Analysis

September 19, 2021

Final Thoughts

Written by Tim Triplett

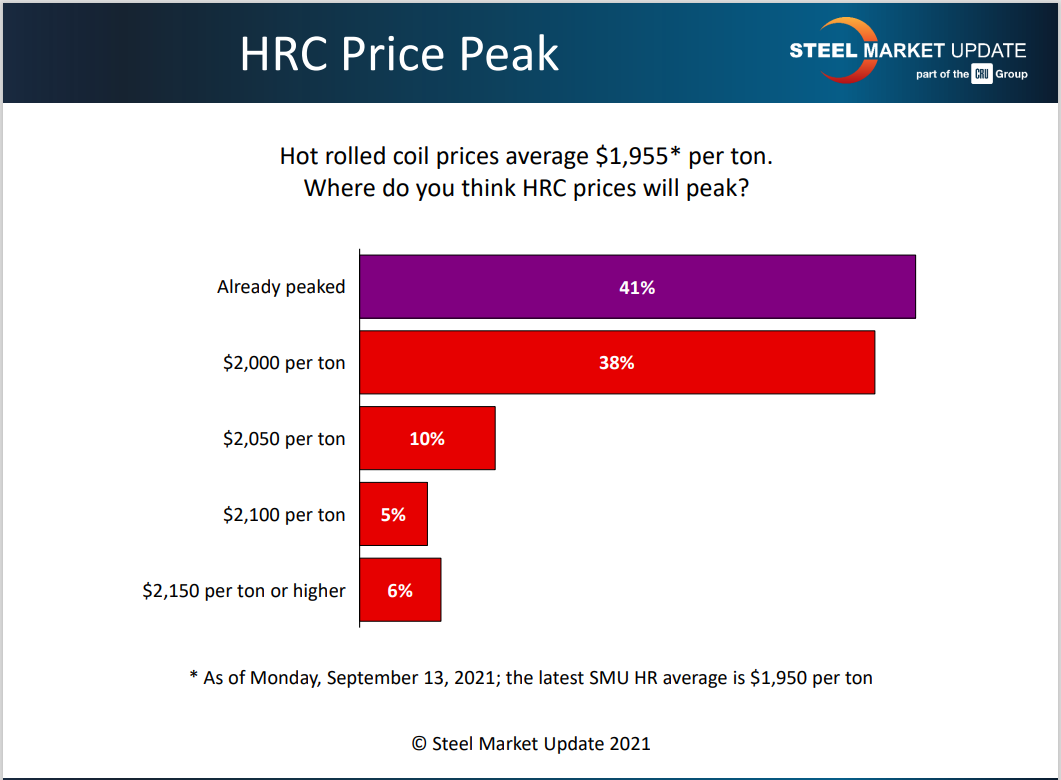

Steel Market Update’s check of the market this week puts the average spot price for hot rolled at an incredible $1,950 per ton. But for the first time in nearly a year, we are not reporting a new record high this week. Our HRC price actually dipped by a small $5 per ton. Next week the price could decline further or go up by $5 or more. Steel prices may bounce around a bit before the trend becomes clear. What is clear is the consensus view that the market is near its peak, if not there already.

As the chart below shows, nearly 80% of the buyers responding to SMU’s survey this week feel we are within $50 of the top. What the chart doesn’t show – and what no one knows – is how rapidly prices may fall.

View from CRU

Analysts at CRU, SMU’s parent company, believe steel prices are overdue for a correction, possibly a sharp one, possibly soon. Abundant imports, which are as much as $500 per ton cheaper than domestic tags, are beginning to hit U.S. shores, helping to ease the supply tightness that has kept prices elevated. While steel demand is still very strong, it is rising at a slower rate. Service centers are beginning to report inventories that are balanced with outbound shipments, foretelling weaker demand from the distribution sector. Planned maintenance outages by various mills in the fourth quarter will keep steel supplies tight in the near term. However, slower seasonal demand and the irresistible bargain offered by imports will serve to quickly bring steel sheet prices more in line with global prices, CRU predicts.

Another EAF for USS

U.S. Steel announced this week that it is looking for a good site to build a new electric arc furnace mill. It is planning to spend $3 billion of its recent windfall profits to construct a minimill with three million tons of annual flat-rolled capacity, to begin production sometime in 2024. USS had been touting a “Best of Both” strategy as it made a case for both integrated and EAF steel production. This latest announcement is part of its “Best for All” strategy as the mill gets behind industry efforts to reduce harmful greenhouse gas emissions from the steelmaking process. As the company said, “Our customers are looking for like-minded partners to continue marching towards a sustainable future.”

Cliffs to Disrupt Scrap?

Many are speculating on Cleveland-Cliffs’ plans to buy its way into the scrap market. Cliffs top exec Lourenco Goncalves revealed as much during SMU’s Steel Summit in Atlanta last month. The company has set up a new services division to handle scrap, as well as logistics and procurement, and appointed President Keith Koci to run it. So it doesn’t sound like a question of if Cliffs will get into the scrap business, but when? And where? Cliffs currently operates four EAF mills, as well as eight blast furnaces, and plans to add more environmentally friendly EAF production in the future. So, geographically speaking, it’s difficult to predict which scrap processors are the most likely acquisition targets. “No comment” from the company on the current “rumors.” Suffice it to say, the giant steelmaker’s foray into the scrap space could prove very disruptive to its competitors.

Beware, Middlemen

Producers trying to “cut out the middleman” is a concept that has been around as long as there have been distributors between mills and consumers. Recent reports of certain steelmakers trying to poach large OEM accounts away from service centers appear to be more business as usual than a new “disintermediation” trend.

Following is a (lightly edited) comment from one reader that offers some insights: “The concept of mills going around service centers is not new. It’s no secret that the mills have always had margin envy and consider the service center industry as a necessary evil. As an OEM, it is hard to ignore a service center’s margin objectives. While they are not unreasonable at 8-15%, in a market like we are in today that may equate to $150-300/ton, which is quite significant. The reality, though, is that it does not make sense for a large customer who has become used to the value proposition offered by service centers to go 100% in the other direction. Planning challenges at the OEM level will always need service centers’ inventory to fall back on. The question is, has the service center industry as a whole gotten too used to the new normal of making substantial profits and forgotten that customers will always find a way to bring a reality check to the market? In this case, that reality check may come at the expense of service center margins and may well contribute to a fresh wave of industry consolidation.”

Perhaps it’s the record-high steel prices that have turned up the volume on concerns about “disintermediation,” as it has become harder for service centers to justify their percentage. Rather than simply viewing it as a threat, perhaps it should serve as a wakeup call for any middlemen who have gotten too complacent. Service centers, it may be time to step up your game.

Bell Blasts China

The United States does not get enough credit for its leadership in “green” steelmaking, says Phil Bell, president of the Steel Manufacturers Association. America produces 70% of its steel using the electric arc furnace process, while the rest of the world largely makes steel using air-polluting blast furnaces. In fact, China makes more than half the world’s steel, 90% of it in blast furnaces. Those furnaces have an average age of just 12 years and will be pumping CO2 into the air for many years to come. If that isn’t bad enough, the Chinese have announced projects to construct 20 new blast furnaces. These excerpts from Bell’s column in SMU this week really put the environmental challenge facing the steel industry in perspective – a daunting and scary perspective. Bell and SMA have agreed to be regular monthly contributors to Steel Market Update. Don’t miss Phil’s insights on steel and events in Washington in upcoming issues.

SMU Events

It’s not too late to sign up for SMU’s next Steel 101: Introduction to Steel Making & Market Fundamentals Workshop, which will be held in a COVID-safe virtual format on Oct. 5-6. In addition to the classroom portion with SMU’s crack team of expert instructors, participants will get a look at all the stages of production in a virtual guided tour of a steel mill. You can learn more about next month’s Steel 101 workshop by clicking here.

Don’t forget SMU will co-host the Tampa Steel Conference, along with Port Tampa Bay, on Feb. 14-16, 2022, at Tampa’s Marriott Water Street Hotel. This will be a live and in-person event. You can learn more by clicking here.

As always, we appreciate your business.

Tim Triplett, SMU Executive Editor, Tim@SteelMarketUpdate.com