CRU

November 16, 2021

CRU: Turkey Set to Lose if the EU Bans Scrap Exports

Written by Thais Terzian

By CRU Senior Analyst Thais Terzian and Analyst Chris Bandmann, from CRU’s Crude Steel Market Outlet, Nov. 15

There is currently a lot of market discussion that the EU may act to restrict scrap exports. Here we look at who could be hurt and who might see opportunities. Other regions have already acted to protect domestic scrap supply, but if EU scrap exports were cut, Turkey will feel the greatest impact. A ban on European scrap exports would leave Turkish scrap buyers severely undersupplied, with few other options to turn to.

Restricting Exports Could Fit with the Green Deal

There is currently a lot of market discussion that the EU may act to restrict scrap exports as part of a review of EU Waste Shipment Regulations. Here we look at who could be hurt and who might see opportunities.

Restricting scrap exports may be an extreme end state, but it does in principle align with some of the goals of EU’s Green Deal, which looks to raise security of supply of key raw materials as well as promote low-CO2 steelmaking. Increasing the availability of scrap to the domestic industry could be seen as working towards both of those goals. A clear counter is that the ability to export provides the EU scrap industry with additional economies of scale, but it is possible that policymakers would determine that higher domestic demand could adequately provide that scale, as EU BF/BOFs raise scrap rates or (over the longer term) transition to EAFs.

There are multiple forms that any restrictions could take, and it need not necessarily be the nuclear option of a total ban. Much more likely it would be some form of softer restriction. We await further details. We would also note that within the EU, there is a mix of net importer and net exporter member states. Italy and Spain, for example, are large buyers of scrap, but some of the northern countries have active export industries. Lobbying will thus be complex.

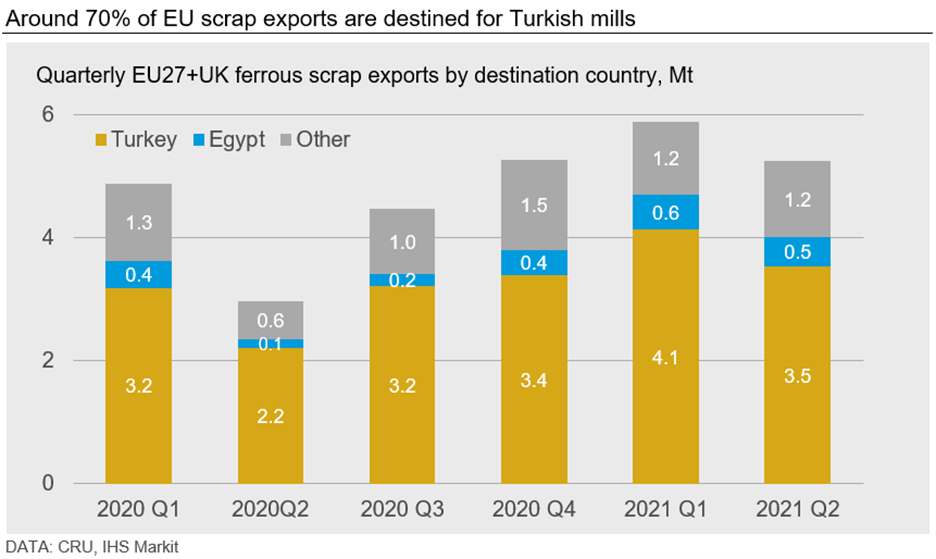

Turkey Is Currently the EU’s Largest Customer

Turkish scrap demand cannot be satisfied through domestic sourcing alone, and mills need to turn to the international market for their feedstock. This is primarily sourced from the EU27+UK and the USA. The EU was responsible for around 28% of total world steel scrap exports in 2020, with the vast majority going to Turkey – the largest scrap importer in the world by a substantial margin.

Other major export destinations for European scrap include Egypt, the USA, Switzerland and Pakistan.

A ban on European scrap exports would leave Turkish scrap buyers severely undersupplied, with few other options to turn to. The UK appears attractive due to geographic proximity, but volumes are limited. Russia would be another option for sourcing, but the growing tariff on scrap exports and the government’s implicit goal of retaining more scrap domestically, make this a volatile option.

There are Precedents in Other Regions

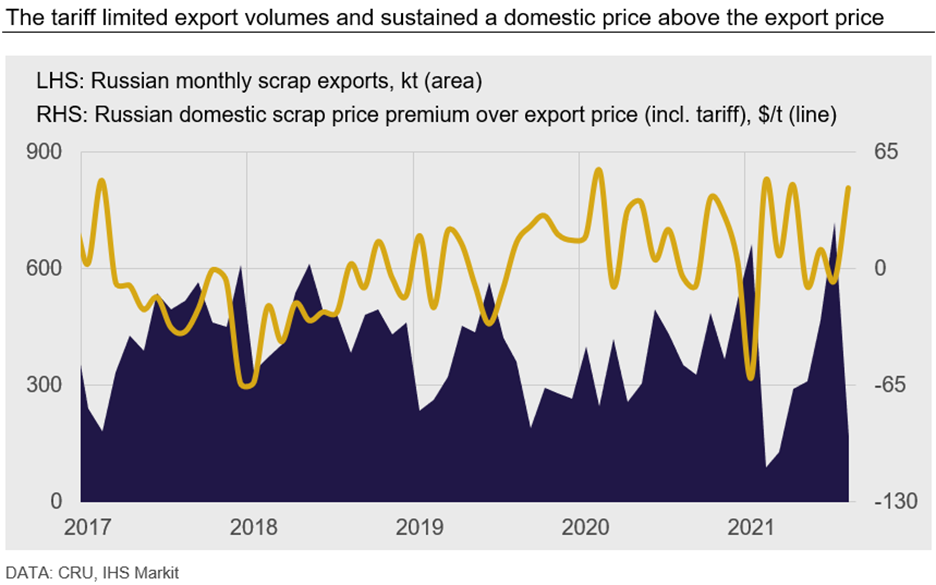

In February 2021, the Russian government introduced changes to an existing export tariff on ferrous scrap. While the 5% tax was kept unchanged, the minimum levy under the export duty was increased from €5 to €45 /t. The aim of the change was to protect the domestic industry from supply shortages and high international prices.

Many scrap dealers boosted exports ahead of the tax implementation, but exports fell immediately afterwards as they lost competitiveness against domestic and international prices. However, the impacts of the tariff started to ease in May as the gains in international scrap prices were sufficient to compensate for the cost increase in Russia, and Russian exports picked back up. As a result, the government announced another increase in the tariff minimum levy from €45 /t to €70 /t, starting from August 2021. Exports spiked again ahead of the change and plummeted right afterwards. Amidst such swings, YTD to August, Russian scrap exports were 2.4% lower y/y and fell 7.4% versus the same period in 2019.

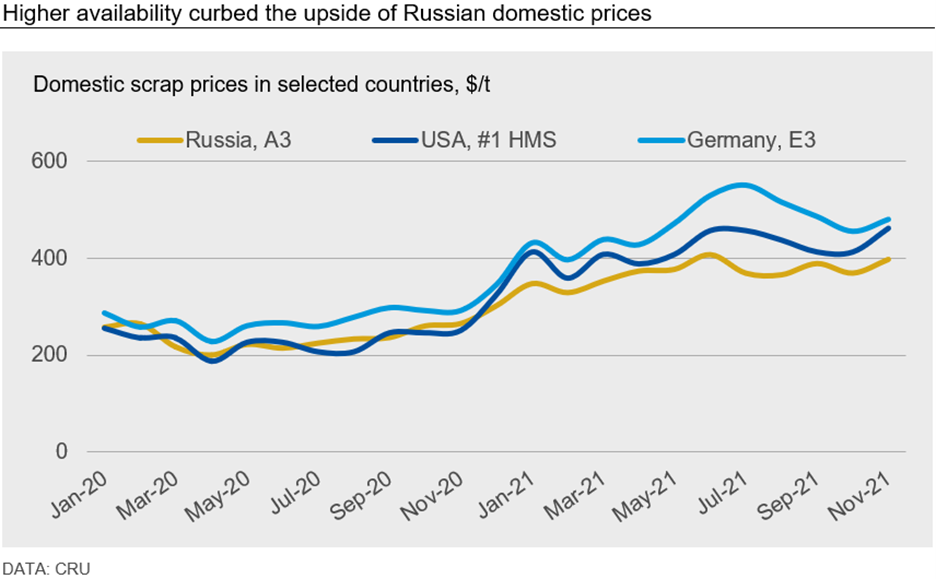

With the tariff increase and fewer attractive export options, more material stayed in the country, preventing Russian domestic scrap prices from rising as rapidly as prices in other markets. Local mills faced less competition from exporters and were able to set relatively lower purchasing prices, although the support coming from higher finished steel prices and bulk raw materials was also reflected in Russian scrap price versus 2020 levels.

Possible Outcomes of an Export Ban in the EU

We believe the implementation of a full ban on exports in the EU is unlikely. However, if implemented, it would put downward pressure on domestic prices in the region, particularly in exporting countries, given the rapid increase in availability. Nevertheless, in the medium term, this could be offset by higher consumption of scrap locally, supported by emission targets as well as higher availability.

Meanwhile, the global scrap market would become tighter, with fewer supply options available and increasing prices as a result. Scrap costs, alongside restricted supply, would curb crude steel production in scrap importing countries, particularly Turkey given its high dependency on EU scrap. However, this would not necessarily impact finished steel output, as semi-finished product imports could compensate for lower scrap and crude steel supply. The CIS countries, India and Iran would benefit in the case of higher demand for merchant billet, while higher demand for slab would be positive again for CIS countries and Brazil.

In the case of a taxation and not a full export ban, the impact on prices would be similar as the above mentioned, while trade flows would be more dependent on international scrap prices. As observed in Russia, a higher export tax was sufficient to better balance the domestic market while international prices were high enough to maintain exports flowing out of the country in some periods – and something similar could happen with EU exports.

The European Commission is expected to announce the outcomes of the revision of EU Waste Shipment Regulations on Nov. 17, and more details about the implications for scrap trade will be known by then.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com