Prices

January 9, 2022

CRU: The Promise of Solar for Steel and Aluminum

Written by Greg Wittbecker

By Greg Wittbecker, Advisor, CRU Group

Virtually every mention of the infrastructure spending plans and Build Back Better touts renewable energy. We thought it might be worthwhile to talk about some of the tangible effects of that on solar photovoltaic (SPV) energy generation.

![]()

The Solar Energy Industries Association (SEIA) is the best source of data on trends in solar in the U.S. In their recently released “Solar Market Insight Report “for Q4 2021, these were the highlights:

• Q3 solar installations were the highest on record at 5.4 GW, a 33% increase over Q3 2020.

• Solar represented 54% of all new power generation capacity added in the first three quarters of 2021.

• Residential installations exceeded 1 GW with over 130,000 systems in a single quarter, which was a first. One of every 600 homes is now installing solar each quarter.

• Utility scale installations set a record at 3.8 GW in Q3 2021, with Texas and Virginia contributing over 50% of total installations.

• About 6.1 GW of new utility scale projects were awarded during Q3, bringing the backlog to 81 GW.

• Supply chain constraints, lack of clarity around antidumping petitions on imported panels and major price increases will result in a 25% decline in 2022 installations or about 7.4 GW of reduced potential generation capacity.

• The Build Back Better Act is still perceived to be a huge boost to solar. The extension of investment tax credits and other incentives could increase solar demand 31% or an incremental 43.5 GW between 2022 and 2026.

How GW Installations Translate to Tangible Demand for Steel and Aluminum

The solar market is segregated into two broad categories: residential and commercia/industrial, and utility scale.

The former category is largely roof-top installation and this plays into the strength of aluminum, which is its weight advantage vis-à-vis steel. Roof-top mounts want a lightweight mounting or racking system to support the panels, which are mainly aluminum-framed.

Utility scale applications are ground-mounted; hence weight is not a consideration. Here the mounting/racking systems are dominated by steel.

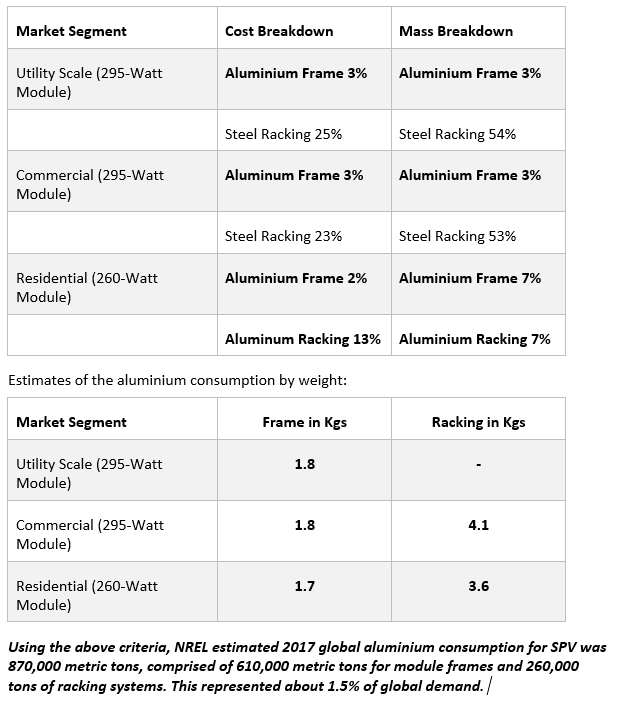

The U.S. National Renewable Energy Laboratory (NREL) provided some excellent foundational “rules of thumb” for estimating aluminum demand in SPV in a July 2019 analysis.

NREL detailed the composition of racking and framing within the three categories as follows:

Steel’s command of the mounting/racking systems delivers impressive demand also. ArcelorMittal estimates that each new MW of solar generation requires between 35-45 tons of steel.

Taking the SEIA numbers for Q3 2021 as an example, the 3.8 GW of utility scale installations = 3,800 MW or implied steel demand of 152,000 tons for the period. The estimated backlog of 81 GW of utility scale projects on the books translates into 3.24 million tons of steel demand within the U.S.

If you want to get more enthusiastic, consider what the International Energy Agency (IEA) thinks about long-term installations.

The IEA believes SPV generation could rise 4.5 times from its 2019 global baseline of 720 GW , reaching 3,268 GW by 2030.

It bases this projection on what it calls its “Sustainable Development Scenario,” which forecasts annual growth of 15% for the decade. This estimate is very conservative based upon trailing performance over the past five years, when installations rose an average of 31%.

All in all, the outcome for both aluminum and steel looks extremely good as contributors to the renewable energy boom.

Greg Wittbecker joined CRU in January 2018 after retiring from Alcoa, where he was Vice President of Industry Analysis and Managing Director of Alcoa Beijing Trading, based in Shanghai, China. His career spans 35 years in the aluminum industry, having also held senior commercial and management roles at Cargill, Wise Metals and Koch Supply and Trading. Greg brings perspective on the entire aluminum supply chain from bauxite to aluminum finished products and will be a regular contributor to SMU going forward. He can be reached at gregory.wittbecker@crugroup.com

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com