Plate

December 10, 2021

Imports' Share of Sheet and Plate Markets Stays Strong in October

Written by David Schollaert

Imports of less-expensive sheet and plate products continue to make their way into the U.S. market, a steady increase over the past six months as buyers continue to seek relief from record-high steel prices in the U.S. October Commerce Department data show imports’ shares of the U.S. flat products markets at their highest levels in the past 4-5 years and trending up.

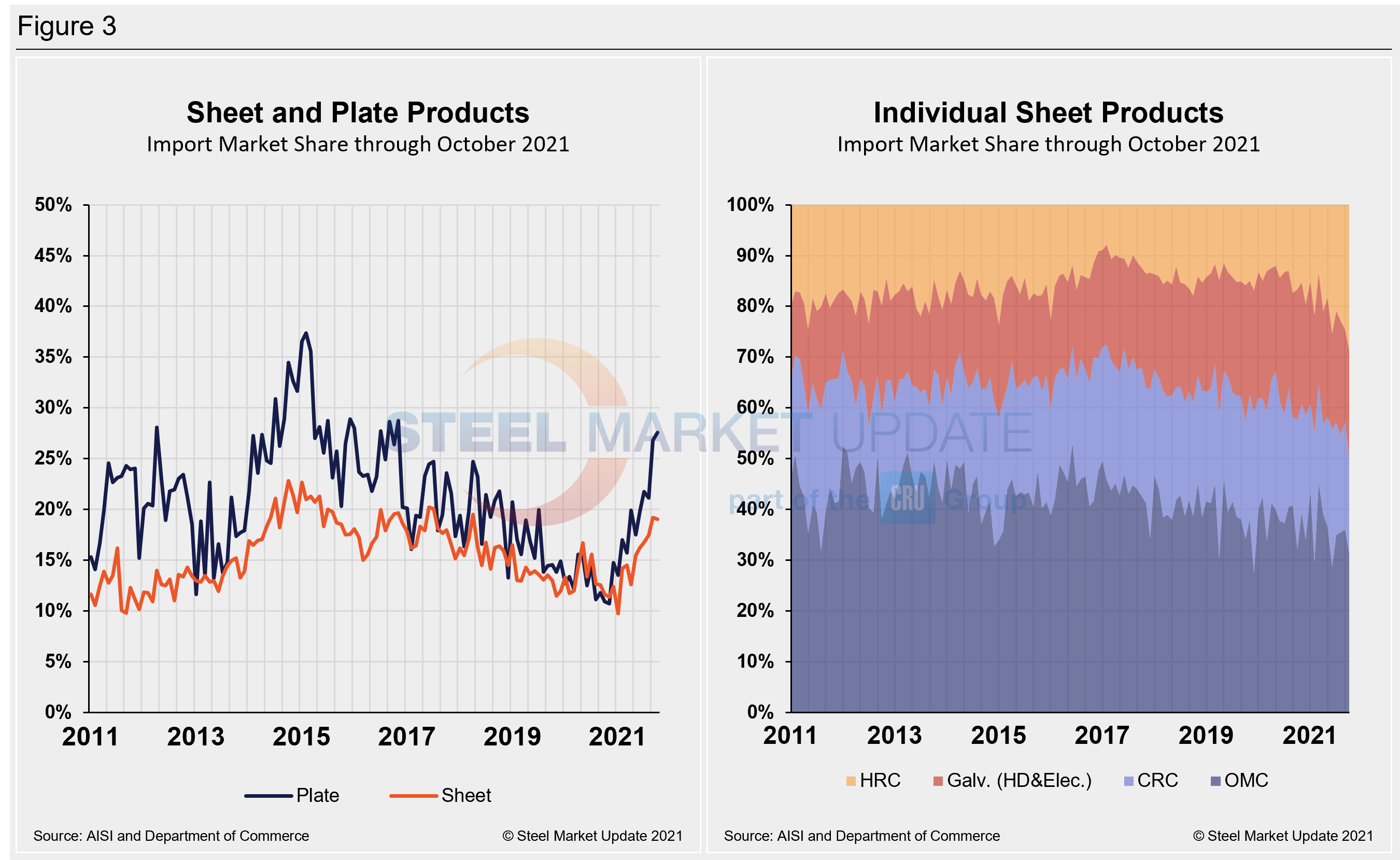

Imports’ share of total sheet product shipments into the U.S. was 19.0% in October, a negligible change from 19.2% the month prior. With the slight uptick, driven by a 1.4% rise in domestic shipments of sheet products, foreign sheet remains near its highest mark in nearly four years. Market share of plate product imports rose to 27.6% in October versus 26.8% the month prior, and the top mark in five years.

Imports’ share of domestic sheet product shipments hit its lowest level in more than a decade at 9.7% at the beginning of 2020. Since then, except for a slight contraction in April, sheet imports into the U.S. have risen consecutively for the past six months. October’s results were impacted by a 1.4% increase in domestic shipments, while import totals inched up 0.5% to 1.055 million tons and exceeded the 1-million-ton mark for just the second time since April 2018.

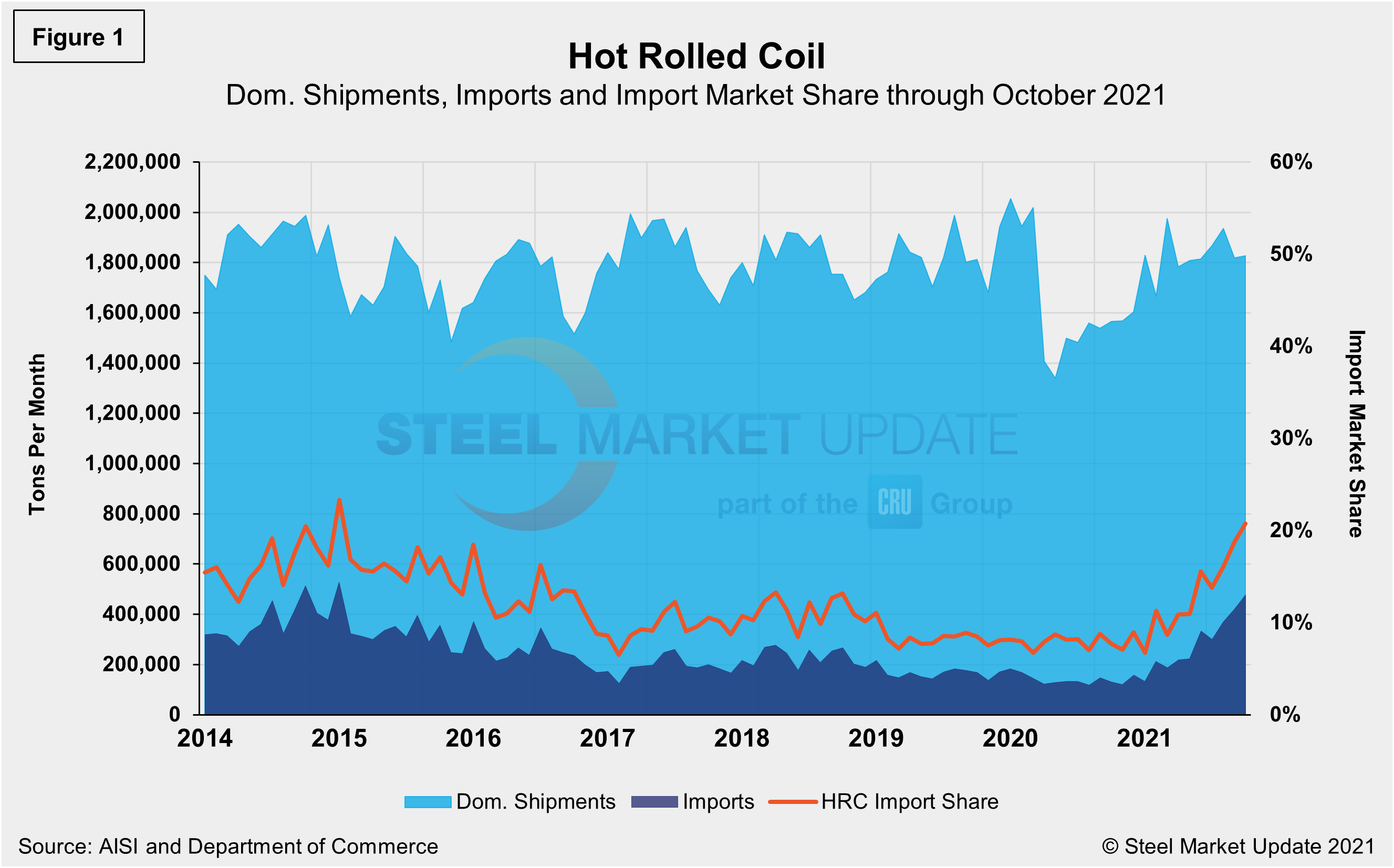

Overall sheet product shipments were up 1.2% in October versus September, totaling 5.544 million tons. Hot rolled coil (HRC) imports totaled 477,420 tons in October, the highest mark since January 2015, and pushing import market share to 20.7%, exceeding the 20% mark for the first time in nearly six years. These details are shown below in Figure 1.

Plate products in October saw an overall decrease in shipments as apparent supply slipped by 1.1% month on month. The loss was driven by a decline of 2.2% in domestic plate shipments, while imported plate products rose 1.6% during the month. October plate imports of 220,486 tons represented the highest monthly total year-to-date and the strongest since May 2018. All told, total shipments downstream, including foreign and domestic, were 800,103 tons in October, down from 809,337 tons the month prior, which was the highest total thus far in 2021.

Domestic sheet shipments in October totaled 4.489 million tons, up 1.4% from 4.427 million tons the month prior. Imports of sheet products in October totaled 1.055 million tons, up from 1.049 million tons the month prior and the highest mark since April 2018 when imports totaled 1.074 million tons.

The import share of HRC rose 1.9 percentage points to 20.7% in October, the highest mark since January 2015. The increase in share was driven by a 13.7% jump in imports month on month. HRC imports totaled 477,420 tons, the highest in nearly seven years, and nearly doubling in just a matter of three months.

Imports of cold rolled coil (CRC) and other metallic coat (OMC) were both down in October after gaining ground in September. Market share of foreign CRC and OMC both slipped to 13.7% and 22.7%, respectively. Galvanized (hot dipped and electrolytic) imports rose 12.2% in October to 252,183 tons or a 15.3% market share. The figure is a 1.4 percentage point increase month on month from 13.9% in September.

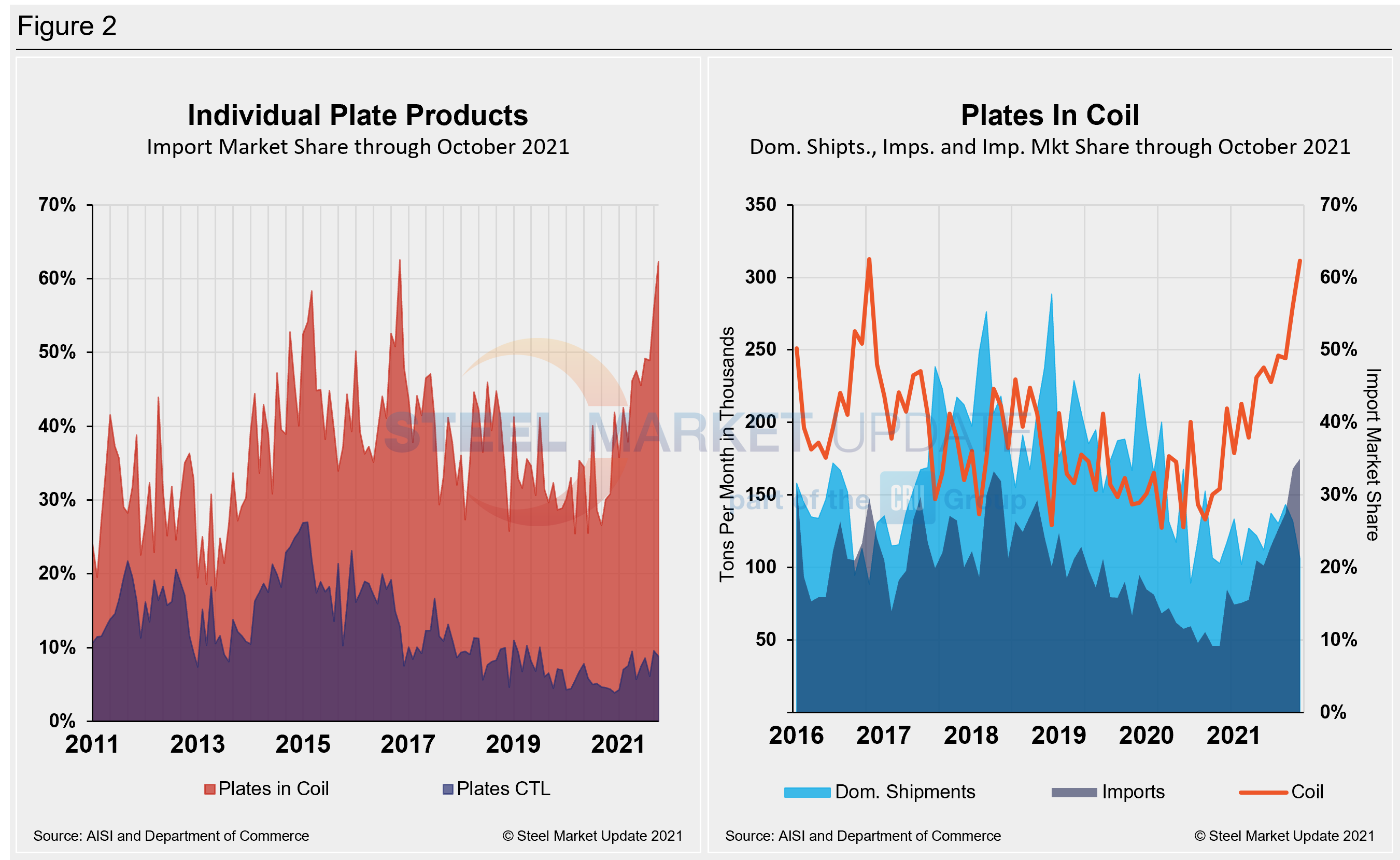

The import market share for plates in coil jumped to 62.3% in October, a 6.3 percentage point increase month on month. The gain was driven by a 19.7% decline in domestic shipments, while imports increased by just 4.1% month on month. Total imports of plates in coil were 174,880 tons in October, the highest since July 2015. The decrease in U.S. mill shipments of plate in coil brought total supply (domestic mill plus imports) down 6.4% month on month to 280,760 tons, but still the second best total year-to-date and over the past two years.

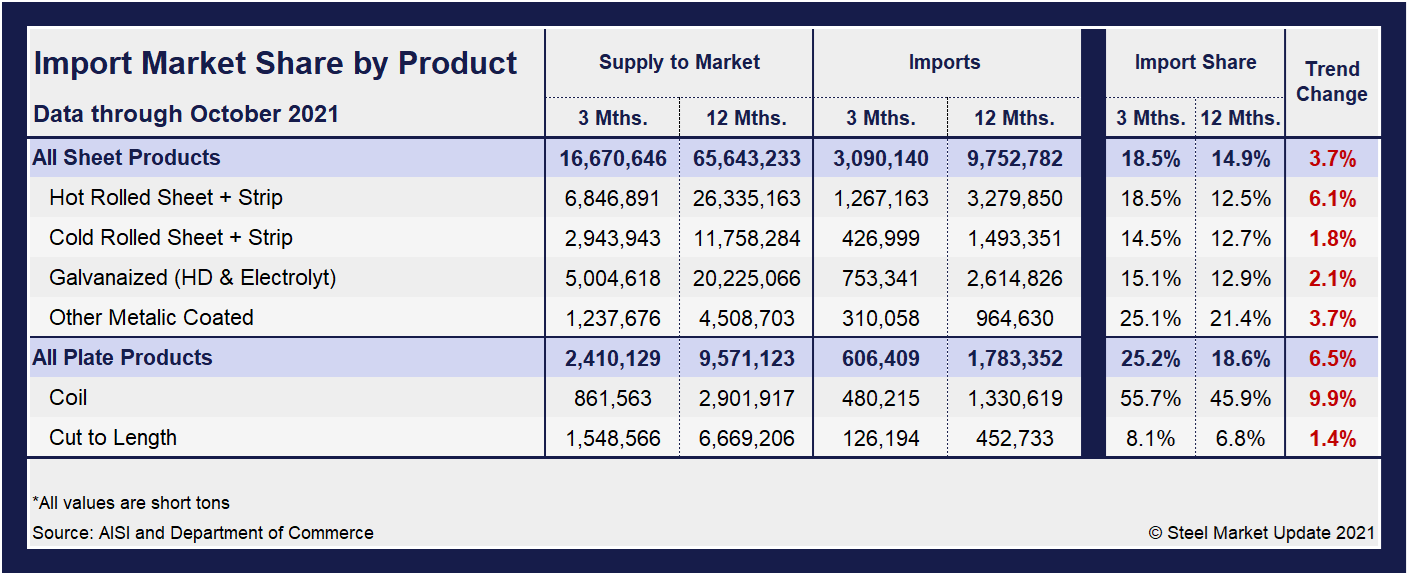

The table below displays total supply to the market in three months and 12 months through October 2021 for sheet and plate products and six subcategories. Supply to the market is the total of domestic mill shipments plus imports. It shows imports on the same three- and 12-month basis and then calculates import market share for the two time periods for six products. Finally, it subtracts the 12-month share from the three-month share and color codes the result green or red according to gains or losses. If the result of the subtraction is positive, it means that import share is increasing and the code is red.

The big picture is that imports’ share of sheet and plate continues to rise month after month, in some cases nearing all-time highs. The big second-half jump in total imports is the result of historically and disproportionately high domestic steel prices. November preliminary license data already suggests that total import numbers will be even higher. How long that trend will continue is in question as domestic steel prices continue to decline, eroding imports’ advantage.

Hot rolled and cold rolled sheet and strip have seen a trend shift along with plate products, illustrating how import competition is rising versus domestic products in three months compared to 12 months. Most notable of those subcategories are plates in coil (up 9.9%) and hot rolled coil (up 6.1%) through October 2021.

The import market share of individual plate products as well as a breakdown of the market share for plates in coil are displayed together in Figure 2. The historical import market share of plate and sheet products and the import market share of the four major sheet products are shown side-by-side in Figure 3. The import share of plate had been decreasing erratically over the past six years, but has trended up this year and is back to pre-pandemic levels, hovering just below 30.0%. Sheet product imports’ share had also trended down over the past several years, but has gained ground since the beginning of the year despite a steady rise in domestic shipments. The import market share of plates in coil is now higher than domestic shipments at 62.3%, and holding strong since the beginning of the year.

By David Schollaert, David@SteelMarketUpdate.com