Prices

September 28, 2021

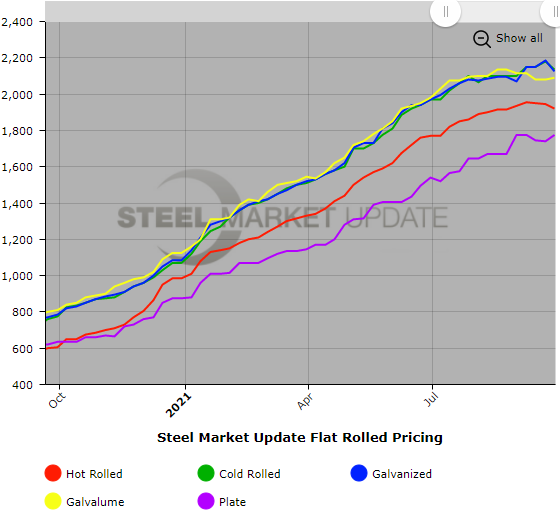

SMU Price Ranges & Indices: Hot Rolled Price Dips Again

Written by Brett Linton

It’s beginning to look like hot rolled steel prices will fall short of the $2,000 per ton ($100 per cwt) mark that many believed would be the peak. Steel Market Update’s check of the market on Monday and Tuesday shows the average hot rolled price decreasing for the third time in as many weeks to $1,920 per ton. If that downtrend continues, HRC will have topped out at an astounding high of $1,955 per ton reported by SMU on Sept. 7. That bests the previous 2008 high of $1,070 per ton by nearly $900 or 83%. Cold rolled and galvanized prices also declined this week, while Galvalume and plate increased. Due to the mixed messages the market is sending across the various products, SMU will keep its Price Momentum Indicators at Neutral this week.

Hot Rolled Coil: SMU price range is $1,860-$1,980 per net ton ($93.00-$99.00/cwt) with an average of $1,920 per ton ($96.00/cwt) FOB mill, east of the Rockies. The lower end of our range declined $40 per ton compared to last week, while the upper end decreased $10. Our overall average is down $25 per ton from one week ago. Our price momentum on hot rolled steel will remain Neutral until the market establishes a clear direction.

Hot Rolled Lead Times: 6-11 weeks

Cold Rolled Coil: SMU price range is $2,010-$2,260 per net ton ($100.50-$113.00/cwt) with an average of $2,135 per ton ($106.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $170 per ton compared to one week ago, while the upper end increased $60. Our overall average is down $45 per ton from last week. Our price momentum on cold rolled steel will remain Neutral until the market establishes a clear direction.

Cold Rolled Lead Times: 8-12 weeks

Galvanized Coil: SMU price range is $2,000-$2,250 per net ton ($100.00-$112.50/cwt) with an average of $2,125 per ton ($106.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $170 per ton compared to last week, while the upper end increased $50. Our overall average is down $60 per ton from one week ago. Our price momentum on galvanized steel will remain Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $2,078-$2,328 per ton with an average of $2,203 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 6-14 weeks

Galvalume Coil: SMU price range is $1,960-$2,220 per net ton ($98.00-$111.00/cwt) with an average of $2,090 per ton ($104.50/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end increased $20. Our overall average is up $10 per ton from last week. Our price momentum on Galvalume steel will remain Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,251-$2,511 per ton with an average of $2,381 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7-14 weeks

Plate: SMU price range is $1,710-$1,840 per net ton ($85.50-$92.00/cwt) with an average of $1,775 per ton ($88.75/cwt) FOB mill. The lower end of our range increased $70 per ton compared to last week, while the upper end remained unchanged. Our overall average is up $35 per ton from one week ago. Our price momentum on plate steel will remain Neutral until the market establishes a clear direction.

Plate Lead Times: 6-9 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.