Market Data

December 22, 2021

Steel Mill Negotiations: It's a Buyer's Market Once Again

Written by Tim Triplett

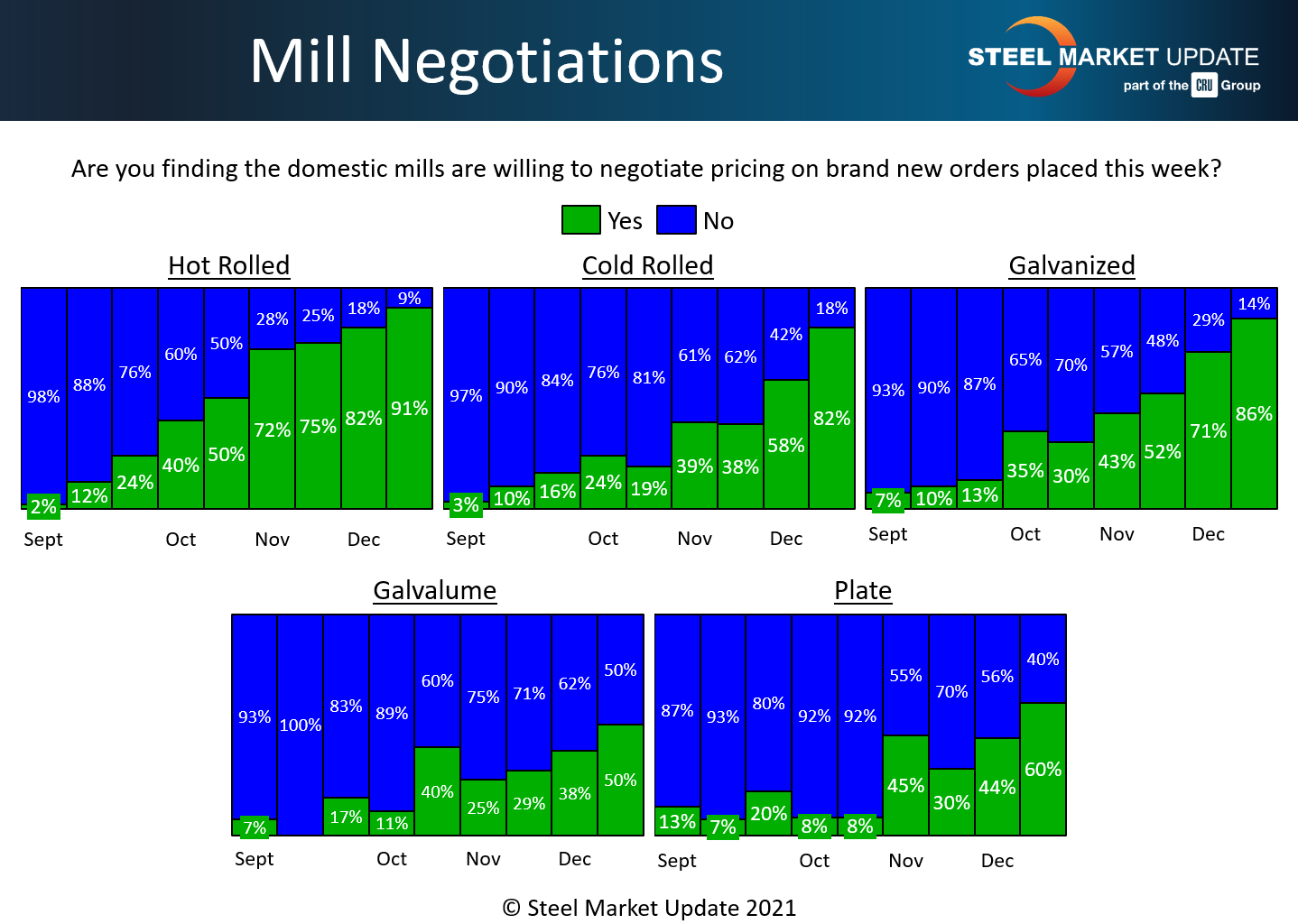

As the upward slope of the green bars in the charts below clearly illustrate, the bargaining position in steel price negotiations has been steadily shifting in favor of steel buyers for the past three months.

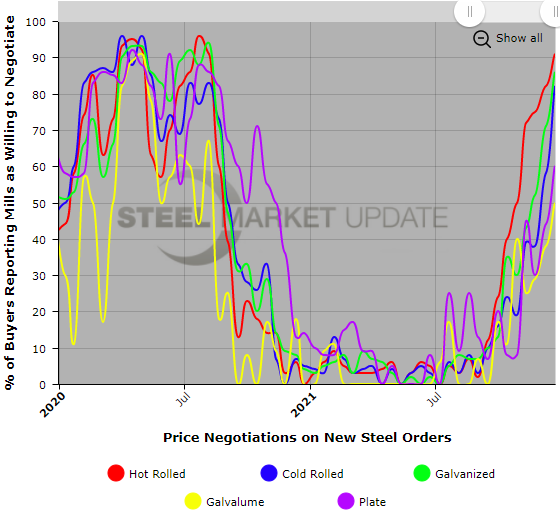

Since September 2020, it had been a seller’s market, with steel in short supply. Until lately, the mills have had little need to discount prices to secure orders. But with competition from imports on the way up and steel prices on the way down, steel has become a buyer’s market once again.

SMU asks buyers every two weeks whether mills are willing to talk price on spot orders. Most of the service center and manufacturing executives responding to SMU’s survey this week reported mills now willing to offer deals on most products. About 91% of hot rolled buyers, 86% of galvanized buyers, 82% of cold rolled buyers, 60% of plate buyers and 50% of Galvalume buyers said mills are now open to negotiating to land an order.

For most of 2021, the charts below were almost solid blue as the mills just said no to any dealmaking. If this trend continues, it appears the dominant color scheme will be green in 2022 – at least in the first quarter.

By Tim Triplett, Tim@SteelMarketUpdate.com