Market Data

January 27, 2022

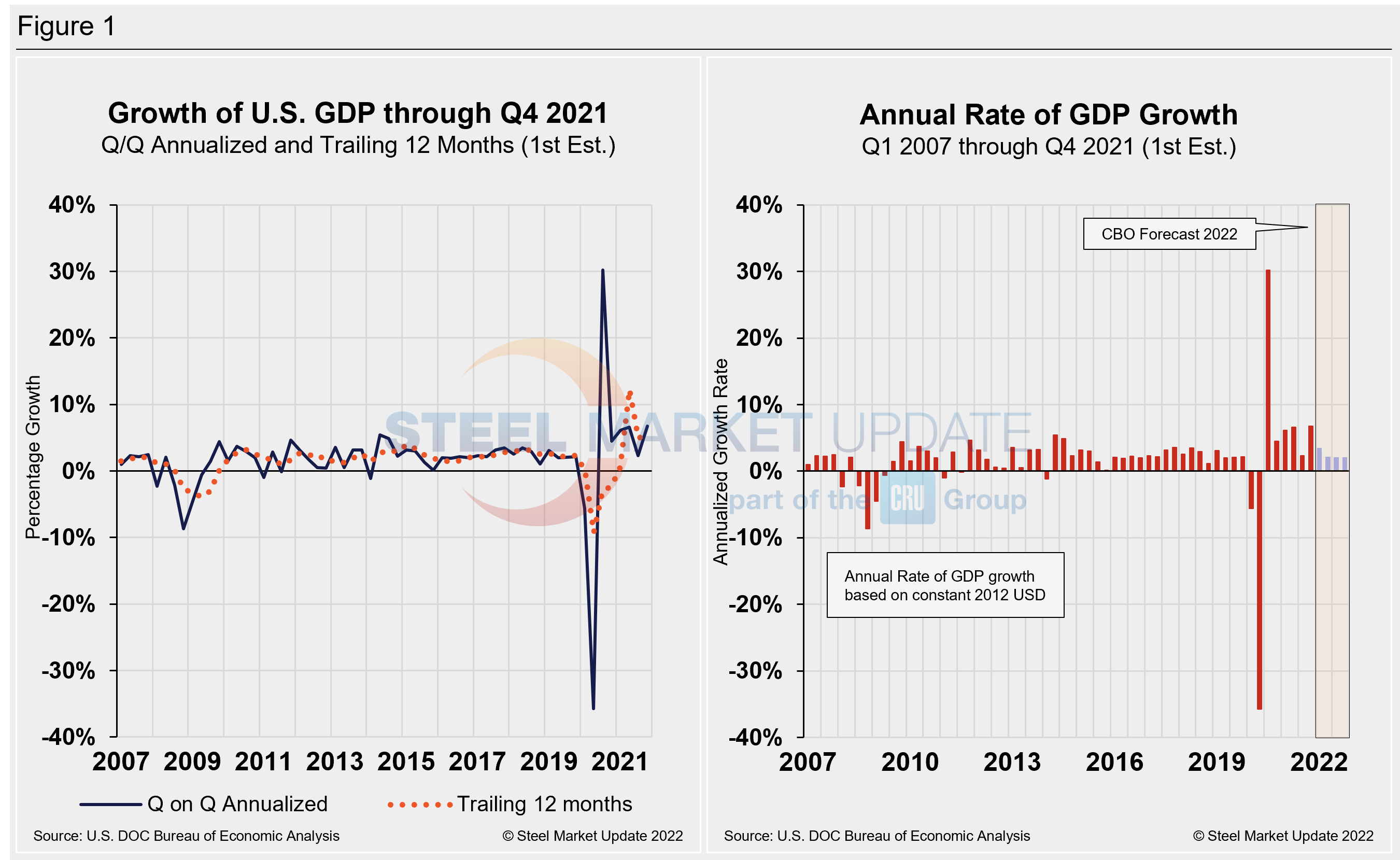

Fourth-Quarter GDP Surprises at 6.9% Growth

Written by David Schollaert

U.S. gross domestic product (GDP) expanded at a much better than expected pace to close out 2021. At an annual 6.9% rate in the fourth quarter, growth was driven by sizeable boosts in inventories and consumer spending, according to the Bureau of Economic Analysis (BEA) advanced estimate.

Despite signs that the acceleration may have tailed off toward the end of the year, the increase was well above the 2.3% growth in the third quarter, and above estimated gains of 5.5% from market experts. The growth was exceptional given it came despite a surge in Omicron cases that slowed hiring and business output.

The advanced estimate by BEA reflected gains in private inventory investment, strong consumer activity as reflected in personal consumption expenditures, exports, and business spending as measured by nonresidential fixed investment. The increase was offset by decreases in the pace of government spending subtracted from GDP, as did imports, which are measured as a drag on output.

All told, the quarter brought an end to a 2021 that saw a 5.7% increase in annualized GDP, the strongest pace since 1984 as the U.S. tried to pull away from the unprecedented drop in the early days of the pandemic.

Personal consumption, which accounts for more than two-thirds of GDP, rose 3.3% for the quarter. Gross private domestic investment, a gauge of business spending and inventory build, soared 32%. Inventories added substantially to the headline growth, boosted by motor vehicle dealers.

The Department of Commerce’s first look at U.S. GDP in Q4 totaled $23.99 trillion, a noteworthy 14.3% or $790.1 billion increase from the previous quarter, measured in chained 2012 dollars on an annualized basis. Below in Figure 1 is a side-by-side comparison of the growth of U.S. GDP and the annual rate of GDP, both through Q4 2021. In the first chart, you’ll see the contrast between the trailing 12-month growth and the headline quarterly result. The chart on the right details the headline quarterly results since Q1 2007 including the Congressional Budget Office’s GDP projection through 2022. On a trailing 12-month basis, GDP accelerated to 5.53% in the fourth quarter, up from 4.95% in the prior quarter but still well behind the 12.23% growth in Q2. Nevertheless, it’s a vast improvement from -9.27% in Q2 2020 at the height of the pandemic. For comparison, the average in 48 quarters since Q1 2010 has been a growth rate of 2.09%.

Shown below in Figure 2 is a side-by-side comparison of two charts. On the left is the mix of the six major components in the GDP growth calculation, while the chart on the right puts a spotlight on personal consumption, a measure of consumer confidence and spending engagement. The most notable change and major source of GDP fluctuation is personal consumption, which saw a negative 24.01% contribution in Q2 2020 at the onset of COVID, followed by a positive 25.44% the following quarter as the economy reopened. Personal consumption jumped from 1.58% in Q4 of 2020 to 7.42% in Q1, edging up to 7.92% in the second quarter. The slump to 1.35% in the third quarter was disappointing; however, Q4’s expansion to 2.25% was a welcome sign of economic improvement. The extreme shifts the U.S. economy has faced over the past 16-24 months can be seen in the big swings in personal consumption.

Quarterly contributions of the six major subcomponents of GDP since Q4 2020 and the breakdown of the $23.99 trillion economy in BEA’s initial review of Q4 GDP are both shown in Figure 3. The chart on the left is detailed out for cross-comparison with Figure 1 above. The chart on the right shows the size of the other components relative to personal consumption.

SMU Comment: U.S. economic growth arrived as inflation surged in 2021, particularly in the second half of the year, as supply couldn’t keep up with growing demand largely due to supply-chain disruptions. Fourth quarter’s surprise acceleration has lead to a historic GDP for the year, a positive result as the country continues to grapple with COVID and its latest variant, while all eyes remain steadfast on the country’s economic growth.

By David Schollaert, David@SteelMarketUpdate.com