Market Data

January 17, 2022

Service Center Shipments and Inventories Report for December

Written by Estelle Tran

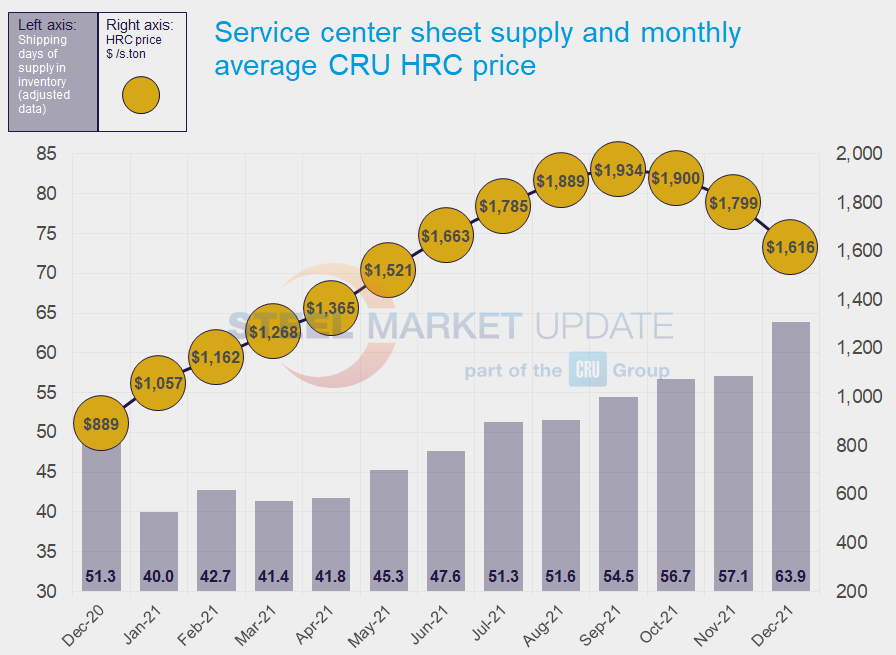

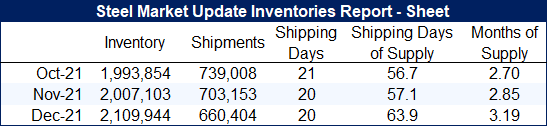

Flat Rolled = 63.9 Shipping Days of Supply

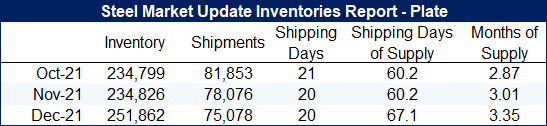

Plate = 67.1 Shipping Days of Supply

Flat Rolled

U.S. service center flat rolled inventories jumped in December, in line with seasonal trends. At the end of December, service centers carried 63.9 shipping days of supply on an adjusted basis, up from 57.1 in November, according to Steel Market Update data. In terms of months on hand, service centers carried 3.19 months of sheet supply at the end of December, up from 2.85 months in November.

In December 2019, before the pandemic, service centers carried 62.9 shipping days of supply, up from 50.5 in November. December is a challenging month to analyze because of the holidays. Data providers reported they had 19-20 shipping days in December, and we used 20 shipping days for December calculations.

Some market contacts have said that shipments were slower because customers delayed taking orders; others reported continued weaker demand related to component and labor shortages. In contrast, other service center contacts said that December shipments were stronger than expected, especially considering many service centers only had 19 shipping days. Many had concerns about weaker-than-usual shipments in January and February, as they struggled to meet contract minimums.

After rising slightly in November, the amount of sheet on order eased back in December. The drop in the amount of material on order reflects a hesitancy to book material with prices falling. Multiple service centers said they were only willing to buy what they have pre-sold.

We expected a drop in the amount of material on order as lead times have shrunk, but this trend has been tempered by imports planned for early 2022. The latest SMU lead times survey published Jan. 6 showed HRC lead times at 4.69 weeks, though multiple service center contacts said mills were still looking for orders in December that could be rolled by month end.

Plate

U.S. service center plate inventories also grew in December, reflecting slowing demand and typical seasonality. At the end of December, service centers carried 67.1 shipping days of supply of plate, up from 60.2 shipping days in November. Inventories in December represented 3.35 months of supply, up from 3.01 in November.

Service centers said that plate availability has increased from the mills, and at the same time the resale market has become more competitive. SMU has reported plate lead times around 5-6 weeks. Market contacts said there were some mixed signals about the strength of the plate market, noting the unusual announcement by Nucor to keep plate prices unchanged for February. Market contacts said they were reluctant to book more than what they knew they could move quickly.

At the end of December, the amount of plate on order edged down slightly, as service centers continued to focus on limiting their purchases at current elevated prices.

Based on this data, we view plate prices to be at the peak and poised to recede in Q1.

By Estelle Tran, Estelle.Tran@CRUGroup.com