Prices

October 12, 2021

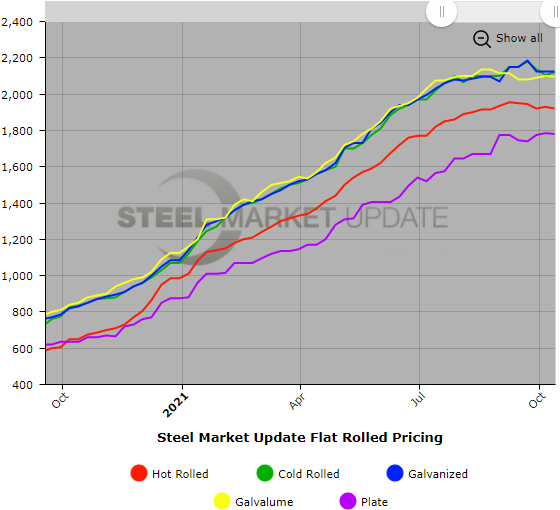

SMU Price Ranges & Indices: Small Ups and Downs

Written by Brett Linton

Flat rolled and plate steel prices were flat to down slightly this week with the exception of a small increase in cold rolled, according to Steel Market Update’s check of the market on Monday and Tuesday. The small ups and downs in steel prices over the past month are in line with most buyers’ expectations of a gradual, uneven correction heading into next year. Hot rolled steel topped out at $1,955 per ton as reported by SMU on Sept. 7 and now averages $1,920 per ton, down $10 from a week ago and down $35 from last month. Service center and manufacturing executives tell SMU demand remains very strong and they are optimistic about their prospects in the coming weeks and months. The market has yet to feel the full impact of lower-priced foreign steel as import arrivals have been slowed by supply-chain bottlenecks. SMU will keep its Price Momentum Indicators at Neutral until the market establishes a clear direction.

Hot Rolled Coil: SMU price range is $1,870-$1,970 per net ton ($93.50-$98.50/cwt) with an average of $1,920 per ton ($96.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $30 per ton compared to last week, while the upper end increased $10. Our overall average is down $10 per ton from one week ago. Our price momentum on hot rolled steel will remain Neutral until the market establishes a clear direction.

Hot Rolled Lead Times: 6-11 weeks

Cold Rolled Coil: SMU price range is $2,030-$2,210 per net ton ($101.50-$110.50/cwt) with an average of $2,120 per ton ($106.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago, while the upper end increased $10. Our overall average is up $15 per ton from last week. Our price momentum on cold rolled steel will remain Neutral until the market establishes a clear direction.

Cold Rolled Lead Times: 8-12 weeks

Galvanized Coil: SMU price range is $2,050-$2,200 per net ton ($102.50-$110.00/cwt) with an average of $2,125 per ton ($106.25/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained unchanged compared to last week. Our overall average is unchanged from one week ago. Our price momentum on galvanized steel will remain Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $2,128-$2,278 per ton with an average of $2,203 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 6-14 weeks

Galvalume Coil: SMU price range is $2,020-$2,170 per net ton ($101.00-$108.50/cwt) with an average of $2,095 per ton ($104.75/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end decreased $10 per ton. Our overall average is down $5 per ton from last week. Our price momentum on Galvalume steel will remain Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,311-$2,461 per ton with an average of $2,386 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7-14 weeks

Plate: SMU price range is $1,720-$1,840 per net ton ($86.00-$92.00/cwt) with an average of $1,780 per ton ($89.00/cwt) FOB mill. Both the lower and upper ends of our range decreased $5 per ton compared to last week. Our overall average is down $5 per ton from one week ago. Our price momentum on plate steel will remain Neutral until the market establishes a clear direction.

Plate Lead Times: 6-9 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.