Prices

October 5, 2021

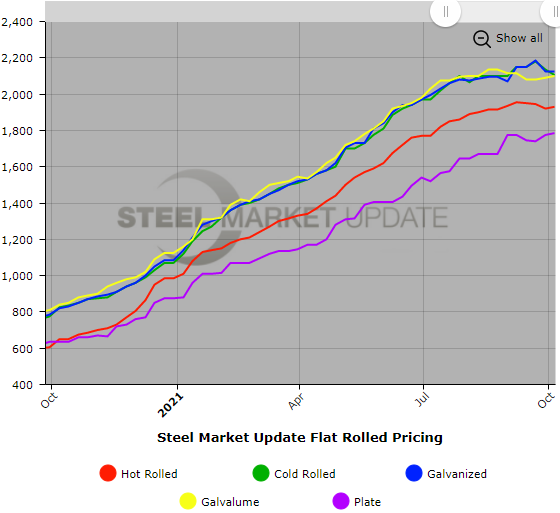

SMU Price Ranges & Indices: Transition Adds Volatility

Written by Brett Linton

Flat rolled steel prices are in transition, which tends to lead toward more volatility and wider price ranges in Steel Market Update data. One of the issues we face when we reach an inflection point in the spot market is the lack of daily transactions. With service center inventories nearing a state of balance, combined with the normal seasonal slowdown, there are a limited number of “true buyers” out there in the market. This week’s check of the market shows hot rolled prices slightly higher at an average of $1,930 per ton, after seeing small declines for the last few weeks. There’s also a wider gap than usual between cold rolled and galvanized. SMU’s Price Momentum Indicators will remain at Neutral until there is a clear consensus regarding the future direction of prices in the various product categories.

Hot Rolled Coil: SMU price range is $1,900-$1,960 per net ton ($95.00-$98.00/cwt) with an average of $1,930 per ton ($96.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $40 per ton compared to last week, while the upper end decreased $20. Our overall average is up $10 per ton from one week ago. Our price momentum on hot rolled steel will remain Neutral until the market establishes a clear direction.

Hot Rolled Lead Times: 6-11 weeks

Cold Rolled Coil: SMU price range is $2,010-$2,200 per net ton ($100.50-$110.00/cwt) with an average of $2,105 per ton ($105.25/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end decreased $60 per ton. Our overall average is down $30 per ton from last week. Our price momentum on cold rolled steel will remain Neutral until the market establishes a clear direction.

Cold Rolled Lead Times: 8-12 weeks

Galvanized Coil: SMU price range is $2,050-$2,200 per net ton ($102.50-$110.00/cwt) with an average of $2,125 per ton ($106.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $50 per ton compared to last week, while the upper end decreased $50. Our overall average is unchanged from one week ago. Our price momentum on galvanized steel will remain Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $2,128-$2,278 per ton with an average of $2,203 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 6-14 weeks

Galvalume Coil: SMU price range is $2,020-$2,180 per net ton ($101.00-$109.00/cwt) with an average of $2,100 per ton ($105.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $60 per ton compared to one week ago, while the upper end decreased $40. Our overall average is up $10 per ton from last week. Our price momentum on Galvalume steel will remain Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,311-$2,471 per ton with an average of $2,391 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7-14 weeks

Plate: SMU price range is $1,725-$1,845 per net ton ($86.25-$92.25/cwt) with an average of $1,785 per ton ($89.25/cwt) FOB mill. The lower end of our range increased $15 per ton compared to last week, while the upper end increased $5. Our overall average is up $10 per ton from one week ago. Our price momentum on plate steel will remain Neutral until the market establishes a clear direction.

Plate Lead Times: 6-9 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.