Market Data

November 16, 2021

Premium Product Spotlight: Service Center Shipments and Inventories

Written by Brett Linton

Steel Market Update is pleased to share the below excerpt of a Premium item with Executive members. SMU publishes service center shipment and inventory data for Premium subscribers on the 11th business day of each month, one day after our data providers receive the data. Premium member reports include expanded analysis with detailed shipment and inventory levels, shipping rates, and days/months of supply, as well as data tables for flat rolled and plate. For information on upgrading to a Premium-level subscription, and getting access to our shipment and inventory data, email Info@SteelMarketUpdate.com.

Flat Rolled

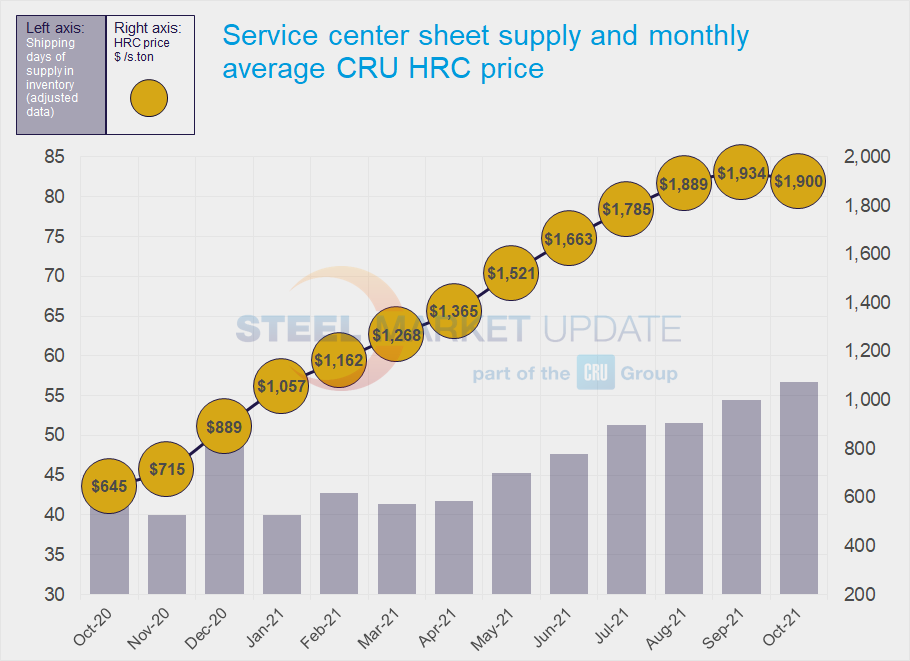

U.S. service center flat rolled inventories increased in October, as shipments slowed, according to Steel Market Update data.

Service center contacts have said they’re seeing more competition in the resale market and there are prices for processed material that are lower than current spot coil offer prices from mills. Service centers are motivated to sell material before year’s end and because prices are softening.

Going forward, we expect inventory levels to continue to rise as mills catch up on past due orders and demand slows. Considering lower seasonal demand ahead in Q4, inventories appear to be on the heavier side relative to shipments.

The amount of sheet on order is falling, which is coinciding with shortening domestic mill lead times and import arrivals. Though material on order keeps sliding, it remains higher than usual. The higher on-order volumes heading into November and December suggest that inventories will be elevated for a while.

Plate

U.S. service center plate inventories increased in October, as plate shipments also slowed.

For now, service centers remain reluctant to book more material than they can sell quickly because of wariness about current high prices. The U.S.-EU trade agreement imposing a tariff-rate quota on steel imported from the EU will alleviate some of the tightness for certain sizes and grades.

Plate lead times have shortened in recent weeks to about 7 weeks, according to SMU data. The amount of plate on order, though decreasing, is still historically high.