Analysis

January 13, 2022

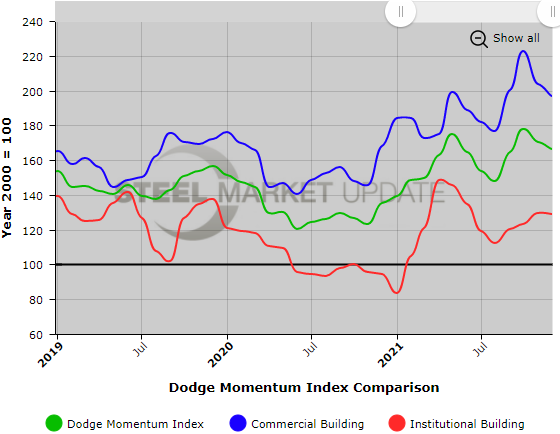

Dodge Momentum Index: 2021 a Strong Year for Construction

Written by Brett Linton

The Dodge Momentum Index declined 3% in December to a reading of 166.4, according to Dodge Data & Analytics. Though the year ended on a down note, 2021 was a good one for construction with the index rising by 23%, its strongest annual gain in 15 years.

![]()

Both components of the construction index also declined from November to December, with commercial planning down 4% to 196.7 and institutional planning down 1% to 128.9. But on an annual basis, the commercial and institutional components reached multi-year highs of 13 and 14 years, respectively.

“The signals provided by the Dodge Momentum Index continue to suggest that construction activity will improve in 2022 — and, more importantly, that this growth will be more balanced than what was seen in 2021. However, the ever-present risks of the pandemic and tight labor force will work to counter these trends, leading to moderate growth over the new year,” the research firm said.

The Dodge Momentum Index is a key advance indicator of nonresidential construction demand, leading construction spending by as much as a year.

An interactive history of the Dodge Momentum Index is available here on our website; an example is shown below. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.