Market Data

September 30, 2021

Steel Mill Lead Times: Notably Shorter

Written by Tim Triplett

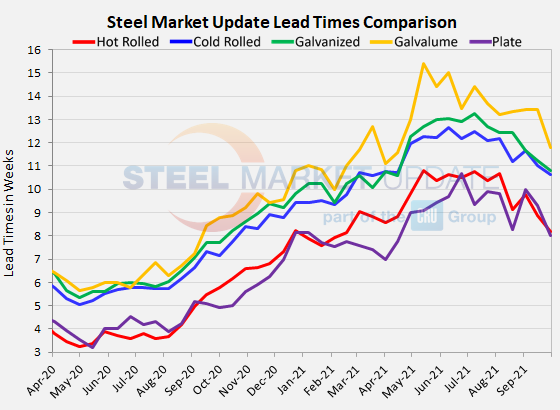

Mill lead times for flat rolled and plate products have gradually been shortening over the past two months. Steel Market Update’s check of the market this week shows the average lead time for hot rolled down to nearly eight weeks from more than ten weeks in early August. Lead times for cold rolled and galvanized have come in by more than a week and now average less than eleven weeks, while plate is down to eight weeks.

Buyers polled by SMU this week reported mill lead times ranging from 5-10 weeks for hot rolled, 7-14 weeks for cold rolled, 8-14 weeks for galvanized, 10-14 weeks for Galvalume, and 6-10 weeks for plate.

The average lead time for spot orders of hot rolled declined to 8.21 weeks, down from 8.89 weeks in mid-September. Cold rolled lead times moved down to 10.64 weeks from 11.00 in the same period. Galvanized lead times dipped to 10.82 weeks from 11.22 weeks. The average Galvalume lead time dropped to 11.80 from 13.43 weeks.

Like flat rolled products, mill lead times for plate have also shortened. The average plate lead time moved down to 8.00 weeks from the 9.30 weeks seen in SMU’s check of the market two weeks ago.

Lead times are considered a leading indicator of steel prices. The shorter the lead times, the less busy the mills and the more likely they are to discount prices to keep their order books full. The current lead times still exceed historical averages by two weeks or more, but are perhaps beginning to normalize. SMU will be watching closely to see if steel prices follow.

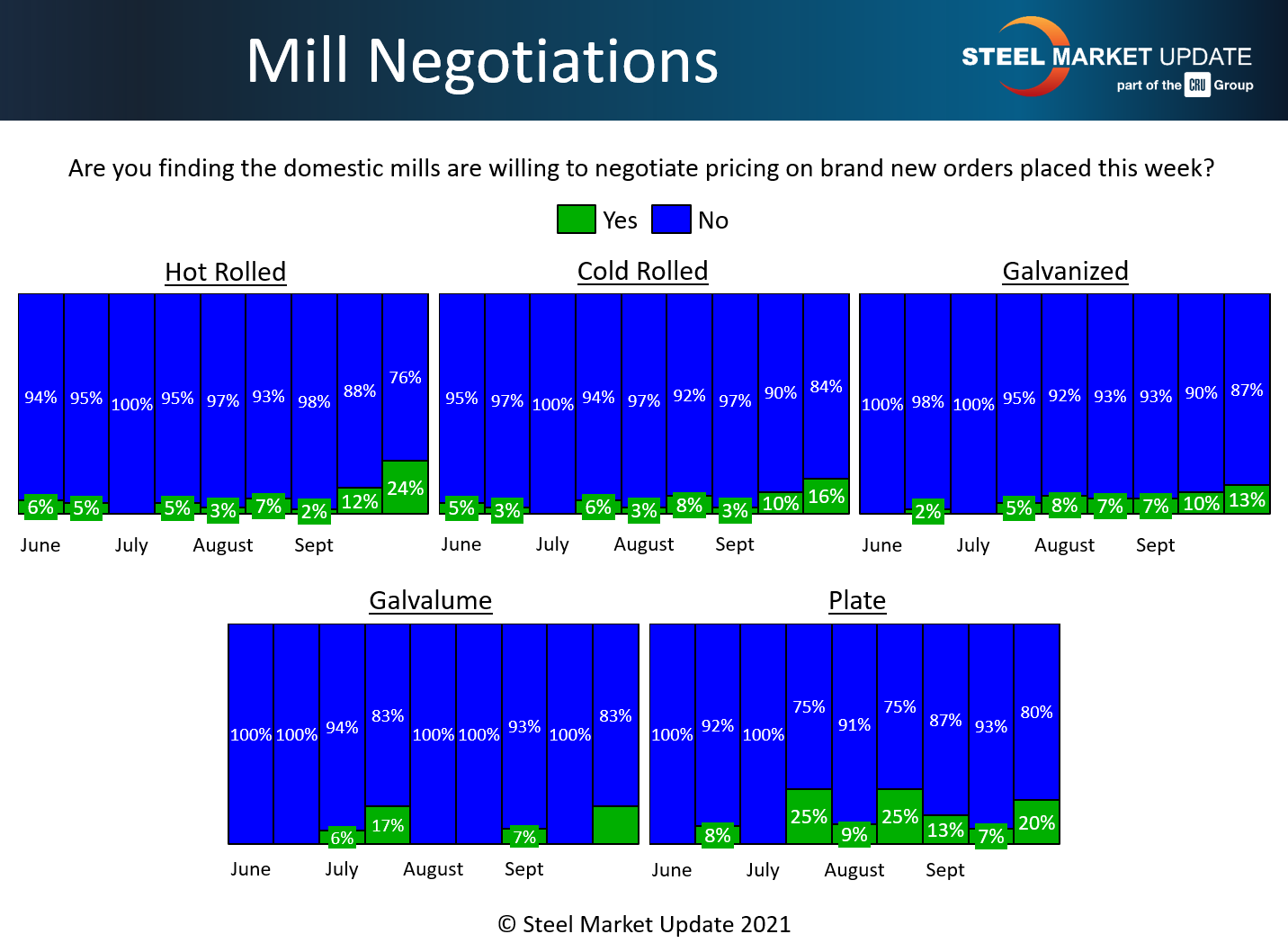

Negotiations

The month of September saw a notable change in the tone of price negotiations for hot rolled steel, suggesting that buyers may finally be winning some concessions from the mills. SMU asks buyers every two weeks if the mills are willing to talk price on spot orders. In SMU’s poll of the market in early September, just 2% of the respondents said mills were open to negotiating prices on hot rolled. By this week that figure had jumped to 24% – the highest percentage in nearly a year. The numbers are similar for cold rolled and coated products, where 13-17% of buyers now report mills opening up to price discussions. In plate, the figure is 20%. A significant change from the single-digit percentages of the past 10 months. The mills clearly still have the stronger bargaining position, but they may be feeling the pressure from imports and buyers who have replenished their inventories and are content to sit on the sidelines for a bit to see if steel prices moderate.

By Tim Triplett, Tim@SteelMarketUpdate.com