Prices

January 19, 2022

CRU: Iron Ore Shook by Weather, But Demand Still Leads Price

Written by Erik Hedborg

By CRU Principal Analyst Erik Hedborg and Research Analyst Aaron Kearney-Keaveny, from CRU’s Steelmaking Raw Materials Monitor, Jan. 19

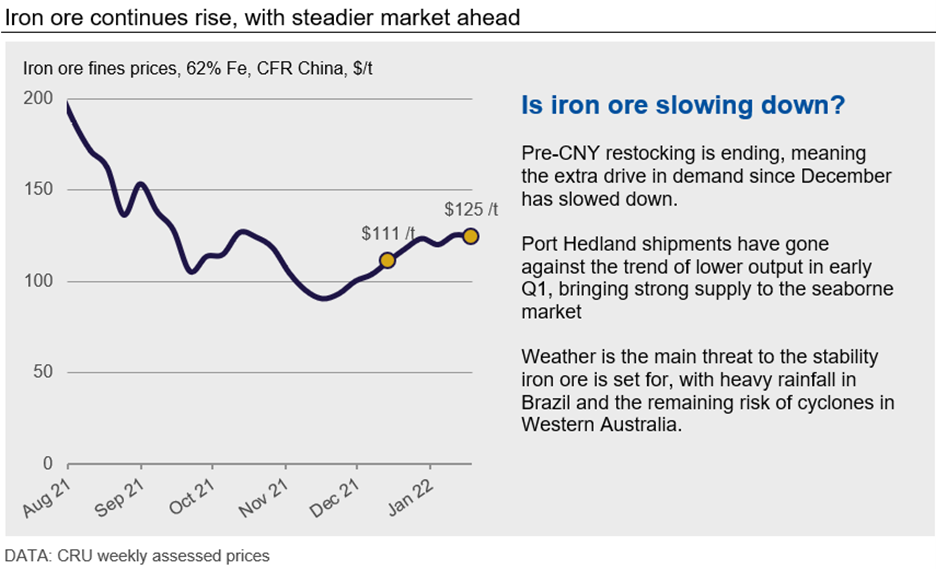

Over the past month, the iron ore price has continued its rise that started back in mid-November, reaching $125 /dmt on Jan. 18. The rise has been more volatile than the previous month, but has shown signs of stabilizing as is expected for Q1. In December, supply ramped up, particularly from Australia, as did Chinese demand due to BF restarts and pre-CNY restocking. However, with the CNY approaching, Chinese demand will subside as BFs will be operated by drawing down inventories purchased over December-January. Brazilian supply has been disrupted due to heavy rainfall, but the rain has been easing and current forecasts are optimistic.

Strong Supply Threatened by Weather

Port Hedland saw a strong year-end with 50.8 Mt exported in December, the highest of the year and 4.3 Mt higher than December 2020. Entering Q1, production has been slowing down, but remains noticeably higher than last year, hovering around 11 Mt each week. Rio Tinto exported 29.7 Mt the same month, another record for the year, although it was just under 1 Mt lower than the previous year as the company suffers from quality issues arising from continued heritage management. In their Q4 report, the company reported sales of 15.5 Mt of SP10, the company’s lower-grade, off-spec product. This is much higher than the 2.8 Mt reported in 2020 Q4. Rio Tinto also saw sales of its standard, medium-grade products called PBF and PBL decline by 15 Mt compared with 2020 Q4. The recent threat of cyclones around western Australia remains but is yet to impact ports or shipments. The likelihood of incidents will rise and carry through Q1 and into early-Q2.

Northern and southern Brazil exported 14 and 16 Mt respectively in December, a fairly normal level but somewhat underwhelming for the year-end. In Peru, on Dec. 17, union workers at Shougang’s Marcona mine, which produced 17.1 Mt in 2021, went on strike. This ended on Jan. 17 after renegotiations on wages were made. This marked the point where Shougang’s 1 Mt stocks of iron ore would have been depleted. Ultimately, December was a strong month for the seaborne market, outperforming last year.

The most notable story, however, began when heavy rainfall interrupted production and transport in southern Brazil in the second week of January. Soon after the heavy rain began, Vallourec, Vale, Usiminas, Samarco, and CSN all suspended production to some extent, while road and railway shutdowns prevented the transport of iron ore. Samarco announced that the rainfall forced the company to cut production by 50%, but it has been raising production more recently. Vale has resumed its operations in the SES, while the SS has restarted production but not to full capacity, with an estimated loss of over 1.5 Mt in production. Vallourec has attempted to reopen, but is facing restrictions placed by the government. Usiminas has also reported a gradual return to operations. The rainfall has eased off and there are more promising forecasts for the following two weeks, but with tailings dams on high alert.

Demand from China Improves

Chinese iron ore demand started to improve materially in the beginning of 2022 in tandem with higher hot metal production. However, such demand improvement actually started in early-December, when steelmakers had accelerated iron ore purchases. This was in preparation for steel production growth after many provinces achieved their targets of steel production cuts for 2021. There were no further operating restrictions announced for 2022 in addition to that in ‘2+26 cities’ in Northern China.

This demand improvement has reduced iron ore inventories in terms of the number of days for consumption, though the absolute volume has remained elevated given strong shipment arrivals in recent weeks. While this fundamentally supported iron ore price upticks, positive sentiment on hot metal production growth going forward fueled the upward momentum. In particular, high steel margins have directed more buying interest in medium-to-high grade iron ore products, which can help steelmakers to lift BF productivity. Meanwhile, pellet and lump materials have also become popular in Northern China including Tangshan, where operating restrictions on BFs have slightly eased while that on sintering capacity has remained tight.

Outlook: Iron Ore Threatened by Weather, But Set to Stabilize

December delivered strong shipments, but we have already seen major slowdowns in January. In Brazil, supply has been majorly disrupted but has shown signs of improvement as the heavy rain subsides. In Australia, port operations are potentially threatened by cyclones. Demand will also subside, primarily in China where steelmakers have been well stocked for the CNY. Unless supply is further shocked by these threats, we can expect a calmer, steadier market in the upcoming month, with a small, stable fall.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com