Prices

October 19, 2021

SMU Price Ranges & Indices: Momentum Changed to Lower on HR

Written by Brett Linton

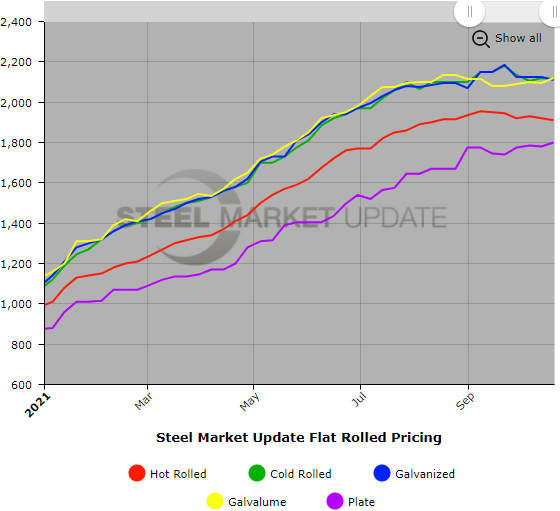

Steel Market Update’s check of the market this week shows another small decrease for hot rolled steel prices. The hot rolled price has dipped three of the last four weeks by a total of $45 from the high of $1,955 per ton in the first week of September. SMU is changing its Hot Rolled Price Momentum Indicator to Lower from Neutral in anticipation of further declines in HR prices over the next 30-60 days. That assessment is not as simple for other steel products. Cold rolled and galvanized saw small declines this week, while Galvalume and plate saw modest increases. SMU’s Price Momentum Indicators for other products will remain at Neutral until the trend becomes clearer. As one service center executive said: “We are for sure seeing an easing or a plateauing effect. The numbers have definitely stopped their ferocious climb upward. But I think we’ll still see some ebbs and flows over the coming weeks or months.”

Hot Rolled Coil: SMU price range is $1,900-$1,920 per net ton ($95.00-$96.00/cwt) with an average of $1,910 per ton ($95.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $30 per ton compared to last week, while the upper end decreased $50. Our overall average is down $10 per ton from one week ago. Our price momentum on hot rolled steel is Lower, meaning we expect prices to decrease over the next 30 days.

Hot Rolled Lead Times: 6-11 weeks

Cold Rolled Coil: SMU price range is $2,030-$2,200 per net ton ($101.50-$110.00/cwt) with an average of $2,115 per ton ($105.75/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end decreased $10 per ton. Our overall average is down $5 per ton from last week. Our price momentum on cold rolled steel will remain Neutral until the market establishes a clear direction.

Cold Rolled Lead Times: 8-12 weeks

Galvanized Coil: SMU price range is $2,000-$2,220 per net ton ($100.00-$111.00/cwt) with an average of $2,110 per ton ($105.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $50 per ton compared to last week, while the upper end increased $20. Our overall average is down $15 per ton from one week ago. Our price momentum on galvanized steel will remain Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $2,078-$2,298 per ton with an average of $2,188 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 6-14 weeks

Galvalume Coil: SMU price range is $2,000-$2,240 per net ton ($100.00-$112.00/cwt) with an average of $2,120 per ton ($106.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to one week ago, while the upper end increased $70. Our overall average is up $25 per ton from last week. Our price momentum on Galvalume steel will remain Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,291-$2,531 per ton with an average of $2,411 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7-14 weeks

Plate: SMU price range is $1,725-$1,875 per net ton ($86.25-$93.75/cwt) with an average of $1,800 per ton ($90.00/cwt) FOB mill. The lower end of our range increased $5 per ton compared to last week, while the upper end increased $35. Our overall average is up $20 per ton from one week ago. Our price momentum on plate steel will remain Neutral until the market establishes a clear direction.

Plate Lead Times: 6-9 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.