Market Data

October 3, 2021

SMU Steel Buyers Sentiment: Unfailingly Optimistic

Written by Tim Triplett

By most measures, the steel market is in transition. Demand remains strong, with notable exceptions in sectors such as automotive. Supplies remain tight, but not nearly as tight as earlier in the year thanks to surging imports. Mill lead times are still highly extended versus historical averages, but are a week or two shorter than they were two months ago. Steel prices are plateauing, if not beginning a protracted downturn. And the economy continues to deal with the COVID crisis. Yet despite all that volatility and uncertainty, steel buyers remain unfailingly optimistic.

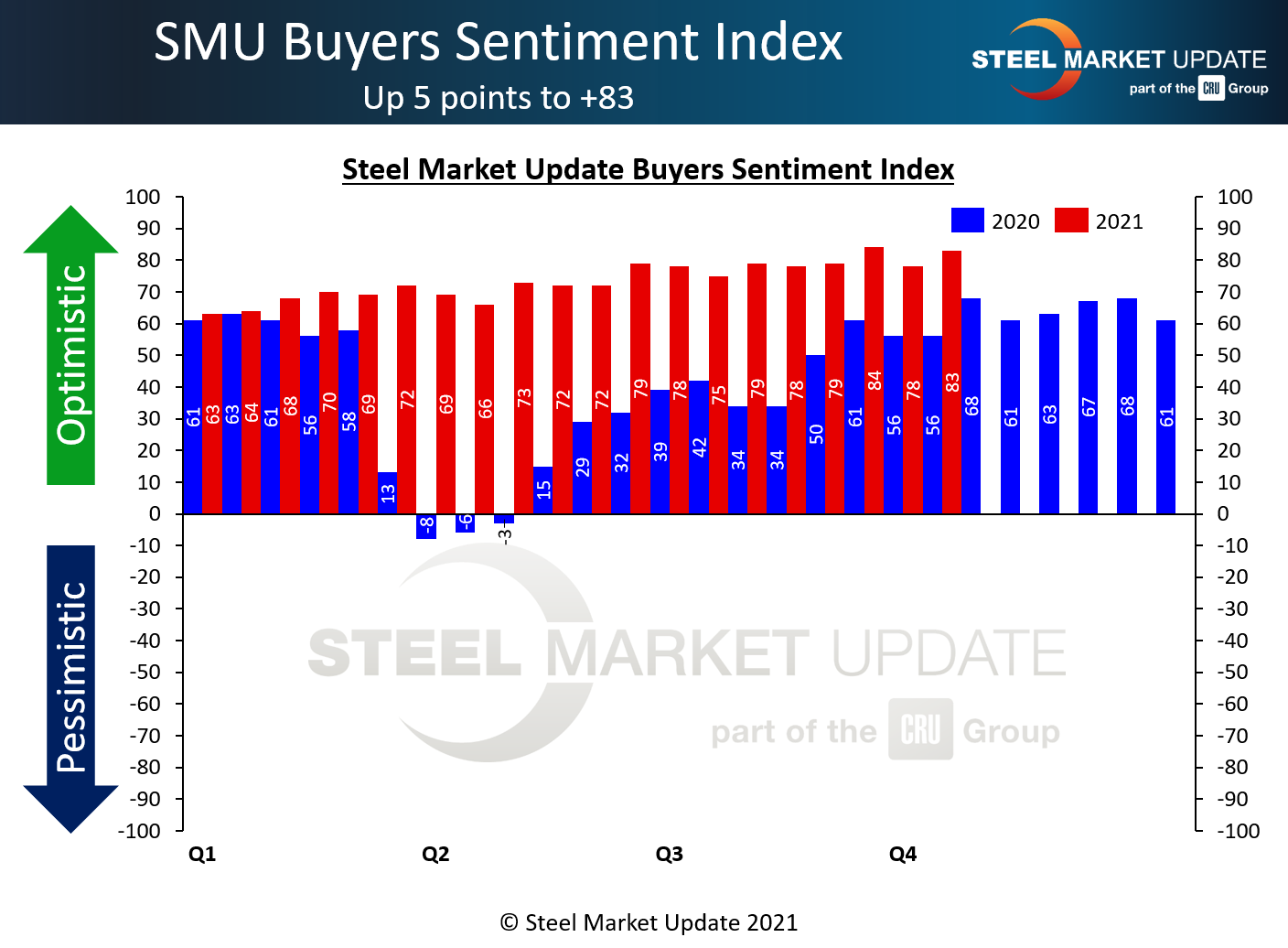

Steel Market Update polls service center and manufacturing executives every two weeks and asks how they view their chances of success in the near and longer term. SMU’s Current Buyers Sentiment Index moved up five points to a reading of +83 on Sept. 30, a single point below its all-time high set on Sept. 2, suggesting buyers have never felt better about their opportunities. No doubt that has much to do with steel prices, which remain near historical highs.

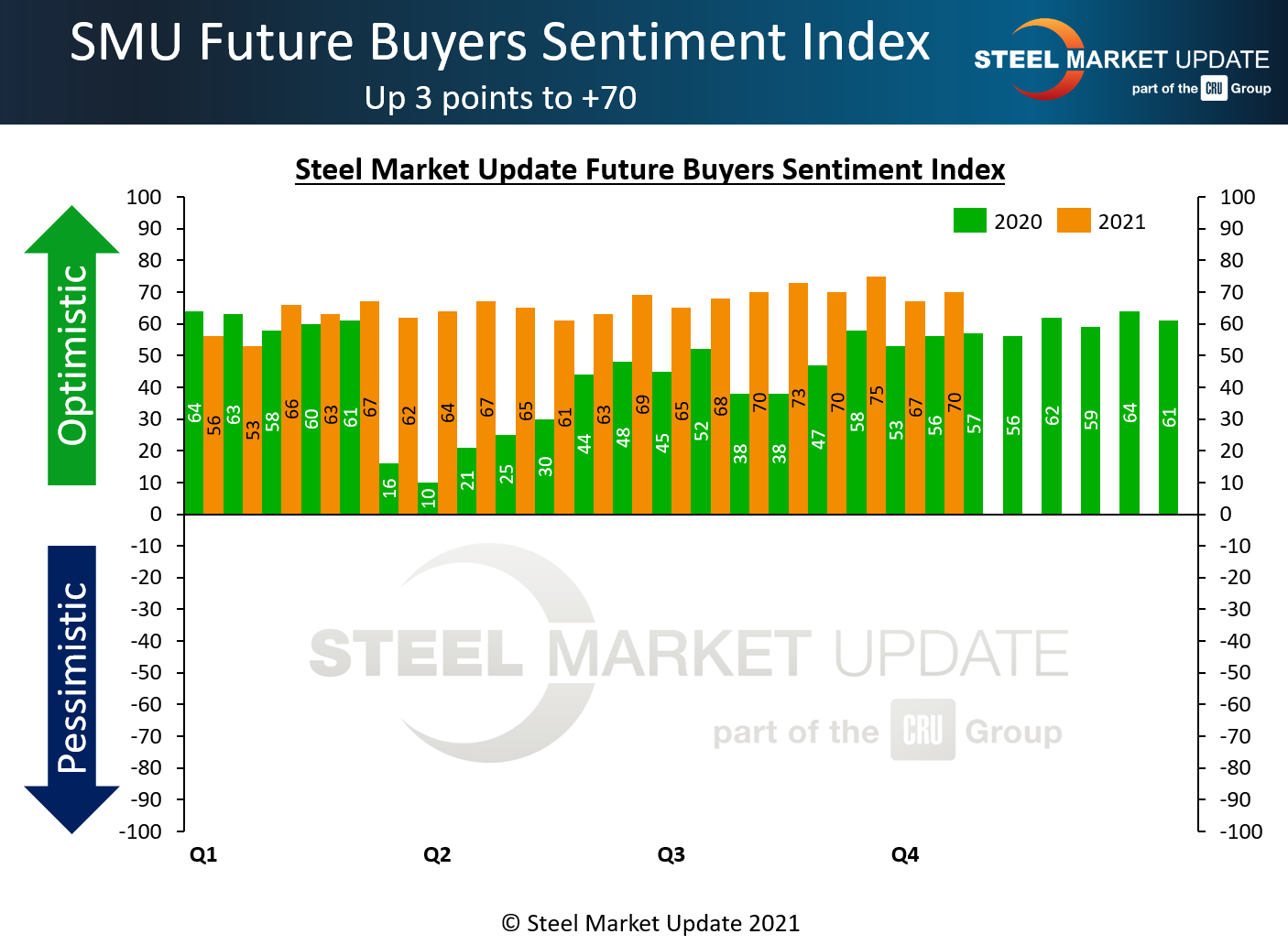

Similarly, Future Sentiment moved up three points to +70 this week. The index, which measures steel buyers’ feelings about their prospects three to six months in the future, remains near the all-time high of +77 seen in February 2018.

Results most likely were still influenced by survey respondents who attended SMU’s Steel Summit in late August. The tone of the conference was a very bullish one and may have skewed the sentiment readings. With that caveat, though, it appears most steel buyers are unfazed by recent events and still feel very positive about their chances for success in the coming weeks and months.

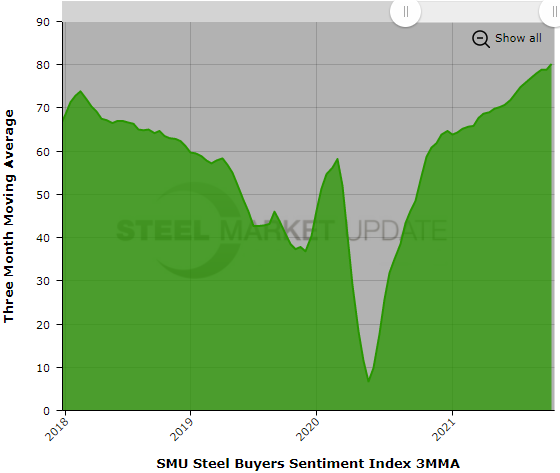

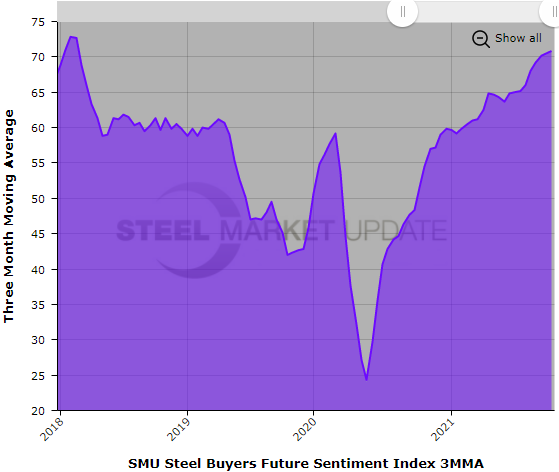

Measured as a three-month moving average (3MMA) to smooth out the variability, Current Sentiment stood at a new all-time high of +80.17 this week. The Future Sentiment 3MMA moved up to +70.83, its highest since February 2018.

SMU’s Steel Buyers Sentiment Index, like other sentiment indicators, is an attempt to quantify the way people feel in an effort to predict their future behavior. The individual numbers themselves are less important than the message they send about the current market psychology, which remains buoyant, even at a time when buyers should probably be more “cautiously optimistic.” Now is not the time to throw caution to the wind.

What Respondents Had to Say

“Market fundamentals are good for now.”

“Month after month, we continue to see record profits. The team (and service center sector as a whole) certainly deserves this after a tough few years.”

“I think we’ll see very good returns and near record profits through 1H 2022.”

“We cannot get enough steel.”

“The future holds a lot of uncertainty.”

“We’re concerned as demand in building products has slowed primarily due to pricing.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat-rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings run from +10 to +100. A positive reading means the meter on the right-hand side of our home page will fall in the green area indicating optimistic sentiment. Negative readings run from -10 to -100. They result in the meter on our homepage trending into the red, indicating pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace. Sentiment is measured via Steel Market Update surveys that are conducted twice per month. We display the meter on our home page for all to see.

We currently send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies. Approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.

By Tim Triplett, Tim@SteelMarketUpdate.com