Overseas

December 2, 2021

CRU: Recovery in Galvanized Steel Sheet Output to Slow

Written by CRU Americas

By CRU Analyst Tanya Bhaiji, from CRU’s Steel Sheet Products Monitor, Nov. 29

Galvanized sheet is the biggest first use for refined zinc, constituting around 30% of total refined zinc demand in 2020. The majority of galvanized sheet is consumed in end-use sectors such as construction and automotive while a smaller percentage is also consumed in consumer durables, other engineering, and transportation infrastructure. To estimate the zinc contained in galvanized sheet, we combine the steel sheet output numbers from our Steel Sheet team, along with assumptions related to the percentage of zinc contained per tonne of steel sheet. In absolute terms, galvanized sheet totaled 4.1 Mt of global refined zinc demand in 2020. In this insight, we explore the galvanized sheet sector, looking at how the recovery from COVID-19 has affected output and the outlook going forward.

![]()

The Momentum in Global Recovery Decelerates

Following a strong recovery since the start of 2021, the global economy is facing multiple headwinds with supply chain problems, an energy crisis, and a new COVID-19 variant of concern. CRU’s economics team expects global IP to grow by 7.6% y/y in 2021 but risks to the downside still remain, as supply chain bottlenecks and inflation risks on the horizon continue to impede a full recovery in the industrial sector. The global energy crisis and rising prices are also affecting both producers and consumers. We have slightly revised down our forecast of industrial production growth from 4.3% to 4.2% in 2022.

The two biggest end-use sectors of galvanized sheet, construction and automotive, were hit hard by the restrictions imposed during COVID-19 lockdowns in 2020 and the subsequent slowing of the global economy. Global automotive output was more heavily affected in 2020, declining by 15.6% y/y compared to a decline in construction output by 4.3% y/y. This resulted in a loss of refined zinc demand from galvanized sheet in the auto sector of ~130,000t y/y in 2020. Construction has recovered quickly from the pandemic on the back of massive stimulus and is expected to increase by 5.6% y/y in 2021. Starting from the low base in 2020, we expect the construction sector to add ~180,000t y/y of galvanized sheet-related refined zinc demand in 2021. In contrast, the auto sector recovery continues to be impeded by the global chip shortage. More recently, however, trends in the construction recovery have diverged across different economies. In Europe, Germany’s construction activities have remained at relatively normal levels throughout the pandemic while Italy has seen a strong V-shaped recovery. Construction output in France and Spain remains sluggish and is likely to see a stronger growth next year. The Chinese real estate market has been slowing too, posing downside risks to galvanized sheet demand.

Refined Zinc Demand in Galvanized Sheet Recovered in 2021

In 2020, global galvanized sheet output contracted by 6.3% to 151 Mt because of COVID-19-related restrictions. This equated to a loss of about 260,000 t y/y of galvanized sheet-related zinc demand. The exception was China, where galvanized sheet output increased by 5.2%, aided by the early containment of COVID-19 in 2020 H1, leading to an increase in galvanized sheet-related zinc demand of 80,000t y/y. The global slump in 2020 was followed by a strong recovery in galvanized sheet output in 2021, with a y/y increase of 9.8% in 2021 Q1-Q3. Starting from a low base, Q2 was the strongest quarter for galvanized sheet production as the global economy was recovering strongly in tandem with strong vaccination drives. Overall, we expect global galvanized sheet output to grow by 7.6% y/y in 2021, and more than recover the previous year’s loss in zinc demand with an increase in zinc contained of ~300,000 t y/y.

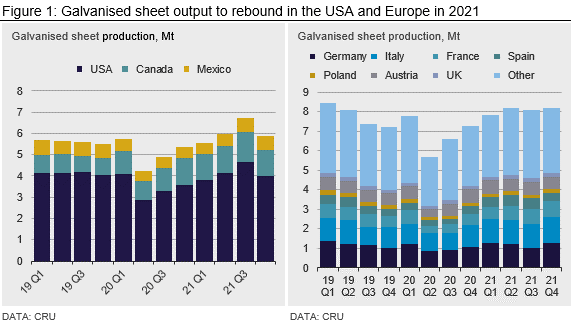

Galvanized Sheet Supply to Increase in the USA

In North America, galvanized sheet production increased by 21.1% y/y in 2021 Q1-Q3. In the USA, domestic output of galvanized sheet in 2021 is expected to grow to 21.65 Mt, surpassing 2019 levels. This will increase demand for zinc contained in galvanized sheets by 98,000 t in comparison to 2020.

The USA and the EU have recently reached an agreement to replace the Section 232 tariffs of 25% on steel products with a quota system, to allow a specified amount of duty-free steel products into the country. Hence, galvanized sheet prices are likely to become more competitive in the U.S. and supply will increase, as output is also expected to grow further with new capacity coming online. However, downside risks to production still remain, including continued supply chain bottlenecks and an uptick in COVID-19 cases.

High Energy Prices Could Reduce European Galvanized Sheet Output

European galvanized sheet output increased by 17.3% y/y in 2021 Q1-Q3. Although auto-related demand remains constrained by the chip shortages, other end-use sectors in Europe like construction have fared well and more than offset auto sector losses. Starting from a very low base in 2020, we expect annual galvanized sheet output to increase by 17% in 2021 y/y to 33.17 Mt. This translates to an increase in refined zinc demand in the sector of around 140,000 t y/y.

The rise in European electricity prices and high metal premia are increasing producers’ costs for galvanized steel sheet, making them less competitive and posing downside risks to output. Some steel mills have already reduced production at peak times although we do not believe that galvanized sheet output has been impacted to date. But high prices could make the European market vulnerable to higher imports from lower-cost countries where an antidumping duty is not already in place.

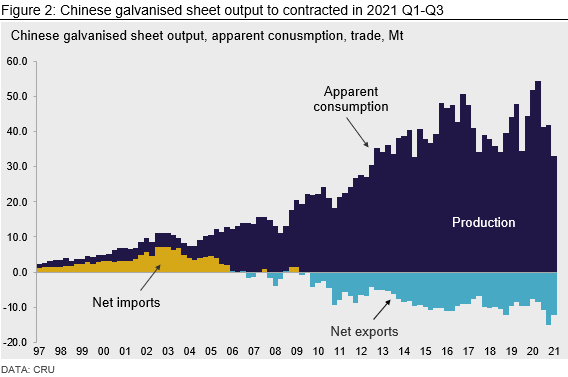

Chinese Galvanized Sheet Output Contracted in 2021

In contrast, Chinese galvanized sheet output contracted by 2.1% in 2021 Q1-Q3, as limits imposed on steel output to curb emissions reduced production, and manufacturing demand weakened. Chinese economic growth peaked in 2021 Q1 and is set to slow down on weaker construction activity and lower manufacturing investment. It is expected to almost halve by next year, from 9.6% to 5% in 2022.

Total Chinese zinc demand is therefore expected to grow at slower pace as it will be weighed down by a slowing construction sector and lower exports of galvanized sheet-containing white goods. At the same time, the energy crunch in 2021 Q4 and Chinese policy around environmental protection and carbon emission controls, are likely to result in further production cuts in the medium term, leading to lower galvanized sheet output. We expect China’s annual galvanized sheet output in 2021 to decline by 3.4% y/y, resulting in a loss of 63,000 t of zinc contained.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com