Market Data

August 26, 2021

CRU Economists: Signs of Relief for Supply Chains

Written by Alex Tuckett

By CRU Principal Economist Alex Tuckett, from CRU’s Global Economic Outlook, Jan. 31

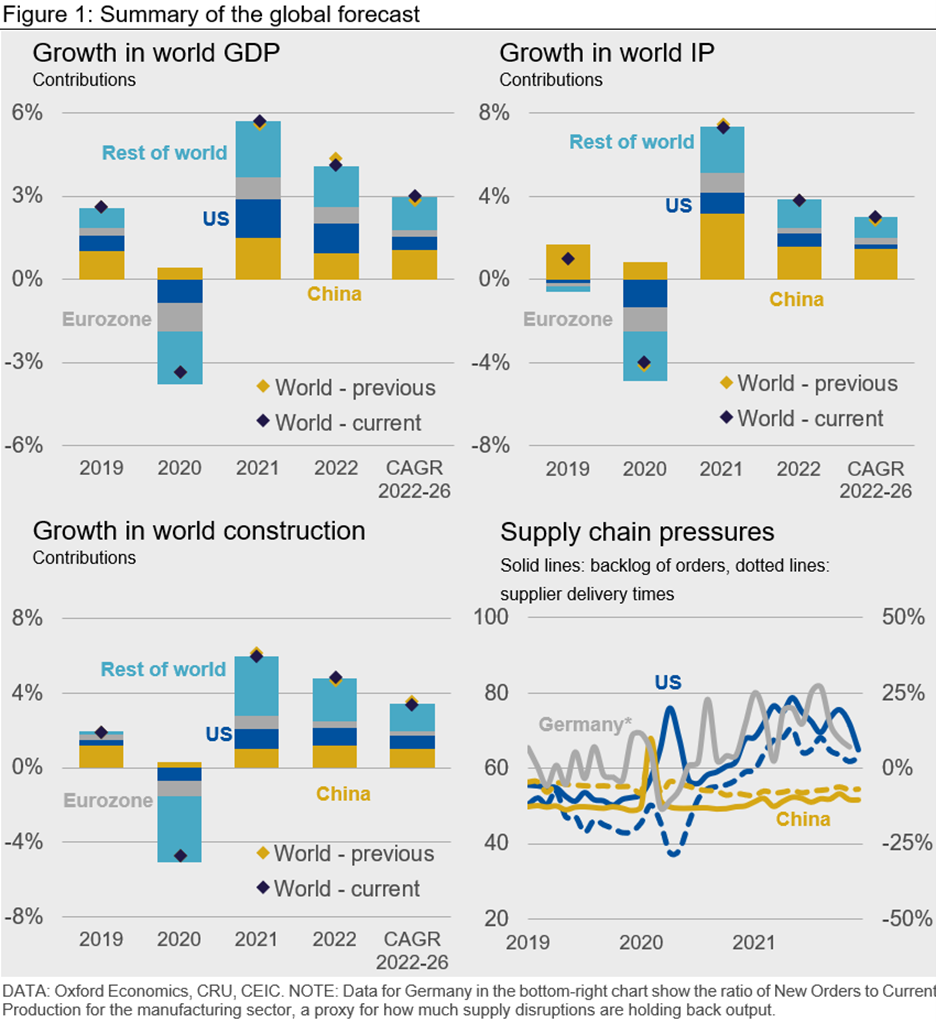

2022 has begun with tentative signs that supply chains are slowly normalizing. Business survey measures of delays, bottlenecks and price pressures in the U.S. and Europe are moderating. PPI inflation looks to have peaked. This is essential to our view that consumer price inflation will moderate and growth will remain above trend this year.

However, energy prices have risen on both demand and supply pressures, and Omicron remains a risk. We have revised down our forecast for 2022 world growth from 4.1% to 4.3%, mainly driven by a slower start to the year for Europe and the U.S.

While China is poised to move toward easing policies, we believe these measures are to stabilize rather stimulate the economy, and we have not changed our forecast for 2022 China growth.

Summarizing the CRU Economics Team’s outlook:

• 2022 has begun with tentative signs that supply chains are slowly normalizing (Figure 1, bottom-right). This is essential to our view that inflation will moderate, and growth will remain above trend this year.

• Despite this, we have revised down our forecast for 2022 world growth from 4.1% to 4.3%, mainly driven by a slower start to the year for Europe and the US, as higher energy and other input prices bite.

• We have marginally revised up our forecast for 2022 growth in world industrial production (IP) from 3.8% to 3.9%, and for construction from 4.7% to 4.8%.

• We have revised growth in automotive vehicle production from 13.6% to 12.1%, mainly as a result of a stronger 2021.

Recent material published by the CRU Economics team can be found in Figure 1 below.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com