Prices

November 2, 2021

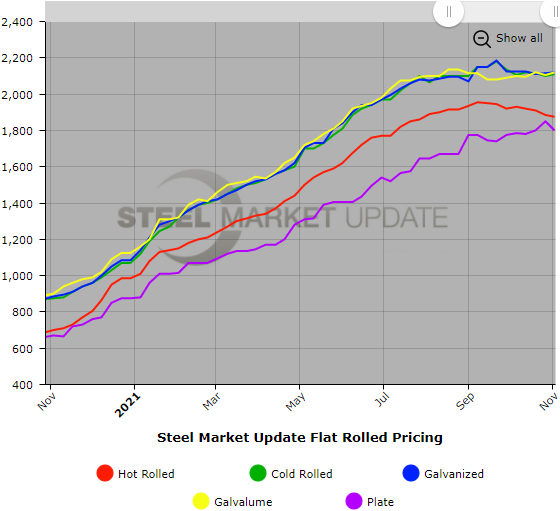

SMU Price Ranges & Indices: Cold Rolled and Coated Stronger than Hot Rolled

Written by Brett Linton

As expected, steel prices are volatile and unpredictable as the market approaches year-end. Hot rolled continued its slow, gradual descent averaging $1,875 per ton this week, down another $10, based on Steel Market Update’s survey data gathered on Monday and Tuesday. Cold rolled and coated products, on the other hand, saw small increases to around $2,110-2,120 per ton. Plate gave back the $50 it gained last week to an average around $1,800 per ton, despite the price increases announced by the mills in late October. SMU’s Price Momentum Indicator for hot rolled is pointing Down, but remains Neutral for other products until the trend becomes clear.

Comments from various sources reflect the unsettled and varied nature of recent steel transactions, which make it difficult to pin down prices. “Many mills are now acknowledging that holes in order books from the auto sector are becoming more prevalent. While mills believe they’ll muddle through the end of the year, they see bigger challenges emerging come January and beyond,” said one respondent.

The fact that service center inventories are finally more balanced appears to be having an effect on demand as the year comes to a close. Said one service center exec: “For the most part domestic producers are recognizing this is an inventory bubble moving through Q4 and that dropping prices won’t generate orders. Hot rolled is the primary bubble; tandem value-added products remain stronger.”

SMU has heard reports of deals for galvanized and Galvalume at well below $2,000 per ton, at least for customers who can afford to wait. “People who have short lead time expectations are paying triple-digit numbers. With automotive at 75-80% capacity because of the chip issue, there are opportunities from those lines, but lines serving building products and construction have fewer unsold tons. So, it’s all over the place.”

At least one source considers SMU’s prices to be too pessimistic. “HR may continue to slide, but CRC and coated should be steady. The market is not that bad,” he said.

Hot Rolled Coil: SMU price range is $1,845-$1,905 per net ton ($92.25-$95.25/cwt) with an average of $1,875 per ton ($93.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $5 per ton compared to last week, while the upper end decreased $15. Our overall average is down $10 per ton from one week ago. Our price momentum on hot rolled steel is Lower, meaning we expect prices to decrease over the next 30 days.

Hot Rolled Lead Times: 5-12 weeks

Cold Rolled Coil: SMU price range is $2,045-$2,175 per net ton ($102.25-$108.75/cwt) with an average of $2,110 per ton ($105.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $45 per ton compared to one week ago, while the upper end decreased $25. Our overall average is up $10 per ton from last week. Our price momentum on cold rolled steel will remain Neutral until the market establishes a clear direction.

Cold Rolled Lead Times: 7-13 weeks

Galvanized Coil: SMU price range is $2,040-$2,200 per net ton ($102.00-$110.00/cwt) with an average of $2,120 per ton ($106.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to last week, while the upper end remained unchanged. Our overall average is up $5 per ton from one week ago. Our price momentum on galvanized steel will remain Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $2,118-$2,278 per ton with an average of $2,198 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 6-14 weeks

Galvalume Coil: SMU price range is $2,065-$2,175 per net ton ($103.25-$108.75/cwt) with an average of $2,120 per ton ($106.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $65 per ton compared to one week ago, while the upper end decreased $35. Our overall average is up $15 per ton from last week. Our price momentum on Galvalume steel will remain Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,356-$2,466 per ton with an average of $2,411 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7-12 weeks

Plate: SMU price range is $1,730-$1,870 per net ton ($86.50-$93.50/cwt) with an average of $1,800 per ton ($90.00/cwt) FOB mill. The lower end of our range decreased $40 per ton compared to last week, while the upper end decreased $60. Our overall average is down $50 per ton from one week ago. Our price momentum on plate steel will remain Neutral until the market establishes a clear direction.

Plate Lead Times: 5-9 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.