Market Data

December 6, 2021

CRU: Our Top 10 Calls for 2022

Written by Jumana Saleheen

By CRU Chief Economist and Head of Sustainability Jumana Saleheen and CRU Principal Economist Alex Tuckett, from CRU’s Economic Outlook, Nov. 30

Global Economic Outlook November 2022

In this Global Economic Outlook, we look ahead to 2022 and outline our top 10 calls for the global economy. These include predictions on world growth, inflation, exchange rates, the auto and construction sectors, labor markets, commodity prices and China.

Global Growth Will Slow, But Remain Above Trend

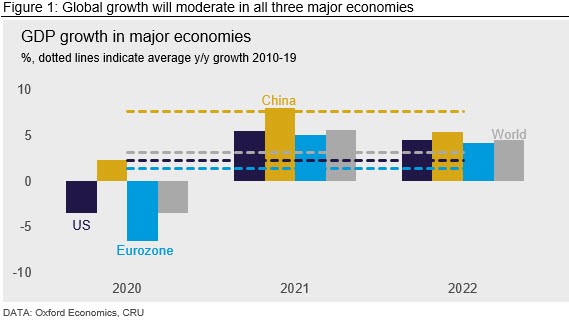

2021 should deliver world GDP growth of 5.6%, the fastest in decades, as the world economy recovers from the pandemic. 2022 will not match that blistering pace, but we expect world growth to remain above trend at 4.5%. Many economies are still below the pre-pandemic level of activity, let alone trend. This means there is plenty of room for above-trend growth.

However, there are downside risks. High inflation is already leading to a policy response from some central banks, which may derail growth (see our call on inflation below). There are signs the pandemic may have led to permanent shifts in the labor market that constrain the recovery (see our Labor Market call below). And China’s real estate sector could experience a continuous slowdown through 2022 H1 (see Construction call below).

Global Supply Chains Will Normalize by Mid-2022

The supply chain crisis is currently one of the greatest risks to the global recovery. After falling sharply in early 2020, global demand bounced back more sharply than expected. This demand was skewed heavily towards goods, with services recovering more slowly, and was turbo-charged by the need to restock after inventories were run down in early 2020.

This strong recovery in goods demand and trade has combined with Covid-19 disruptions to both production and logistics, and problems with energy supply, to put unprecedented strain on global supply chains. As well as Covid-19 outbreaks causing port closures and factory shutdowns, China’s Dual Control policy has led to energy-intensive sectors facing shutdown, leading to shortages that cascade through supply chains. This has constrained growth and raised inflation across the world.

There are tentative signs that the situation is improving. Countries are recognizing the critical role ports play and trying to clear traffic jams (for example, the U.S. has extended working hours to 24/7 at ports of Los Angeles and Long Beach, its largest container port). The power situation in China appears to be improving. However, with Christmas and Chinese New Year approaching, it will take time for the backlog to clear, and we expect supply-chain disruption to remain an issue through most of 2022 H1. Furthermore, there are still risks; an extreme weather event or further Covid-19 outbreak could easily set things back.

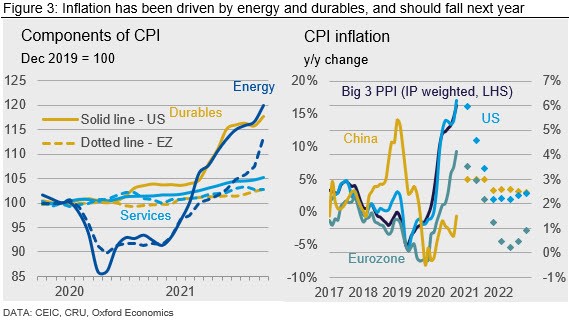

Inflation Will Fall as Durables and Energy Pressures Ease

As well as constraining growth, the supply chain crisis has sharply increased prices for many goods, particularly – in the U.S. – durables. For example, prices of used cars and trucks in the U.S. are 30% higher than in January 2021. Together with energy prices, this has pushed headline inflation in the U.S. above 6%, and in the Eurozone above 4% – multi-decade highs (Figure 3).

As supply-chain problems ease, demand rotates towards services and energy prices moderate, we expect inflation to fall sharply next year. However, there are upside risks to this from the labor market (see below) and housing, particularly in the U.S. Central banks are already under pressure to tighten policy, and if inflation falls only slowly, this will intensify. Rising interest rates – particularly in dollar markets – could threaten growth.

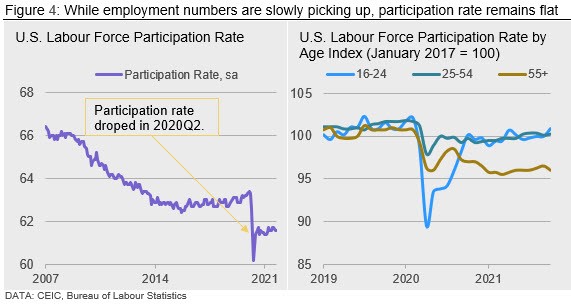

U.S. Participation Rate to Remain Below Pre-pandemic Levels

Total nonfarm payroll employment rose by 531,000 (0.34% month-on-month) in October, which was a long-awaited positive shift in the labor market. The unemployment rate fell from 4.8% to 4.6%, and job growth was not limited to Covid-resistant sectors, although public education payrolls remained a sore spot for a second month in a row.

Economists had hoped that, as schools and childcare returned to normal, and enhanced unemployment benefits expired, workers would return to the labor market. However, the participation rate in the U.S. remains well below its pre-pandemic peak (Figure 4, left-hand side). The 55+ group in particular shows few signs of recovery. It appears that some people the Fed was counting on to return to the labor force may have taken advantage of strong asset prices to choose early retirement. In contrast, while employment for 16- to 24-year-olds suffered a major hit in 2020 Q1, their participation in the labor market went back to nearly pre-pandemic trend in October 2021. However, together with losses in state and local education payrolls, one cannot help but wonder if school-leavers are choosing full-time jobs over textbooks.

All this matters because it affects the amount of “slack” there is in the labor market; how much above-trend growth the economy can absorb without generating pressure on wages (and then prices). Through 2022, the Fed’s attention is likely to turn from inflation caused by supply-chain and energy issues, to the labor market. A shortage of workers could prove to be as big an issue in 2022 as shortages of materials and components have been in 2021.

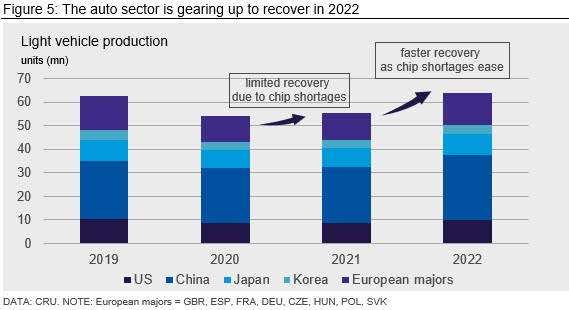

The Automotive Sector Will Finally Bounce Back

Last year, lockdown measures to contain the pandemic were placed in force in almost every major economy, consumers suppressed their demand for cars and automakers trimmed their production plans. In contrast, with nearly no national lockdowns present a year later, demand for autos has recovered strongly. But a severe shortage of semiconductors has prevented supply from meeting that demand, and so the recovery has been disappointing.

The chip shortage for the auto sector is now beginning to ease, with improving month-on-month data in China, U.S. and Germany. This will be too late to salvage this year; we expect only 6.2% growth in global light vehicle production in 2021. But the auto sector is getting into gear for recovery in 2022. With finished inventories low, but significant numbers of “almost finished” vehicles missing only chips, the industry has the potential to ramp up production rapidly. But the speed of recovery will depend on how quickly demand moderates for other products requiring chips, and whether further disruptions – for instance from Covid-19 outbreaks – are avoided. We expect the situation to improve through Q1 and Q2, before 2022 H2 sees some above-trend production as car makers catch up with pent-up demand. We forecast that 2022 will see growth of 13.9% in global light vehicle production.

Construction Will Slow But Not Crash

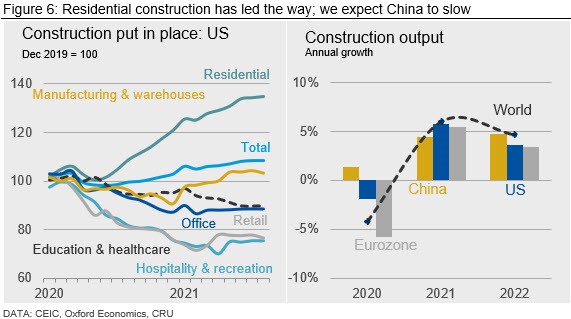

Construction initially had a more straightforward recovery from the pandemic than the automotive sector. Activity quickly bounced back in most regions from the disruptions of early 2020. However, now the outlook has diverged.

Strong housing markets have supported residential construction in the U.S. and other western economies (Figure 6, left-hand side), while other sub-sectors such as office and retail have struggled. Supply-chain problems have also held back output. However, the fundamentals of demand in western economies remain strong while the economic recovery continues, and we expect another year of decent growth in 2022 (Figure 6, right-hand side).

The situation in China is very different, with the construction sector clearly slowing. Pressure on the sector to deleverage has led to liquidity and solvency crises at a number of developers, most notably Evergrande. We think the greater risk is of a fall in demand; prices are now falling in a majority of urban areas. Once there is some certainty about what a property tax will look like, the market should stabilize. Our central case remains for a “soft-landing,” with growth remaining positive next year as infrastructure spending picks up. But there is a risk that the market gets sucked into a downward spiral, where falling prices lead to weaker buyer demand, which further depresses prices.

The Euro Will Bounce Back in 2022

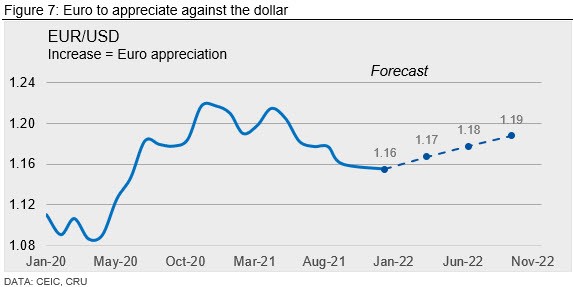

The U.S. dollar has gained over 7% against the Euro this year. However, we do not expect dollar strength to sustain through 2022, given indications of a dollar overvaluation.

Inflation and monetary expectations have driven the currency pair through 2021. The high inflation environment globally has supported the dollar and investors have become more focused on diverging paths for monetary policy. We now expect the Fed to begin raising rates in 2022 H2. In contrast, we do not expect the ECB to raise rates until 2023. The ECB will remain focused on ensuring the recovery is well entrenched and the block does not relapse back into the below target inflation that has become the norm over the last 10 years.

However, we think policy divergence has been priced into the exchange rate. Eurozone GDP remains further below its pre-pandemic trend than U.S. GDP, and so there is scope for faster growth through 2022. We expect supply-chain gridlocks to ease in 2022 (see above), and this will benefit Europe relative to the U.S. As such, we expect the Euro to appreciate modestly against the dollar in 2022, trending towards $1.19/Euro by the end of 2022.

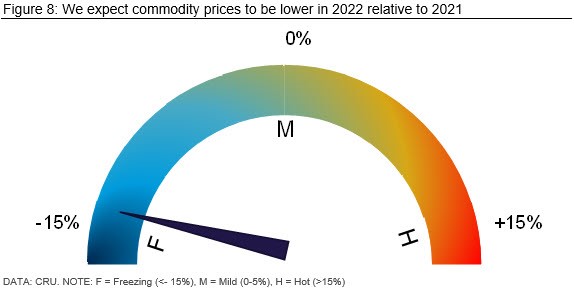

CRU’s Commodity Price Basket Will be Lower in 2022

2021 has been a scorching year for commodity prices. The CRU basket of commodity prices is heading for an annual performance 62% higher than 2020. However, this is for 2021 as a whole; many prices have moderated in the latter part of the year. We expect prices in 2022 to be 11% below the average level in 2021. Some commodities will buck the trend; we expect lithium, cobalt and precious metals to record positive y/y growth. But overall, our call that the uptick in commodity prices reflects a business cycle, not a supercycle, seems on course.

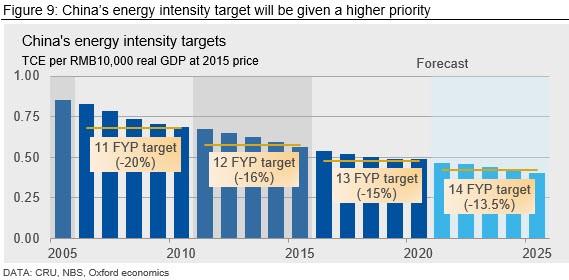

Dual Control is the Primary Tool to Meet the “30-60” Targets

“Dual control” is a key tool used by the Chinese authorities to achieve energy and climate goals of reaching peak carbon emission by 2030 and carbon neutrality by 2060 (“30-60 target”). The policy limits both energy intensity (relative to GDP) and absolute energy consumption at provincial level. Under the current dual-control mechanism, lowering energy intensity will be given a much higher policy priority compared with controlling total absolute energy consumption (Figure 9).

Looking beyond the recent power crunch, we expect the dual control policy will be one of the primary long-term tools that the Chinese authorities will use to meet its energy and climate targets. The central government will likely adopt a more forward-looking, proactive and differentiated approach in managing each province’s energy use. For instance, the projects that are designated as “green” and approved by the State Council and NDRC can be exempted from the province’s energy intensity and consumption evaluation.

China is also expected to reorient itself from the traditional energy-intensive development pathway to a low-carbon and clean future. Various forms of control measures will be needed to facilitate and accelerate “industry upgrading” so that China can meet its 30-60 targets. For example, the NDRC is planning to set energy efficiency benchmarks for five power intensive industries from 2022, while the PBoC’s recent report also sets out China’s plan to include emission from steelmaking into the scope of China’s national ETS soon.

Common Prosperity Will Begin to Shape Policy Priorities

Common prosperity aims to tackle income and wealth inequality, while preserving social mobility, reducing imbalances in public services and cracking down on monopolies. Even as they pivot to social issues, the Chinese authorities will hope to minimize the damage to economic growth, and no radical change in the income structure of GDP is expected.

We believe the Chinese authorities will devise various policy tools that focus on four key areas: reducing wealth polarization, increasing public service provision, boosting social mobility and creating an environment for fair competition. The policy direction can be categorized into three major schemes:

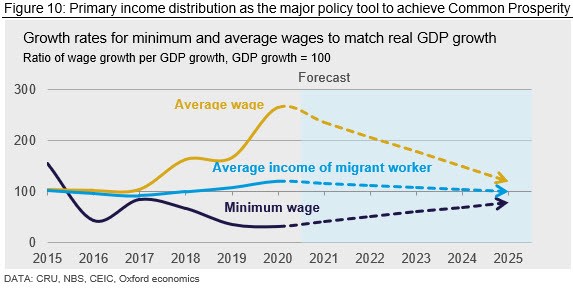

Primary Income Distribution

To reduce income inequality, we expect to see policies to provide continuing education, to facilitate entrepreneurship and innovation and to broaden income sources other than property. Chinese firms should also be prepared for more administrative guidance in wage setting, as the authorities seek to ensure that growth rates for minimum and average wages match that for headline economic growth (Figure 10).

Secondary Income Distribution

The focus of secondary income distribution will be on cracking down on illegal and undeclared income and wealth, as well as being stricter in tax collection and introducing higher penalties for tax avoidance. Introducing wealth taxes such as capital gains, inheritance and property taxes will also be an option. However, the government will be cautious, as such moves may trigger capital flight. Any nationwide property tax will be introduced slowly to avoid volatility in the property market and systematic risk. To equalize access to public services and enhance social mobility, the government will also direct greater state investment to the construction of medical facilities and schools in disadvantaged areas. Meanwhile, further relaxation of hukou (household registration) restrictions are likely, along with investments in public housing and infrastructure connecting rural and urban areas, to increase social welfare provision and to boost social mobility.

Tertiary Income Distribution

Encouraging the wealthy to donate to public fiscal resources will be an option for tertiary income distribution, through tax incentives for companies and individuals that make charitable donations. For example, Alibaba recently announced it would invest RMB100 bn in 14th FYP period in support of a Common Prosperity pilot in Zhejiang province. Industries that have recorded higher than average growth in the past years while lagging behind on labor compensation, such as technology, finance and property, should be prepared for pressure to make donations.

2022 Will Bring New Twists and Turns in the Road to Recovery

The last two years have been dramatic ones for the world economy. A global pandemic caused a synchronized contraction of unprecedented speed. This was followed by a recovery the equally dramatic speed of which has caused huge disruption. We expect 2022 to be quieter, but by no means boring, as the range of risks – and opportunities – in these predictions highlights. And while Covid-19 is no longer the only issue dominating financial markets, the emergence of the Omicron variant is a reminder that the pandemic is not over.

Market Outlook subscribers can get this month’s Global Economic Outlook report here.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com