50/GT early on, but they continued to change continually as that dropped to down about $30/GT, until they finally settled at down $22/GT and change ($520.01/GT – Feb’22). Recent pickup in export 80/20 scrap demand helped prices rise, as well as winter weather. Latest cargoes had been reported above $500 a ton. After strong selling earlier last week, BUS futures in Q2’22 have traded back to $550/GT, and Mar’22 BUS will likely get a winter boost.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.