Market Data

November 23, 2021

SMU Steel Buyers Sentiment: Optimism Follows Prices Down

Written by Tim Triplett

Steel Buyers Sentiment saw a notable dip this week, as did steel prices. Industry sentiment tends to track with steel price tags – the stronger the prices, the more optimistic service center and OEM executives who respond to SMU’s surveys. While sentiment remains near record levels, the downtrend suggests optimism, like prices, may have peaked.

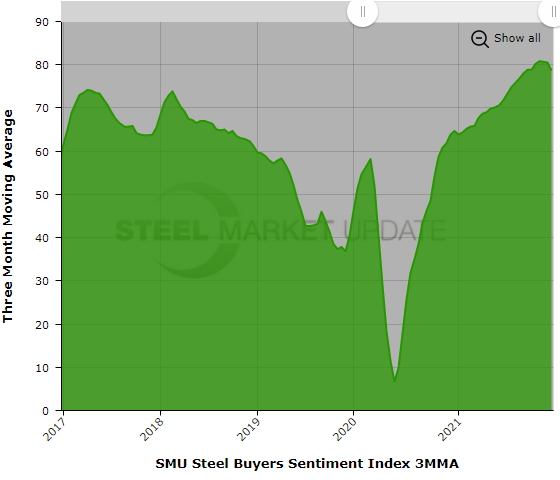

SMU surveys buyers every two weeks and asks how they view their chances of success in the near and longer term. SMU’s Current Buyers Sentiment Index registered +73, down five points over the past two weeks. The all-time high was +84 in early September.

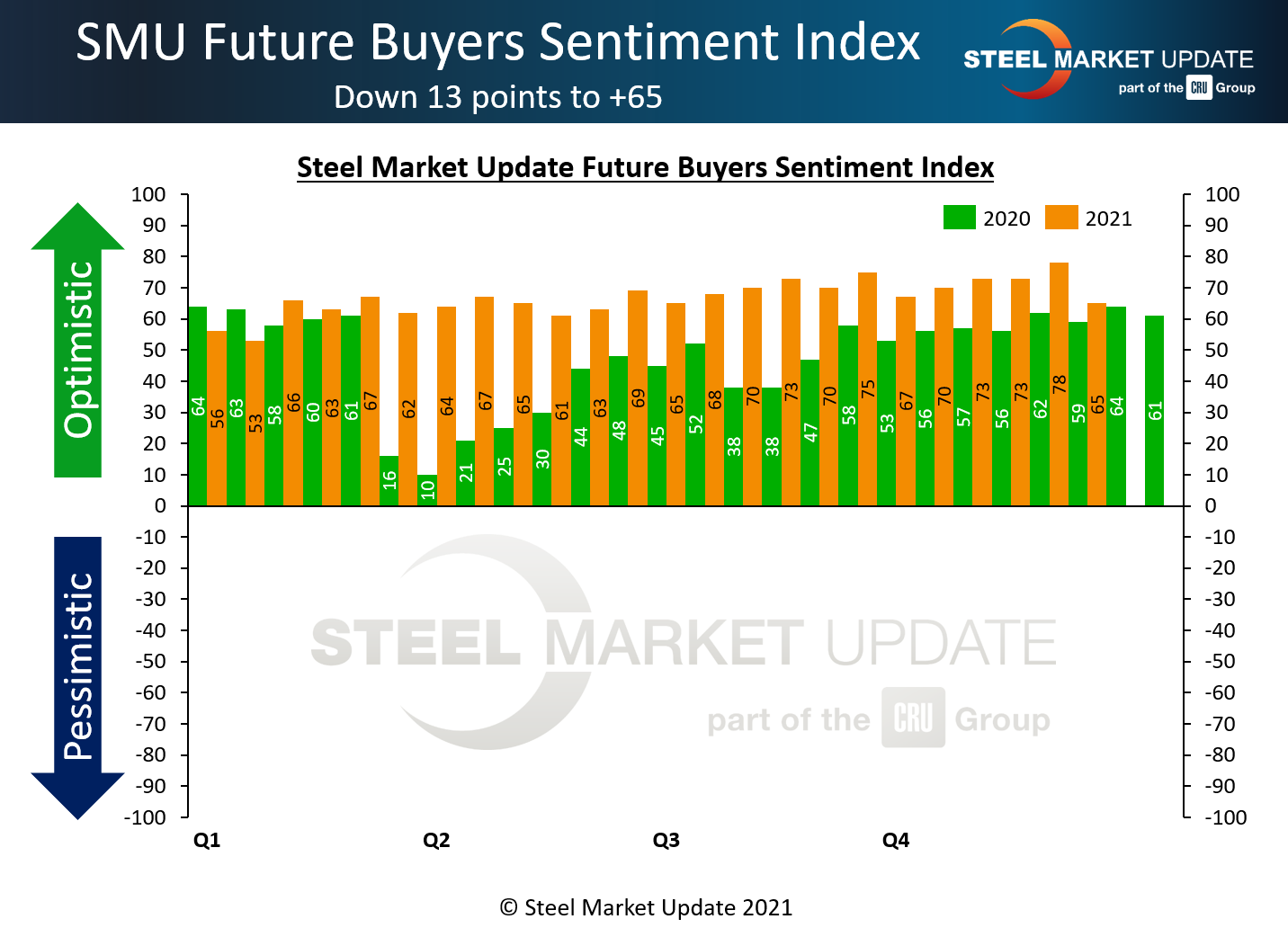

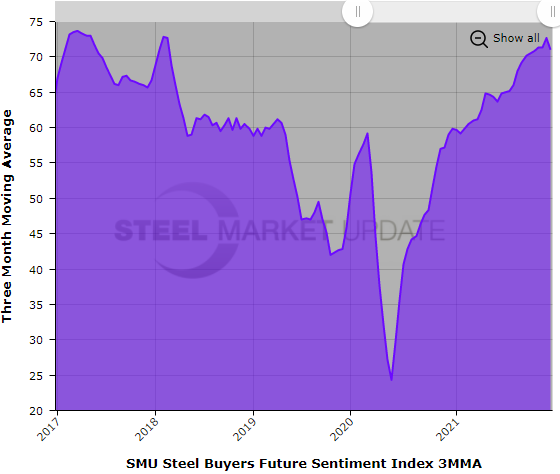

Future Sentiment – which measures steel buyers’ feelings about their prospects three to six months in the future – declined by 13 points to a reading of +65. That compares to an all-time high of +77 in February 2018.

Measured as a three-month moving average (3MMA) to smooth out the variability, the Current Sentiment 3MMA stood at +78.67 this week, while the Future Sentiment 3MMA was at +71.00 – still near record highs.

What Respondents Had to Say

“Too much uncertainty and unknowns to be sure.”

“We will chase prices down. Worry is on changes in trade action and laws making navigating the market more challenging.”

“Can’t be successful with the current premium for domestic steel while the competition is enjoying discounted imports by $600/ton.”

“We hope there is pent-up demand in the construction sector for projects that were put off due to high prices. Q1 appears to be headed to a slow start for January and possibly February, then to gain momentum. Import will be huge this year for the construction sector, at least for the first half of 2022.”

“I am still quite bullish for the 1H of ’22. It will be a great few quarters for mills and service centers, alike.”

“Every month is our best ever. Surely this will be a November that we’ll never be able to surpass.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat-rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings run from +10 to +100. A positive reading means the meter on the right-hand side of our home page will fall in the green area indicating optimistic sentiment. Negative readings run from -10 to -100. They result in the meter on our homepage trending into the red, indicating pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace. Sentiment is measured via Steel Market Update surveys that are conducted twice per month. We display the meter on our home page.

We send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies. Approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.

By Tim Triplett, Tim@SteelMarketUpdate.com