Analysis

October 18, 2021

Final Thoughts

Written by Tim Triplett

It’s hard for most service center executives to feel any urgent concern about declining steel prices as long as demand seems so strong. But there are signs in Steel Market Update’s survey data this week that suggest demand is moderating. With prices likely to follow.

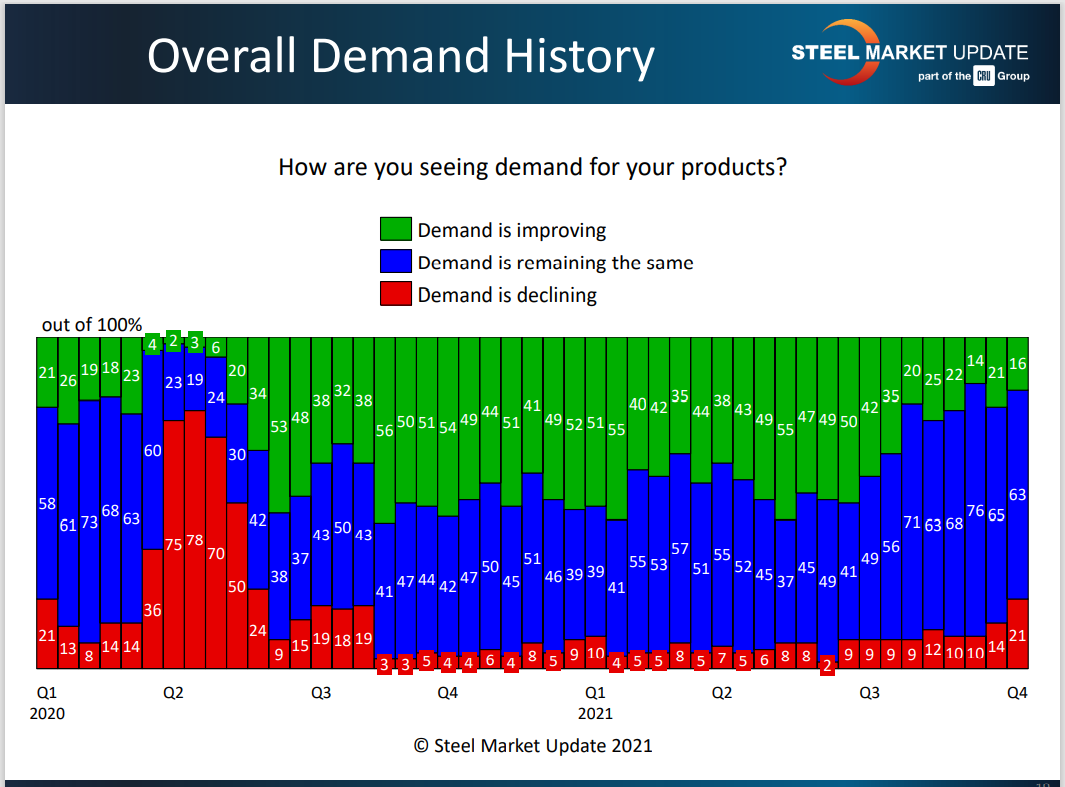

SMU asked: How are you seeing demand for your products? As the bars on the right in the chart below show, 21% said demand is declining while just 16% said demand is still improving. That’s a notable change compared with most of 2021 when the overwhelming majority reported steady to improving demand.

Several respondents commented on the microchip shortage and its dampening effect on automotive demand. Others noted that “concern about declining prices might put some buyers on the sidelines” as they postpone purchases in anticipation of cheaper steel down the road. There may also be some seasonality at work as the year nears its end.

Mill Lead Times Shortening

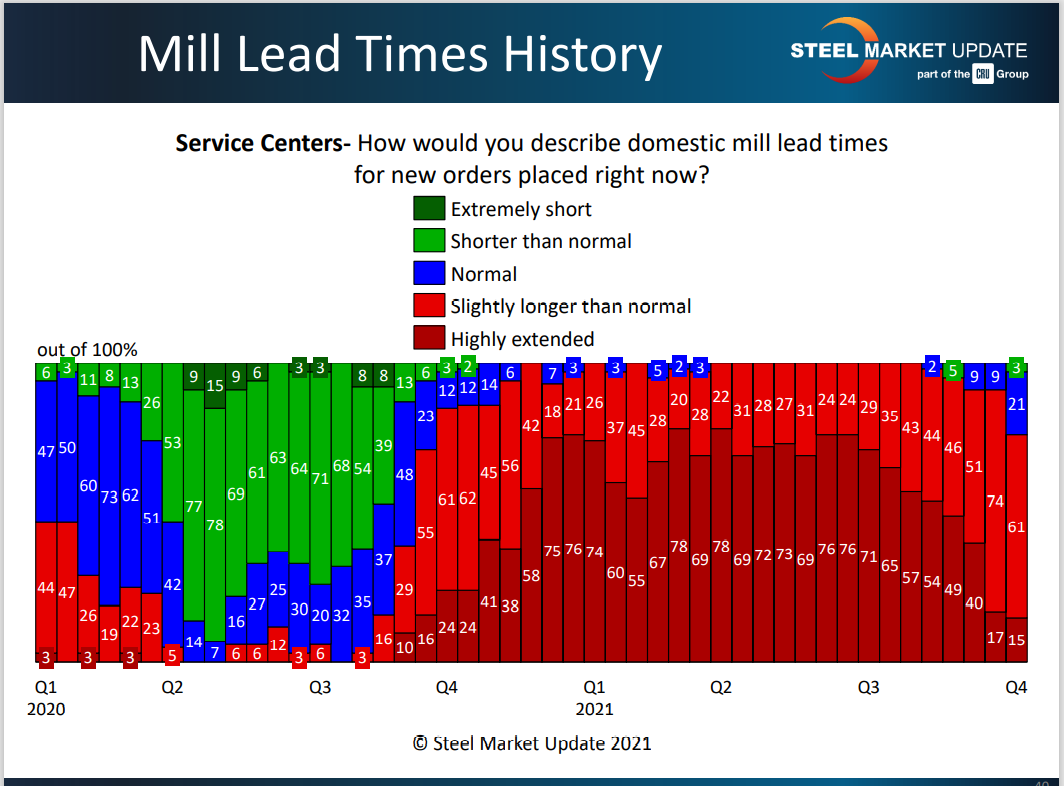

The bars on the right in the chart below clearly show the change in mill lead times. Buyers have been reporting tight supplies and highly extended lead times since the fourth quarter last year. This month the majority describe lead times on orders they have placed with the mills as only “slightly extended,” and 24% consider current lead times to be “normal” or even shorter. When lead times shorten, prices tend to follow.

Availability Has Loosened Up

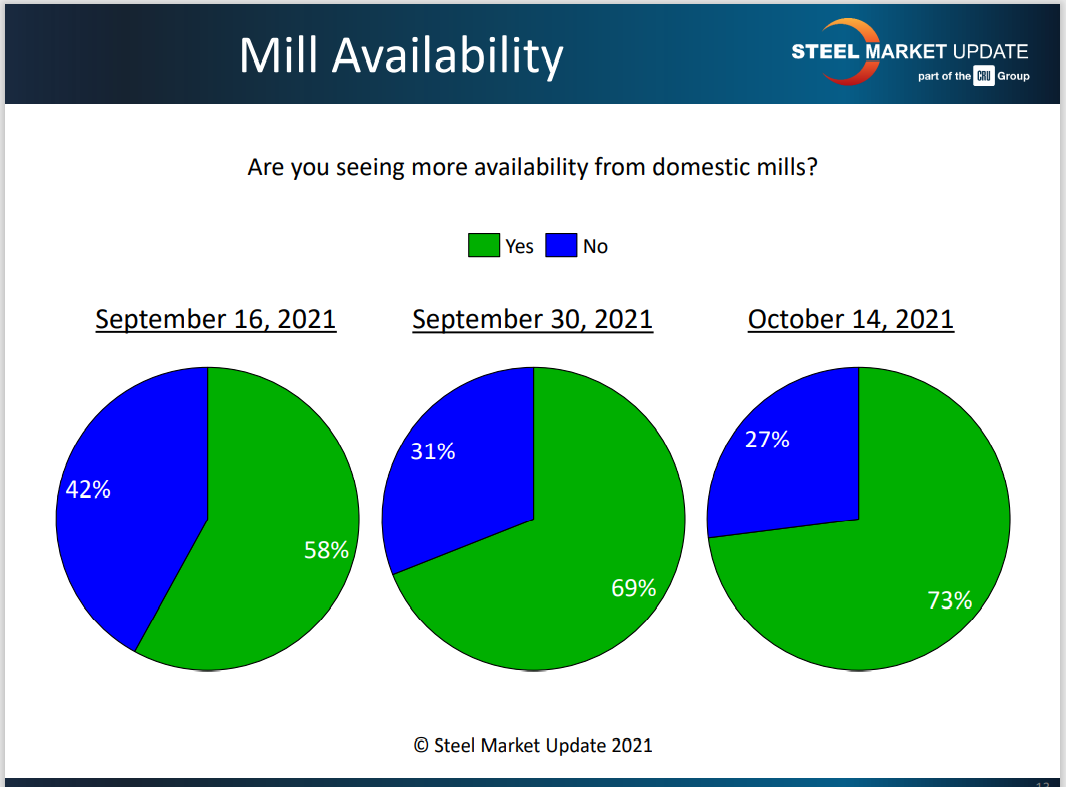

For most of this year, steel supplies have been so tight that buyers have been more concerned about finding steel to buy than what they had to pay for it. That buying frenzy is over. Availability of steel from the domestic mills has improved considerably in just the past month (see chart below) and is a complete reversal from SMU’s June survey when 73% said they were not seeing more availability from the mills.

Customers Resisting Higher Prices

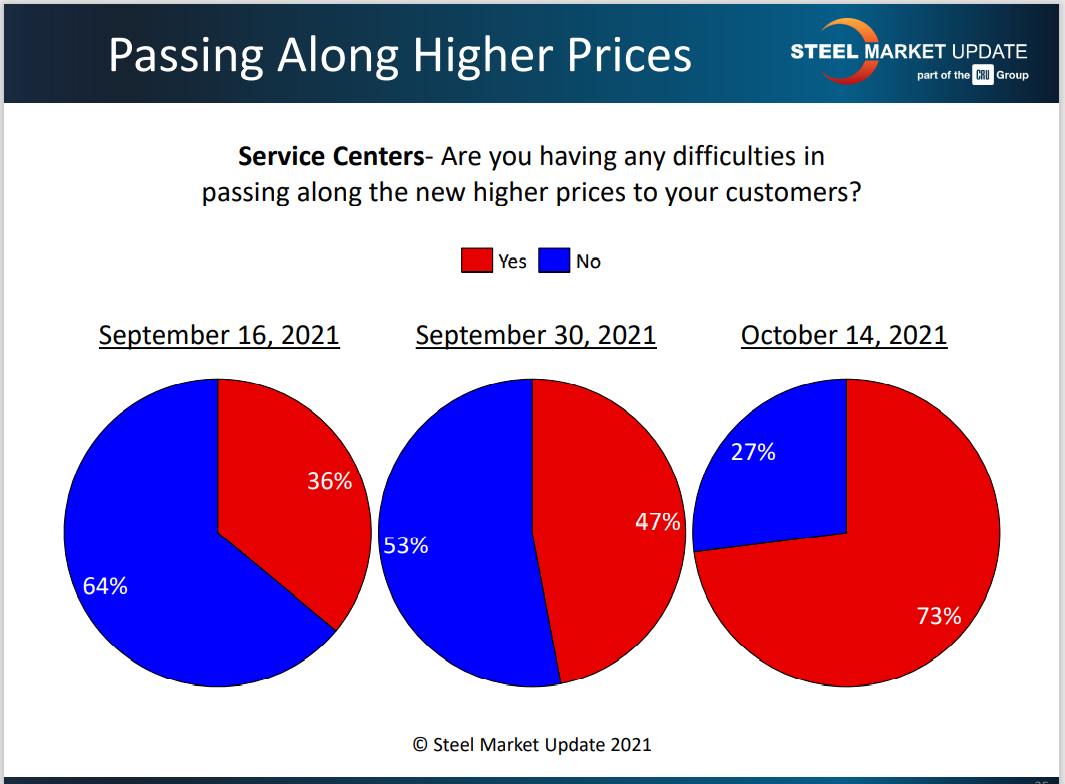

Another sign of softening demand is growing price sensitivity among steel end-users. More service centers say they are finding it difficult to pass along higher steel prices to their customers (see chart below).

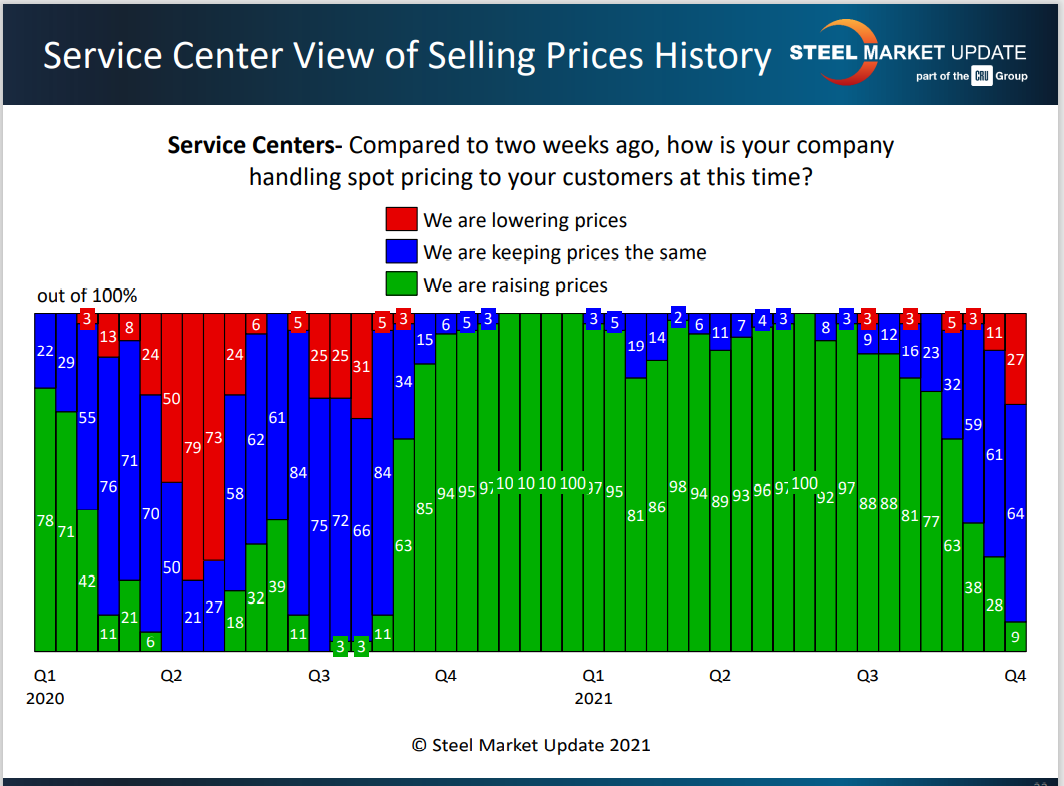

Service centers had been raising prices along with the mills week after week since last summer – until recently. In the past month, a double-digit percentage (see chart below) say they have begun to lower prices in search of sales. Very few are still raising prices – a possible reaction to lower-priced imports that are making their way into the U.S. market.

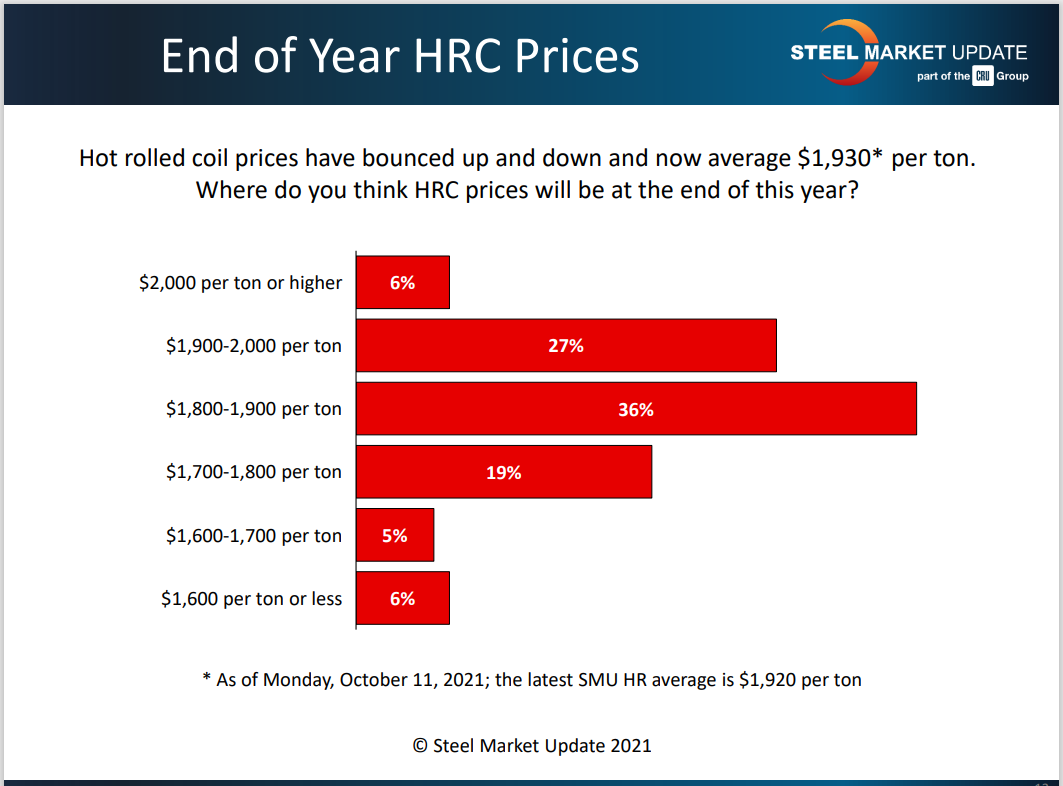

So, where do buyers expect hot rolled steel prices to end the year? SMU data shows the current average price for HRC at $1,920 per ton, down by $35 from the peak of $1,955 per ton in the first week of September. Buyers’ predictions for year-end seem to break down into three distinct groups of roughly the same size – those who believe HRC will stay above $1,900 per ton, those who see a small dip in the range of $1,800-1900 per ton, and those who see a correction somewhere below $1,800 a ton. Calculated as a weighted average of all the responses, that would put hot roll at approximately $1,838 per ton by the end of December – a decline of just 6%.

Is that figure realistic or perhaps wishful thinking? Here’s to a strong finish to 2021!

SMU Events

There are still a few slots open for SMU’s popular Steel Hedging 101 workshop. The virtual event will be held on Nov. 2-3 with instructor Spencer Johnson of StoneX Financial Inc. You can sign up by clicking here.

Time to plan that winter getaway to the Tampa Steel Conference on Feb. 14-16, 2022, at Marriott’s Water Street Hotel in Tampa, Fla. This will be a live and in-person event. You can learn more by clicking here.

As always, we appreciate your business.

Tim Triplett, SMU Executive Editor, Tim@SteelMarketUpdate.com