Prices

December 10, 2021

October Steel Exports at 719,000 Tons, Seven-Month Low

Written by Brett Linton

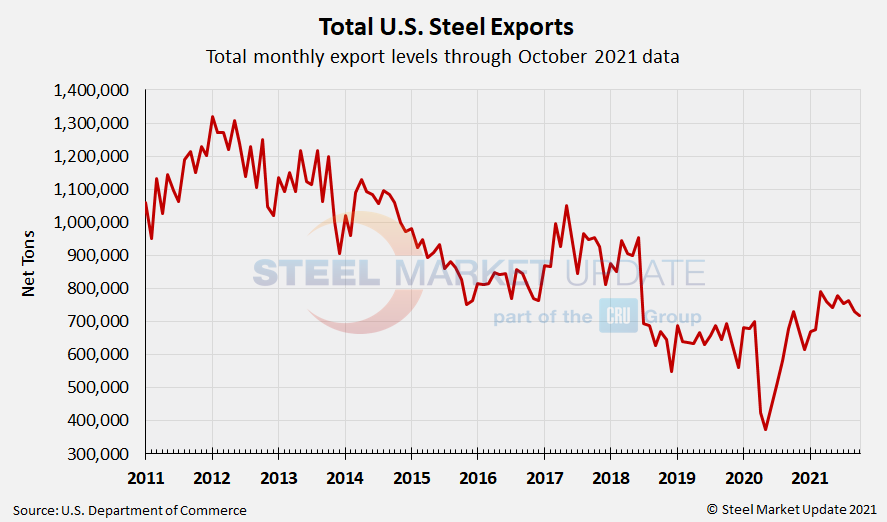

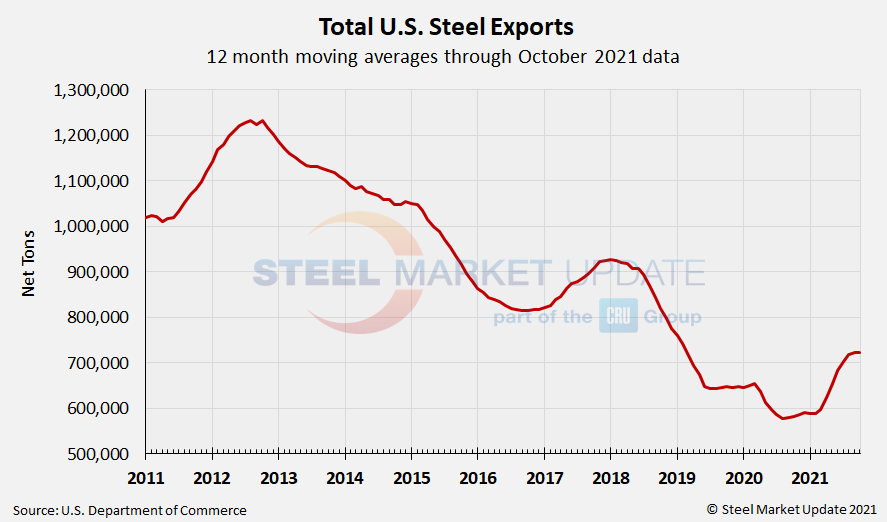

U.S. steel exports fell 2% from September to October and are now at 719,000 net tons, according to the latest U.S. Department of Commerce data. This is the lowest monthly export level in seven months. Recall that in March and June of this year, we saw the two highest monthly export levels in the last three years (790,000 and 778,000 tons, respectively). It was just last summer when the market saw record low exports, with May 2020 levels reaching the lowest seen in 24 years at 374,000 tons.

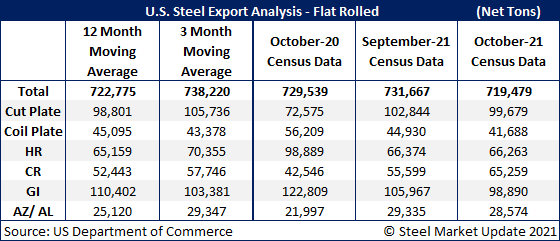

Of our six monitored product groups in October, five products decreased month-over-month and one increased.

Total exports for the first 10 months of 2021 reached 7.39 million tons. That’s up from 5.80 million tons in the same period of 2020, and it’s up from 6.58 million tons in the same period of 2019.

On a rolling-12-month average, exports declined ever so slightly from September’s 30-month high to 723,000 tons through October.

Total October exports are 3% below the three-month moving average (average of August through October 2021), and they are less than 1% below the 12-month moving average (average of November 2020 through October 2021). Here is a detailed breakdown by product:

Cut-to-length plate exports decreased 3% from September to 99,679 tons. But they are up 37% compared to one year ago.

Exports of coiled plate were 41,688 tons in October, down 7% from the prior month and down 26% from levels this time last year.

October hot rolled steel exports were flat compared to September at 66,263 tons and down 33% from one year prior.

Exports of cold rolled products were 65,259 tons in October, up 17% from September and up 53% from the same time last year.

Galvanized exports decreased 7% month over month to 98,890 tons. Compared to levels one year ago, October was down 19%.

Exports of all other metallic-coated products were 28,574 tons, down 3% from September but up 30% year-over-year.

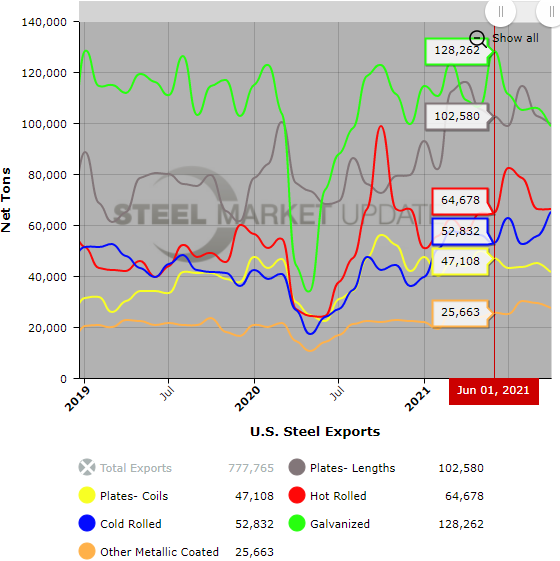

We have an interactive graphing tool available on our website here where readers can further investigate historical export data in total and by product; an example is shown below. If you need assistance logging into or navigating the website, contact us at Info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com