Market Data

December 15, 2021

Service Center Shipments and Inventories Report for November

Written by Estelle Tran

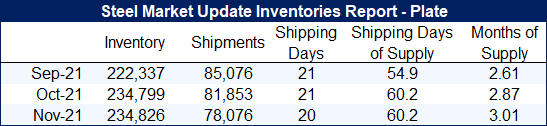

Flat Rolled = 57.1 Shipping Days of Supply

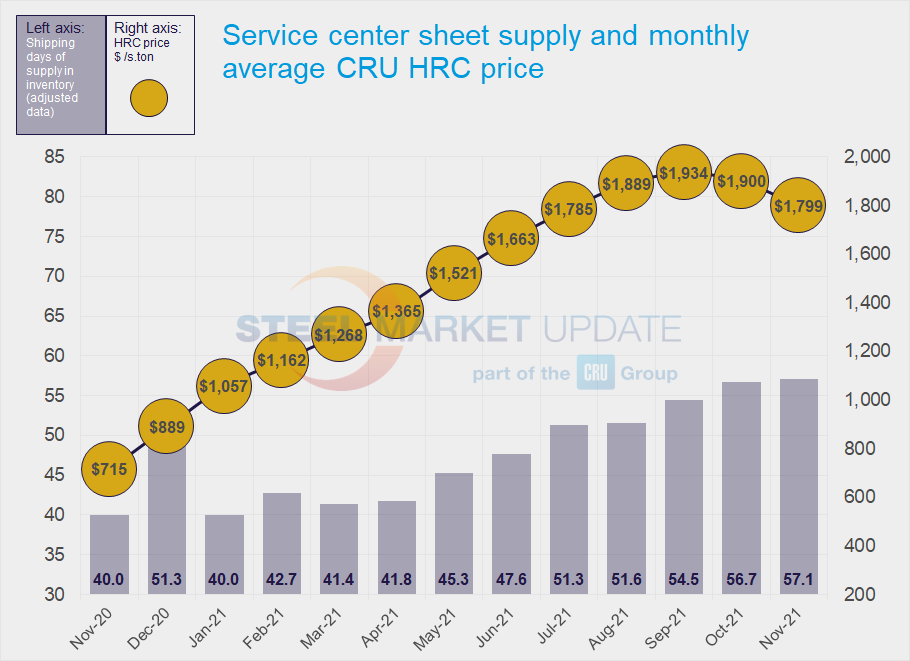

Plate = 60.2 Shipping Days of Supply

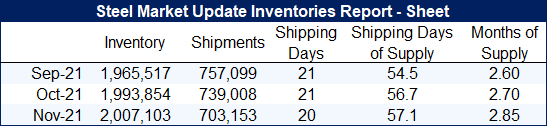

Flat Rolled

U.S. service center flat rolled inventories rose again in November, according to Steel Market Update data. At the end of November, service centers carried 57.1 shipping days of supply on an adjusted basis, compared to 56.7 shipping days of supply at the end of October. November had 20 shipping days, compared to 21 in October.

In terms of months on hand, November inventories represented 2.9 months, while October inventories represented 2.7 months.

With one fewer shipping day in November and the Thanksgiving holiday, shipments dropped as expected, while inventory volumes were flat. With prices falling and the end of year approaching, service centers have been focused on bringing their inventory levels down.

The overall amount of sheet steel on order edged up in November, despite most service centers reporting lower levels of material on order last month. The increase in on-order volumes reflects a boost in import orders by some service centers, increased order entry ahead of the holidays, and inventory building in anticipation of new business for Q1. We expect strong import volumes in H1. But domestic mills have been offering material at aggressive prices to combat imports – something that slows that trend

Lead times have been shortening, with some mills even rolling material ahead of schedule. The latest SMU survey on Dec. 9 showed HRC lead times at 5.04 weeks, down from 6.97 weeks in early November. December inventory data typically spikes with the seasonal drop-off in shipments, and we expect to see that again this year as lead times continue to shorten.

Plate

U.S. service center plate inventories were flat in November, as shipments dropped 5% with one fewer shipping day. At the end of November, service centers carried 60.2 shipping days of plate supply, which was the same as October. In terms of months of supply, service centers carried 3.01 months of plate supply in November, compared to 2.87 in October.

Market contacts reported that any drop-off in shipments has been in line with seasonal expectations and that demand has been steady overall. Some have said that while prices have been supported by recent price increases, the resale market is becoming more competitive.

The amount of material on order has fallen as service centers remain hesitant about placing orders at current high prices. The picture on mill lead times is mixed, depending on the mill. The latest SMU survey showed plate lead times at 6.38 weeks, which was flat compared to a month ago.

The amount of plate on order dropped in November. Unlike the sheet market, the plate market is not poised for an influx of imports in Q1.