Market Data

December 16, 2021

SMA: U.S. Can’t Take One-Size-Fits-All Approach to Section 232 Tariff Negotiations

By Philip Bell, President, Steel Manufacturers Association

As we approach the holidays, there are some who believe that a swift Section 232 deal with Japan is essential. Some also believe a Japanese deal should be equivalent to the deal reached with the European Union this October. The notion of a Jan. 1, 2022, deal deadline has even been floated. These sentiments may be based on Japan’s new Prime Minister Fumio Kishida’s generally pro-American stance. However, we cannot let politics force us to rush to conclusions, or allow Japan to have unrealistic expectations.

![]()

A thoughtful, methodical negotiation process should be America’s focus. Also, Japan should not get a deal equivalent to the EU because the facts and circumstances of our two allies are not equivalent. You cannot treat them the same, because they are not the same. It is critical that we do not give the Japanese steel industry more than it deserves at a time when capacity utilization is declining and imports are increasing.

America’s steelmakers continue to consolidate and invest in the cleanest, most efficient, lowest-carbon-intensity steel industry in the world. Recent announcements by companies such as Big River Steel, Cliffs, Commercial Metals, Nucor, Steel Dynamics and U.S. Steel underscore the steel industry’s commitment to modernization, electrification and sustainable, efficient steelmaking. A hastily made agreement with Japan could negatively impact CAPEX spending, hiring and the lowering of CO2 emissions in our country. Let’s take a look at the facts.

Japan is a significant contributor to global excess steel capacity. According to the Organization for Economic Co-operation and Development (OECD), steelmaking capacity in Japan exceeded production by around 25% and Japanese domestic consumption by approximately 46% in 2019. Rather than make rational adjustments as we do in the United States, Japan chooses to export its excess capacity. In 2020, Japan exported approximately 30 million metric tons, which represents about 36% of its domestic capacity.

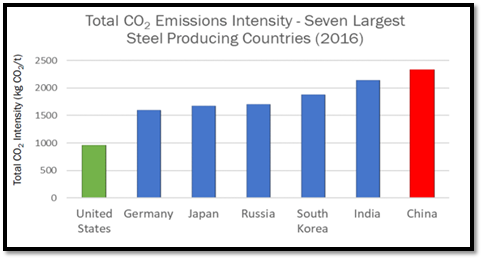

From an environmental standpoint, Japan’s is a high-carbon-intensity steel industry that will undermine the “global arrangement” on decarbonization that the U.S. has reached with the EU. We need to encourage sustainable steel production around the globe. If Japan wants treatment similar to the EU, they must step up their game on the carbon emissions front.

Source: Global Efficiency Intelligence, Blue Green Alliance

Like China and other export economy countries, Japan has a long history of exploiting the domestic steel market. Japan has repeatedly targeted the U.S. market with unfairly traded steel products. There are currently 15 U.S. antidumping orders on steel products from Japan.

If we take a similar approach with Japan and pursue a tariff rate quota (TRQ) arrangement, it should be noted that the period used to allocate a quota volume should not be before 2018. The years preceding 2018 were dominated by unfair trade practices such as dumping, subsidies and circumvention. America’s trade negotiators should also insist that all Japanese product exclusions count against the quota and that an enforceable melted and poured standard be included in any deal.

Japan is a strong American ally. We know that an alternative scheme to the current Japanese S232 tariffs is looming, but any changes should be via a process that is careful and not rushed. Trade deals do not work well with a “cookie cutter” approach.

Phil Bell is president of the Steel Manufacturers Association (SMA). SMA is the largest steel industry trade association in the United States and is the primary trade association representing American EAF steel producers. Accounting for over 70% of domestic steelmaking production, EAF producers are the most sustainable steelmakers in the world. By using an innovative, 21st century production process that is less energy-intensive, domestic steelmakers have up to 75% lower carbon emissions than traditional steelmakers. SMA’s 24 producer members have operations in 35 states. For more information check out our website at www.steelnet.org or our Facebook page.