CRU

November 21, 2021

CRU: Handicapping Potential for Primary Aluminum Capacity Restarts

Written by Greg Wittbecker

By Greg Wittbecker, Advisor, CRU Group

Prices are higher…. why aren’t we seeing more aluminum production?

One of the most natural questions being asked in the world of aluminum is “with LME prices up so much year on year, why aren’t we seeing more capacity coming back to life?”

It IS an appropriate question and one we have touched on in prior columns, but it bears review again.

In our most recent Aluminum Market Outlook circulated to CRU subscribers, we recapped this:

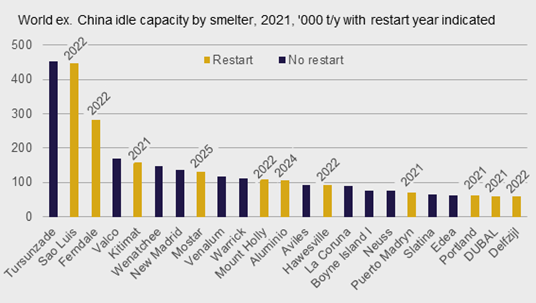

It may be instructive to briefly describe the conditions favoring some restarts and discouraging others:

Tursanzade (TALCO -Tajikistan) – Systemic power shortages and a comprehensive retrofit underway being financed and executed by the Chinese will keep this smelter down until 2023.

Sao Luis (Alcoa/South32- Brazil) – One of the notable restarts, it provides some important lessons. One, the smelter will begin to restart now, but with only about 60% of installed capacity or 268,000 tons, which will take until December 2022 to complete. A cost of $75 million = $280 per ton.

Ferndale (Alcoa) – This smelter was shut in July 2020 and the market is speculating that it may be sold to a third party to bring it back to life. However, considerable investment will be needed to modernize the plant (built in the 1960s) and they will need a power deal for 3-5 years to amortize those costs. It’s also debatable whether the labor force can be brought back or if they have found other employment elsewhere in the tight U.S. labor market.

Valco (Ghana State) – Systemic power shortages have kept this plant hobbled at 20% of its installed 200,000 ton/year capacity for 10+ years. Nothing has changed

Kitimat (Rio Tinto British Columbia) – End of a labor strike in October starts the slow process of reopening 75% of this smelter. That will take 18 months, but will happen.

Wenatchee (Alcoa Washington) – This smelter is permanently closed.

New Madrid (Magnitude 7 Missouri) – Operating at 65% of capacity on two of three lines with tolling with Glencore. Owner is a highly opportunistic trading company and will only open the third line with a solid power deal and an offtake agreement with Glencore or another counterparty. Power may be the challenge.

Mostar (Bosnia State) – Capital-starved with at least three years off. High power costs are crushing marginal economics all over Europe.

Venalum (Venezuelan State CVG) – Another capital-starved smelter with no foreseeable hope of finding partners, considering the Maduro government is a pariah in the political world. Opportunistic trader like Glencore might step in with terms at a VERY steep rate of return given the political risk.

Warrick (Alcoa-Indiana) – Three of five lines remain shut and it uses coal-based energy. Alcoa has recently said it won’t restart or build capacity that is not low carbon. Enough said.

Mount Holly (Century-South Carolina) – Well on its way to reopening 50% of its second line or about 50,000 tons of production. Century has been nimble in securing spot power to facilitate this and appears focused on getting this back to nameplate capacity of 200,000+ tons in the next year.

Aluminio (CBA- Brazil) – CBA generates its own hydro power and to the extent the drought conditions ease in Brazil, they will restart this capacity as this low-carbon production will be sought after.

Aviles (Grupo Industrial Riesgo Spain) – Former owner Parter (who acquired from Alcoa) did nothing with the asset and the new owner has not defined its plans. Don’t expect any imminent plan to restart.

Hawesville (Century-Kentucky) – Smelter has struggled with stability issues, but the intent is to fully resume production. It is believed one line of 40,000 tons is coming back soon.

LaCoruna (Riego Spain) – Aviles’ sister plant…same story.

Boyne Island (Consortium-Australia) – Coal-based production and higher costs conspire to keep this one down.

Neuss (Hydro Germany) – High European power costs threaten this plant’s survival.

Puerto Madryn (Aluar Argentina) – A well managed smelter, the owners are bringing this one back in the aftermath of the pandemic.

Slatina (ALRO Romania) – High power prices in Europe will stunt any plans to bring this back.

Edea (Cameroon State) – Drought conditions have eliminated access to power. No restart possible.

Portland (Alcoa Australia) – Plans to restart 35,000 tons during early 2022 as power is migrating to more renewables and allows them to be consistent with their pledge to only grow low-carbon production.

DUBAL (EGA Dubai) – Highly efficient and well managed smelter, restart of pots.

Delftzil (Aldel Netherlands) – High European power prices have forced a curtailment; restart is contingent on prices falling sharply again.

Those sites marked in BOLD are the only viable capacity that we think is coming back. Sao Luis and Portland really represent the only restarts that were responsible to price. The others were coming back even before the recent rise in prices to $3,000 and higher. A common denominator to why others are NOT coming back remains power. No matter how lucrative prices appear to be, the absence of long-term competitive power is acting as a constraint for others to reopen. This is unlikely to change in the next 3-6 months.

All this combines to underscore why CRU sees the primary aluminum market facing a deficit of historical proportion in 2022…approaching 2.5 million tons.

Greg Wittbecker joined CRU in January 2018 after retiring from Alcoa, where he was Vice President of Industry Analysis and Managing Director of Alcoa Beijing Trading, based in Shanghai, China. His career spans 35 years in the aluminum industry, having also held senior commercial and management roles at Cargill, Wise Metals and Koch Supply and Trading. Greg brings perspective on the entire aluminum supply chain from bauxite to aluminum finished products and will be a regular contributor to SMU going forward. He can be reached at gregory.wittbecker@crugroup.com

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com