Market Data

August 26, 2021

CRU Economics Team: Inflation Paths Diverge

Written by Alex Tuckett

By CRU Principal Economist Alex Tuckett and CRU Chief Economist and Head of Sustainability Jumana Saleheen

A disappointing outlook for U.S. Q3 growth, and the problems in China’s construction sector, have led us to downgrade our forecast for 2021 world growth from 5.8% to 5.4%. Our forecast for 2021 growth in Industrial Production has been revised from 8.0% to 7.4%. We continue to expect above-trend growth in 2022 of 4.8% in GDP and 4.3% in IP, as many regions still have ground to make up after the pandemic. We have also revised down our forecasts for automotive production, delaying much of the recovery until 2022H2.

This month we return to the issue of inflation. This continues to be a threat to the recovery, but is taking different paths in different regions. Inflationary pressures have been greatest in the U.S. and most modest in China, with the Eurozone in between.

Cost Inflation Reflects Global Supply and Demand…

Inflation shares common factors around the world. Producer Price Inflation (PPI) has surged in a highly correlated way (Figure 1, left-hand side). As previously set out, because commodity prices are globally determined and supply chains are global in scope, PPI inflation is highly correlated across countries.

This surge reflects both demand and supply factors.

On the demand side:

• Consumer demand for goods – particularly durable goods – has been incredibly strong in this cycle (Figure 1, right-hand side). As consumers become more confident in going out, spending has begun to rotate back towards services. However, with the Delta variant knocking consumer confidence in many countries, this is happening only gradually.

• Generous fiscal policy in advanced economies, particularly the U.S., has insulated household finances from the impact of the pandemic. Having dramatically built-up savings through lockdowns, many households now have plenty of money to spend.

The global industrial supply chain would have struggled to keep up with such a rapid turnaround in demand at the best of times. This has not been the best of times. A series of supply disruptions have hamstrung the ability of supply to meet this strong demand:

• Fires and droughts in Japan, Taiwan and China contributed to the chip shortage.

• More recently, outbreaks of the Delta variant have led to disruption in many countries with “zero-Covid” policies; for example, port closures in China and reduced capacity at plants in Vietnam and Malaysia.

The extended duration of these supply disruptions has led us to revise down our forecasts for auto production once again. We now expect global light vehicle production to grow by just 8.6% in 2021, followed by 13.4% in 2022 as production accelerates to catch up with pent-up demand.

…But Local Factors Still Matter for Consumer Prices

However, this correlated surge in PPI inflation has had very mixed effects on the prices paid by consumers in different countries. Correlations between PPI and core CPI within countries are generally weaker than correlations in PPI across countries. This reflects the importance of services in CPI, the importance of the business cycle in determining the pricing power of firms, and potentially the rise of global supply chains. Since the pandemic those correlations have risen. But in some countries, the rolling correlation has picked up more than in others (Figure 2, right-hand side).

The U.S. has seen the greatest pass-through of these cost pressures into consumer prices, with headline inflation above 5% for some months now, and core above 4% (Figure 3, right-hand side). Up until recently, the Eurozone had seen much more muted price rises. But in the last few months, inflation has accelerated. In contrast, inflation in China and Japan has remained muted.

Economies have common exposure to global factors such as raw materials prices and chip shortages. So what is causing such differences in CPI inflation? A key factor is that economies are at different stages of the business cycle:

• The U.S. has seen the strongest surge in consumer demand, fueled by fiscal policy and an (initially) rapid vaccination campaign. It has also seen the sharpest rise in inflation.

• In early 2021, Europe was lagging the U.S., as a second wave of lockdowns set back the recovery. Now, with average vaccination rates above the U.S., Europe is seeing a stronger recovery in demand. This has coincided with inflation rising more sharply.

• While exports have performed strongly in China, retail sales data have disappointed. This has partly reflected fears over Delta but may also be a sign the slowing property market is damaging consumer confidence.

This divergent experience matters because it is CPI, not PPI, that central banks care about.

Inflation Poses Two Risks to the Recovery

Inflation may directly impede the recovery if rising prices squeeze out demand. If higher prices for goods pushes consumers towards services, this need not hurt overall GDP – but it will lead to less commodity-intensive growth. Firms may also target lower levels of physical inventory to economize on working capital, although the opposite is also possible; shortages could lead to firms’ building up inventory or investing to increase capacity. Although a common symptom rather than a consequence, supply problems have severely constrained German manufacturing output, and therefore overall growth (Figure 3, right-hand side).

The greater risk relates to monetary policy. The view of central banks in major advanced economies has been that the increase in inflation is “transitory.” By this, they mean that high inflation rates are caused by a one-off increase in prices that will not translate into sustained price rises year on year. If this is correct, there is no need to tighten monetary policy prematurely.

The “transitory” hypothesis remains the most likely outcome. However, sharp rises in goods and energy prices could feed through to broader inflation through two potential channels:

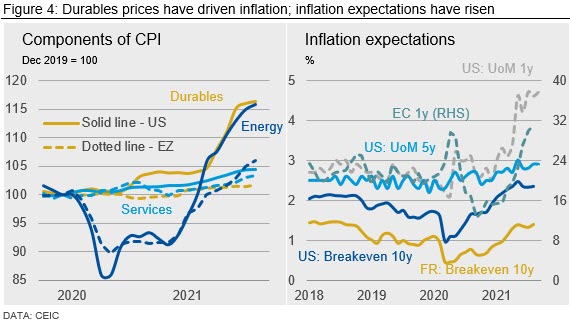

• Most directly, services require goods as inputs, for instance, restaurants need food. Many services are also facing higher costs to comply with Covid-19 restrictions, and this could begin to feed through to prices, although this has not happened yet (Figure 4, left-hand side).

• More seriously, goods inflation could lead to higher inflation expectations and a wage-price spiral. This would lead to much broader inflationary pressure, which would be difficult for Central Banks to overlook. Short-horizon inflation expectations have risen sharply in both the U.S. and Eurozone (Figure 4, right-hand side). Longer-horizon measures have also increased, though more modestly.

With the business cycle and labor market more advanced, these risks seem most acute in the U.S.. Although some sources of inflation – such as used car prices – seem to be easing, housing costs are likely to push up inflation over the next year. Consequently, the Fed is already debating when to dial back stimulus. The ECB does not currently face as much pressure to end loosening, and the recent switch to a symmetrical target gives them more flexibility. However, higher energy prices are sharply pushing up Eurozone inflation, and tough decisions may be around the corner.

Normalization of monetary policy will be painful for many firms and countries, and will impact commodities demand, even if it occurs against a background of strong growth. If normalization comes at a time when supply problems are limiting growth, it will be even more difficult.

Inflation for Breakfast, Deflation for Dessert?

Inflation and the monetary response to it are not the only risks. It is also possible that in six months’ time central banks will be grappling with a different set of problems. If some of the sharp price rises in particular markets reverse – e.g., energy, second-hand cars – inflation rates could reverse quite quickly. Further waves of Covid-19 over the winter period could hit demand again. And the developing situation in the Chinese real estate sector has the potential to act as a deflationary force if the effects spread to the wider Chinese economy.

But for now, inflation and central banks’ response will continue to be watched closely as key threats. The energy crisis in Europe, U.S. housing costs and the disruption caused by the emissions crackdown in China all have the potential to add petrol to the fire before the rain starts falling.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com