Market Data

January 7, 2022

CRU: What’s the Price of Decarbonizing Blast Furnaces?

Written by CRU Americas

By CRU Senior Analyst Atul Kulkarni, from CRU’s Global Steel Trade Service, Jan. 31

The global steel industry is going to witness a transformation in terms of technology and operating practice due to decarbonization pressure. However, this transition will not come without substantial costs, as all CO2 abatement pathways are forecast to be more expensive than the current prevailing technologies in use. In this Insight, CRU assesses what level of carbon price will lead to investments in CO2 reduction technologies for blast furnaces (BF), which are a large source of emissions in the steel value chain.

Blast Furnace Emissions Can Be Cut, But Where and How?

Under pressure to decarbonize from policymakers and other stakeholders, BF operators around the world are seeking to reduce emissions. This has led them to think about how they can change their operating practices to reduce emissions from their existing steel works without losing their competitiveness.

There are a number of options to make substantial emission cuts from BFs in operation today. Two of the most powerful options are considered in this analysis:

- Improving ferrous burden quality by substituting sinter with pellet.

- Changing reductants injected to the BF via the tuyeres. Non-renewable PCI is most widespread. Three leading alternatives for emission reduction are:

- Natural gas

- Blue H2 and

- Green H2

As part of our research into the marginal abatement costs of carbon in the steel industry, we have used CRU’s Steel Cost Model to estimate how far carbon prices need to increase to incentivize widespread global uptake of each of these abatement practices.

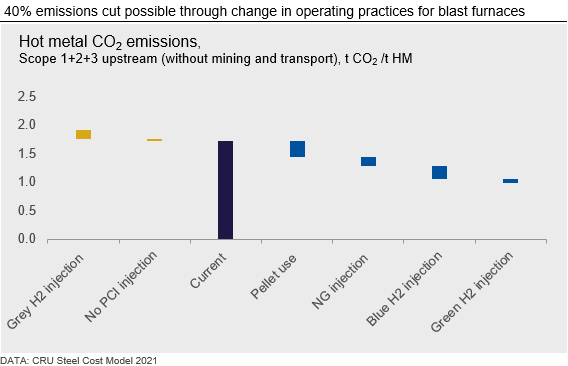

Blast Furnaces Can Cut 15% Emissions by Switching to Pellets

The average of Scope 1, 2 and 3 upstream (excluding mining and transportation) emissions for BFs around the world is ~1.71 metric tonnes of CO2 per tonne of hot metal, with the BF burden having a sinter:pellet ratio of 3:1. If BF operators around the world could switch all of their sinter burden to pellet burden in their total burden mix, a total emission reduction of 0.27 t CO2/t HM will be achieved. Of this total, reduced sintering emissions account for 0.14 t CO2/t HM. The remaining savings of 0.13 t CO2/t HM or ~10% in BFs are attributable to improved bed permeability, which lowers coke consumption.

25% Cut in Emissions Through Pellet Use with Natural Gas Injection

In addition to pellet use, BF emissions can be reduced by a further 10% if they are switched to proven natural gas injection technology from pulverized coal injection technology. Many BF operators in Asia and Europe switched to PCI technology during the late 1980s to reduce costs. However, USA and other countries with lower natural gas prices continued with natural gas injection. With its use, BF emissions can be cut by 0.16 t CO2/t HM.

40% Emissions Cut Possible Through Pellet Use with H2 Injection

Hydrogen injection into the BF is currently being tested at low rates. Once commercialized, in combination with pellet substitution, it will be able to cut BF emissions by ~40%. Specifically, under the blue H2 scenario, emission reduction of 38% is feasible, whereas with the use of green H2, emission reduction of 42% is achievable.

How Carbon Prices Play a Role in Switchover to Greener Steel

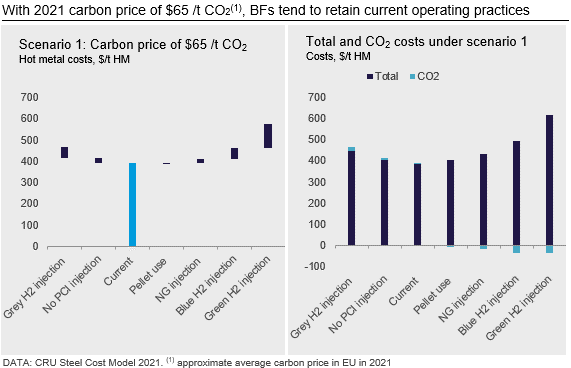

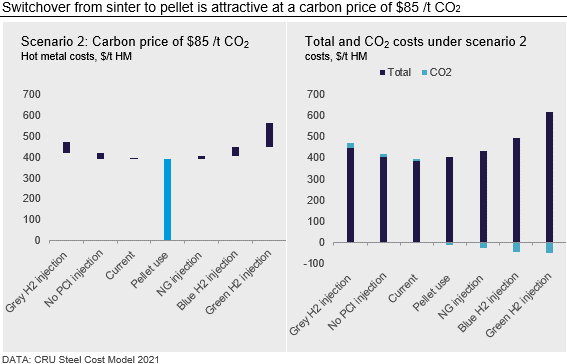

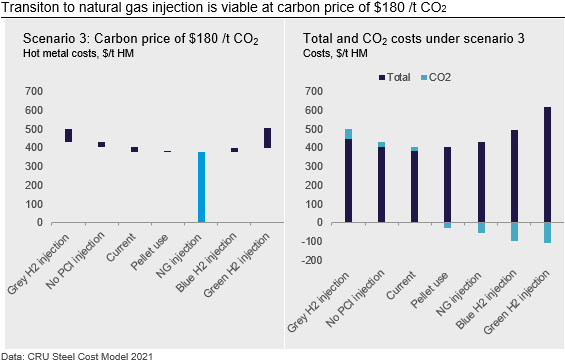

Using CRU’s Steel Cost Model, we have analyzed the global average hot metal production costs for the different BF decarbonization options stated above under four carbon price scenarios. Cost calculations for all the scenarios are based on average 2021 raw material prices without considering their sensitivity to carbon prices. We have assumed that the carbon prices are equally applicable around the world and all steel mills are awarded free allocations consistent with Phase IV stage I of EU ETS; and mills can easily sell their excess carbon credits at the market price.

The current operating practices of BFs with pulverized coal injection for Asian and European mills and natural gas injection for U.S. and Russian mills are retained even when the EU’s 2021 average carbon price of $65 /t CO2 is applied globally.

As the carbon price rises to $85 /t CO2, a switchover to pellets leads to optimal costs for BFs. However, the available supply of pellets at current market prices is a major constraint if all BF operators attempt to shift to pellet burden. More details on this topic can be found in our most recent pellet analysis, available to subscribers of CRU’s Iron Ore Market Outlook.

To incentivize global uptake of natural gas injection into BFs, a carbon price of $180 /t CO2 would be required. As we are currently seeing a surge in natural gas prices across the globe, the threshold carbon price needed to incentivize natural gas injection should be higher than our estimate.

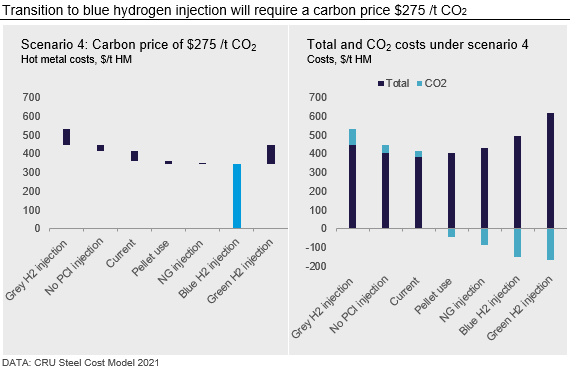

Blue hydrogen injection into BFs is incentivized by a carbon price of $275 /t CO2, assuming an injection rate of 25 kg H2/t HM and a replacement ratio of 0.19 kg H2/kg PCI. Although blue H2 production is cheaper than green H2 production, concerns over the viability of CO2 utilization or storage on such a wide scale, as well as the practical limitations to fully avoiding emissions in its production, need resolving.

Green H2 injection into BFs is estimated to cost $119/t HM more than blue H2 injection currently and the very small benefit in emissions of 0.06 t CO2/t HM from green H2 renders it unsuitable for this application today. However, green H2 costs are expected to fall more rapidly than other options in the coming years, which may close the gap between green and blue H2, potentially increasing the viability of green H2 for injection into the BF.

This analysis demonstrates both the high costs of carbon abatement and some of the limitations of improving ferrous burden and injection practices in the blast furnace. A range of additional improvements will be required for the BF to remain the dominant process for ironmaking as the pathway to decarbonization of steel progresses beyond ~40% reduction.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com