Prices

August 27, 2021

SMU Steel Summit: Reality Check on Prices?

Written by Tim Triplett

Two of the steel industry’s most respected analysts delivered a reality check to the market on Monday during SMU’s Steel Summit in Atlanta. Record-high steel prices enjoyed by steelmakers and distributors for the past year “can’t last,” they declared. Simply put, supply-demand fundamentals indicate that prices are due – indeed overdue – to drop significantly in the next few months. Depsite the experts’ well-reasoned case, the majority of steel executives in the audience remained unconvinced.

![]() Prices today are at historic highs due primarily to a supply deficit, explained CRU Principal Analyst Josh Spoores and John Anton, associate director of steel analytics at IHS Markit. As a result of government stimulus to help the economy recover from the pandemic shutdowns last year, steel demand rebounded faster than expected. Steel mill furnaces were slower to restart, however, and new capacity being added by the mills faced delays from weather and logistical problems.

Prices today are at historic highs due primarily to a supply deficit, explained CRU Principal Analyst Josh Spoores and John Anton, associate director of steel analytics at IHS Markit. As a result of government stimulus to help the economy recover from the pandemic shutdowns last year, steel demand rebounded faster than expected. Steel mill furnaces were slower to restart, however, and new capacity being added by the mills faced delays from weather and logistical problems.

Today, steel production is rising faster than demand, the analysts reported. June steel production in the U.S. was the highest since February 2020 and even higher than the 2019 average. New capacity at mills such as Nucor, SDI and North Star BlueScope is coming online. Imports are starting to arrive in large volume. Inventory building, which had been a huge source of demand, is starting to fade. Service centers are reporting balanced inventories with near-record levels of material still on order. Steel prices are falling in all other parts of the world except the U.S.

“Demand ramped up faster than supply, but then there has been a shift in the last few months and supply is catching up,” Spoores told the crowd. “As the supply deficit eases through increased domestic production, rising imports, less demand from inventory building and the start-up of nearly 12 million tons of new North American capacity, sheet prices will revert back towards a cost-plus relationship.”

Anton noted that the price of cold rolled steel at $2,200 per metric tonne is now higher than the average LME price for aluminum at just under $2,000. “If anyone in this room thinks people will build cars out of steel when aluminum is the same price, please raise your hand. Steel will not stay more expensive than aluminum.”

Global economic factors will also help bring an end to the rising prices in the U.S., Anton said. Steel prices in the U.S. are now $500 per ton more than those in Europe and $1,100 per ton more than in Asia, which will undoubtedly attract more lower-priced imports. “You can’t have prices in the U.S. this different from the rest of the world,” he said. “The supply side is going to get better because the U.S. is the most expensive market in the world. It’s that simple.”

Even the most skeptical in the crowd was inclined to agree that steel prices are probably near their top. Much of the conference conversation was devoted to when and how much they are likely to drop.

Anton and Spoores expect a pretty significant correction, and pretty soon. By October/November, steel suppliers are likely to be facing strong resistance from buyers, Anton said. “The fourth quarter will see a fight between buyers and sellers. They will be asking, “Scrap is down, ore is down, why hasn’t my cost gone down?’” IHS Markit forecasts the HRC price will slide to $750 per ton by the end of next year, still above the long-term average of $640 per ton but less than half of where it is now.

“Prices will peak very soon in the U.S., perhaps even in the coming weeks,” said Spoores. CRU’s forecast calls for an average HRC price of just $813 per ton in 2022, unless the decline is slowed by further unplanned supply disruptions, political factors that restrict imports, an unexpected jump in energy consumption or new stimulus programs that reinvigorate sheet demand.

“The fourth quarter will be chaotic,” said Anton. “The price of steel will come down. Bubbles pop. They always do.”

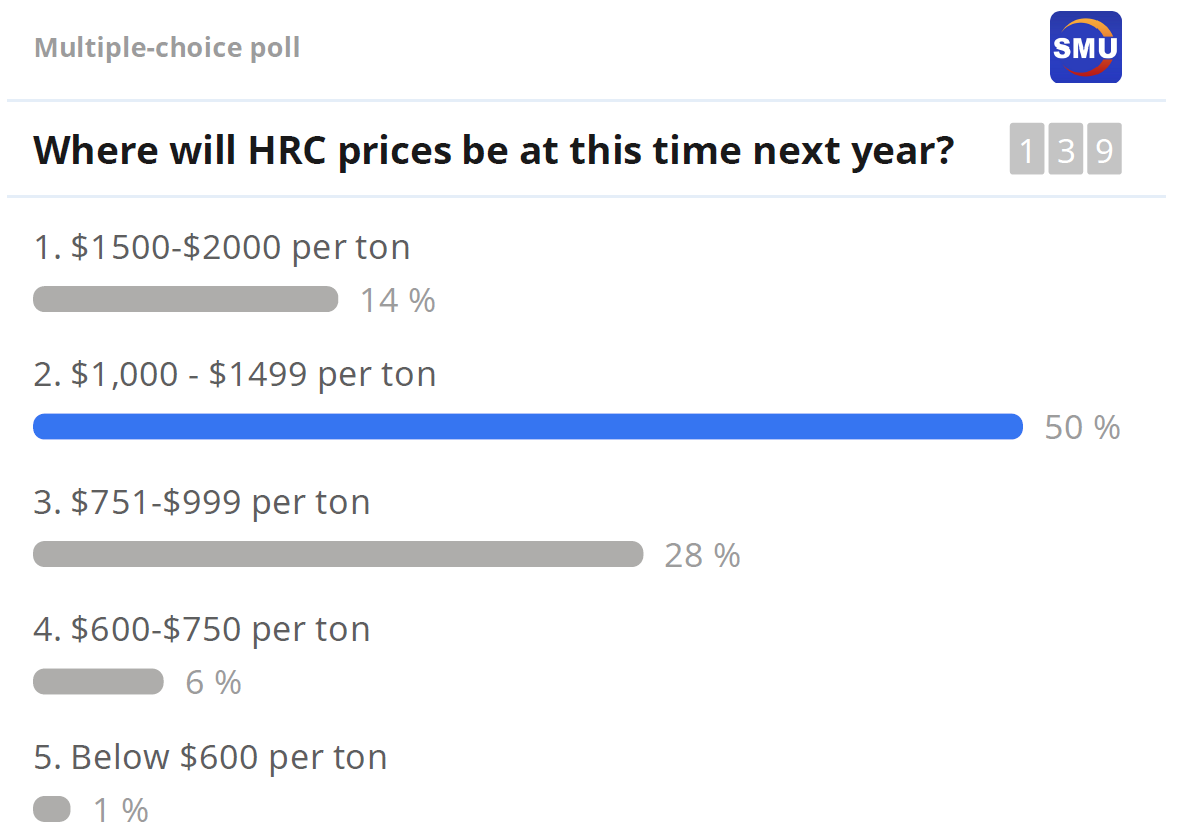

One bubble the analysts failed to pop was the notion that steel prices are poised for just a modest decline. A poll of the execs in the crowd, asking where they believe prices will be come Aug. 22-24, 2022, at the time of the next SMU Steel Summit, showed that the majority believe HRC prices will have the staying power to remain in a range from $1,000-1,500 a ton – a substantial decline of around 25-50% from where they are today, but far from the disastrous plunge in the worst-case scenario. Calculated as a weighted average, the consensus of the crowd puts the HRC price at this time next year around $1,160 per ton, about a 40% drop. Not good, but given what the experts believe, perhaps the best-case scenario.

By Tim Triplett, SMU Executive Editor, Tim@SteelMarketUpdate.com